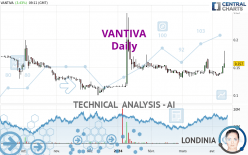

VANTIVA - Daily - Technical analysis published on 04/12/2024 (GMT)

- 108

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : INVALID

Summary of the analysis

Additional analysis

Quotes

The VANTIVA price is 0.1570 EUR. On the day, this instrument gained +3.43% and was traded between 0.1500 EUR and 0.1800 EUR over the period. The price is currently at +4.67% from its lowest and -12.78% from its highest.A bearish opening was detected by the Central Gaps scanner. Sellers are trying to impose a bearish trend in the very short term.

Bearish opening

Type : Bearish

Timeframe : Openning

A study of price movements over other periods shows the following variations:

New HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

Technical analysis of this Daily chart of VANTIVA indicates that the overall trend is strongly bullish. 82.14% of the signals given by moving averages are bullish. The overall trend is supported by the strong bullish signals from short-term moving averages. An assessment of moving averages reveals several bullish signals that could impact this trend:

Bullish trend reversal : adaptative moving average 20

Type : Bullish

Timeframe : Daily

Bullish trend reversal : adaptative moving average 50

Type : Bullish

Timeframe : Daily

Bullish trend reversal : adaptative moving average 100

Type : Bullish

Timeframe : Daily

An assessment of technical indicators shows a strong bullish signal.

But beware of excesses. The Central Indicators scanner currently detects this:

CCI indicator is overbought : over 100

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 1

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : Weekly

Parabolic SAR indicator bullish reversal

Type : Bullish

Timeframe : Daily

Aroon indicator bullish trend

Type : Bullish

Timeframe : Daily

MACD indicator is back over 0

Type : Bullish

Timeframe : Daily

Ichimoku - Bullish crossover : Tenkan & Kijun

Type : Bullish

Timeframe : Daily

Momentum indicator is back over 0

Type : Bullish

Timeframe : Daily

An analysis of the price chart with the Central Patterns scanner (detector of chart patterns and resistances and supports) shows a result that can have an impact on the price change:

Resistance of triangle is broken

Type : Bullish

Timeframe : Daily

For a small rebound in the very short term, the Central Candlesticks scanner currently notes the presence of these bullish patterns in Japanese candlesticks:

White line without lower shadow

Type : Bullish

Timeframe : Daily

Long white line

Type : Bullish

Timeframe : Daily

| S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|

| ProTrendLines | 0.1147 | 0.1356 | 0.1570 | 0.1596 | 0.1830 | 0.2000 |

| Change (%) | -26.94% | -13.63% | - | +1.66% | +16.56% | +27.39% |

| Change | -0.0423 | -0.0214 | - | +0.0026 | +0.0260 | +0.0430 |

| Level | Minor | Intermediate | - | Minor | Intermediate | Intermediate |

Pivot points can also be used to set your price objectives. Here is the price situation in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.1291 | 0.1341 | 0.1429 | 0.1479 | 0.1567 | 0.1617 | 0.1705 |

| Camarilla | 0.1480 | 0.1493 | 0.1505 | 0.1518 | 0.1531 | 0.1543 | 0.1556 |

| Woodie | 0.1311 | 0.1351 | 0.1449 | 0.1489 | 0.1587 | 0.1627 | 0.1725 |

| Fibonacci | 0.1341 | 0.1393 | 0.1426 | 0.1479 | 0.1531 | 0.1564 | 0.1617 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.1231 | 0.1291 | 0.1321 | 0.1381 | 0.1411 | 0.1471 | 0.1501 |

| Camarilla | 0.1327 | 0.1336 | 0.1344 | 0.1352 | 0.1360 | 0.1369 | 0.1377 |

| Woodie | 0.1217 | 0.1284 | 0.1307 | 0.1374 | 0.1397 | 0.1464 | 0.1487 |

| Fibonacci | 0.1291 | 0.1325 | 0.1346 | 0.1381 | 0.1415 | 0.1436 | 0.1471 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.0921 | 0.1121 | 0.1261 | 0.1461 | 0.1601 | 0.1801 | 0.1941 |

| Camarilla | 0.1309 | 0.1340 | 0.1371 | 0.1402 | 0.1433 | 0.1464 | 0.1496 |

| Woodie | 0.0892 | 0.1106 | 0.1232 | 0.1446 | 0.1572 | 0.1786 | 0.1912 |

| Fibonacci | 0.1121 | 0.1251 | 0.1331 | 0.1461 | 0.1591 | 0.1671 | 0.1801 |

Numerical data

The following are the details of the technical indicators and moving averages that were collected to generate this technical analysis:

| RSI (14): | 65.84 | |

| MACD (12,26,9): | 0.0013 | |

| Directional Movement: | 31.5760 | |

| AROON (14): | 35.7143 | |

| DEMA (21): | 0.1454 | |

| Parabolic SAR (0,02-0,02-0,2): | 0.1350 | |

| Elder Ray (13): | 0.0199 | |

| Super Trend (3,10): | 0.1368 | |

| Zig ZAG (10): | 0.1610 | |

| VORTEX (21): | 1.0881 | |

| Stochastique (14,3,5): | 42.70 | |

| TEMA (21): | 0.1468 | |

| Williams %R (14): | -42.22 | |

| Chande Momentum Oscillator (20): | 0.0014 | |

| Repulse (5,40,3): | 8.3052 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | -0.0258 | |

| Courbe Coppock: | 1.92 |

| MA7: | 0.1437 | |

| MA20: | 0.1438 | |

| MA50: | 0.1444 | |

| MA100: | 0.1370 | |

| MAexp7: | 0.1474 | |

| MAexp20: | 0.1443 | |

| MAexp50: | 0.1433 | |

| MAexp100: | 0.1445 | |

| Price / MA7: | +9.26% | |

| Price / MA20: | +9.18% | |

| Price / MA50: | +8.73% | |

| Price / MA100: | +14.60% | |

| Price / MAexp7: | +6.51% | |

| Price / MAexp20: | +8.80% | |

| Price / MAexp50: | +9.56% | |

| Price / MAexp100: | +8.65% |

News

The last news published on VANTIVA at the time of the generation of this analysis was as follows:

- Vantiva - March 2024 - Information concerning the total number of voting rights and shares

- RESULTS 2023 - VANTIVA ACHIEVES ITS OBJECTIVES

- Vantiva Demonstrates One of the First Carrier-Grade Wi-Fi 7 Extenders and Advanced 5G FWA CPE at Mobile World Congress 2024

- Vantiva - January 2024 - Information concerning the total number of voting rights and shares

- Tim O’Loughlin is joining Vantiva Connected Home as Senior Vice President of the Americas Customer Unit

Add a comment

Comments

0 comments on the analysis VANTIVA - Daily