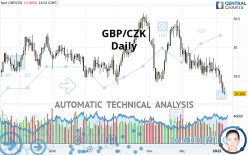

GBP/CZK - Daily - Technical analysis published on 01/10/2022 (GMT)

- 213

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : LEVEL MAINTAINED

Summary of the analysis

Additional analysis

Quotes

The GBP/CZK price is 29.194 CZK. On the day, this instrument lost -0.06% with the lowest point at 29.166 CZK and the highest point at 29.305 CZK. The deviation from the price is +0.10% for the low point and -0.38% for the high point.The Central Gaps scanner detects a bullish opening. A small advantage for buyers in the very short term.

Bullish opening

Type : Bullish

Timeframe : Openning

So that you have an overall view of the price change, here is a table showing the variations over several periods:

New LOW record (1 year)

Type : Bearish

Timeframe : Weekly

Near a new HIGH record (1st january)

Type : Bullish

Timeframe : Weekly

New LOW record (1st january)

Type : Bearish

Timeframe : Weekly

Near a new HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

New LOW record (1 month)

Type : Bearish

Timeframe : Weekly

Technical

A technical analysis in Daily of this GBP/CZK chart shows a sharp bearish trend. The signals given by moving averages are 92.86% bearish. This strong bearish trend is confirmed by the strong signals currently being given by short-term moving averages. There is no crossing of moving average by the price or crossing of moving averages between themselves.

On the 18 technical indicators analysed, 4 are bullish, 4 are neutral and 10 are bearish. Caution: the Central Indicators scanner currently detects an excess:

RSI indicator is oversold : under 30

Type : Neutral

Timeframe : Daily

CCI indicator is oversold : under -100

Type : Neutral

Timeframe : Daily

Previous candle closed under Bollinger bands

Type : Neutral

Timeframe : Daily

Williams %R indicator is oversold : under -80

Type : Neutral

Timeframe : Daily

An analysis of the price chart with the Central Patterns scanner (detector of chart patterns and resistances and supports) shows a result that can have an impact on the price change:

Support of channel is broken

Type : Bearish

Timeframe : Daily

There is also a Japanese candlestick pattern detected by Central Candlesticks that could mark the end of the current short-term trend:

Black hanging man / hammer

Type : Neutral

Timeframe : Daily

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 27.766 | 28.285 | 28.668 | 29.194 | 29.456 | 29.854 | 30.180 |

| Change (%) | -4.89% | -3.11% | -1.80% | - | +0.90% | +2.26% | +3.38% |

| Change | -1.428 | -0.909 | -0.526 | - | +0.262 | +0.660 | +0.986 |

| Level | Minor | Minor | Intermediate | - | Major | Major | Intermediate |

Pivot points can also be used to set your price objectives. Here is the price situation in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 28.931 | 29.067 | 29.139 | 29.275 | 29.347 | 29.483 | 29.555 |

| Camarilla | 29.154 | 29.173 | 29.192 | 29.211 | 29.230 | 29.249 | 29.268 |

| Woodie | 28.899 | 29.051 | 29.107 | 29.259 | 29.315 | 29.467 | 29.523 |

| Fibonacci | 29.067 | 29.147 | 29.196 | 29.275 | 29.355 | 29.404 | 29.483 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 28.570 | 28.886 | 29.049 | 29.365 | 29.528 | 29.844 | 30.007 |

| Camarilla | 29.079 | 29.123 | 29.167 | 29.211 | 29.255 | 29.299 | 29.343 |

| Woodie | 28.493 | 28.848 | 28.972 | 29.327 | 29.451 | 29.806 | 29.930 |

| Fibonacci | 28.886 | 29.069 | 29.182 | 29.365 | 29.548 | 29.661 | 29.844 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 28.790 | 29.146 | 29.365 | 29.721 | 29.940 | 30.296 | 30.515 |

| Camarilla | 29.427 | 29.480 | 29.532 | 29.585 | 29.638 | 29.690 | 29.743 |

| Woodie | 28.723 | 29.112 | 29.298 | 29.687 | 29.873 | 30.262 | 30.448 |

| Fibonacci | 29.146 | 29.365 | 29.501 | 29.721 | 29.940 | 30.076 | 30.296 |

Numerical data

The following is the status of technical indicators and moving averages registered at the time this technical analysis was created:

| RSI (14): | 28.67 | |

| MACD (12,26,9): | -0.1380 | |

| Directional Movement: | -9.034 | |

| AROON (14): | -71.429 | |

| DEMA (21): | 29.395 | |

| Parabolic SAR (0,02-0,02-0,2): | 29.675 | |

| Elder Ray (13): | -0.253 | |

| Super Trend (3,10): | 29.860 | |

| Zig ZAG (10): | 29.180 | |

| VORTEX (21): | 0.8970 | |

| Stochastique (14,3,5): | 7.66 | |

| TEMA (21): | 29.326 | |

| Williams %R (14): | -97.27 | |

| Chande Momentum Oscillator (20): | -0.488 | |

| Repulse (5,40,3): | -1.0890 | |

| ROCnROLL: | 2 | |

| TRIX (15,9): | -0.0500 | |

| Courbe Coppock: | 1.67 |

| MA7: | 29.443 | |

| MA20: | 29.582 | |

| MA50: | 29.772 | |

| MA100: | 29.815 | |

| MAexp7: | 29.392 | |

| MAexp20: | 29.562 | |

| MAexp50: | 29.723 | |

| MAexp100: | 29.795 | |

| Price / MA7: | -0.85% | |

| Price / MA20: | -1.31% | |

| Price / MA50: | -1.94% | |

| Price / MA100: | -2.08% | |

| Price / MAexp7: | -0.67% | |

| Price / MAexp20: | -1.24% | |

| Price / MAexp50: | -1.78% | |

| Price / MAexp100: | -2.02% |

Add a comment

Comments

0 comments on the analysis GBP/CZK - Daily