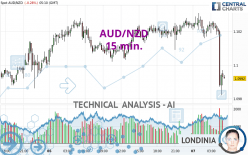

AUD/NZD - 15 min. - Technical analysis published on 05/07/2024 (GMT)

- 83

- 0

Click here for a new analysis!

- Timeframe : 15 min.

- - Analysis generated on

- Status : LEVEL MAINTAINED

Summary of the analysis

Additional analysis

Quotes

AUD/NZD rating 1.0992 NZD. The price is lower by -0.28% since the last closing with the lowest point at 1.0982 NZD and the highest point at 1.1031 NZD. The deviation from the price is +0.09% for the low point and -0.35% for the high point.A study of price movements over other periods shows the following variations:

Near a new HIGH record (5 years)

Type : Bullish

Timeframe : Weekly

Near a new LOW record (1 year)

Type : Bearish

Timeframe : Weekly

New HIGH record (1st january)

Type : Bullish

Timeframe : Weekly

New HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

Technical analysis of AUD/NZD in 15 min. shows an overall bearish trend. The signals given by moving averages are at 67.86% bearish. This bearish trend shows slight signs of slowing down given the slightly bearish signals of short-term moving averages. The Central Indicators scanner detects bearish signals on moving averages that could impact this trend:

Moving Average bearish crossovers : MA20 & MA50

Type : Bearish

Timeframe : 15 minutes

Moving Average bearish crossovers : AMA20 & AMA50

Type : Bearish

Timeframe : 15 minutes

Bearish price crossover with Moving Average 100

Type : Bearish

Timeframe : 15 minutes

Bearish price crossover with adaptative moving average 50

Type : Bearish

Timeframe : 15 minutes

Bearish price crossover with adaptative moving average 100

Type : Bearish

Timeframe : 15 minutes

The probability of a further decline is moderate given the direction of the technical indicators.

Caution: the Central Indicators scanner currently detects an excess:

RSI indicator is oversold : under 20

Type : Neutral

Timeframe : 15 minutes

CCI indicator is oversold : under -100

Type : Neutral

Timeframe : 15 minutes

Williams %R indicator is oversold : under -80

Type : Neutral

Timeframe : 15 minutes

Pivot points : price is under support 1

Type : Neutral

Timeframe : 15 minutes

Price is back under the pivot point

Type : Bearish

Timeframe : Weekly

An analysis of the price chart with the Central Patterns scanner (detector of chart patterns and resistances and supports) shows a result that can have an impact on the price change:

Near support of channel

Type : Bullish

Timeframe : 15 minutes

The presence of a bearish pattern in Japanese candlesticks detected by Central Candlesticks that could cause a correction in the very short term was also detected:

Long black line

Type : Bearish

Timeframe : 15 minutes

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 1.0923 | 1.0938 | 1.0974 | 1.0992 | 1.0993 | 1.1013 | 1.1028 |

| Change (%) | -0.63% | -0.49% | -0.16% | - | +0.01% | +0.19% | +0.33% |

| Change | -0.0069 | -0.0054 | -0.0018 | - | +0.0001 | +0.0021 | +0.0036 |

| Level | Major | Minor | Major | - | Minor | Intermediate | Intermediate |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.0955 | 1.0970 | 1.0997 | 1.1012 | 1.1039 | 1.1054 | 1.1081 |

| Camarilla | 1.1012 | 1.1015 | 1.1019 | 1.1023 | 1.1027 | 1.1031 | 1.1035 |

| Woodie | 1.0960 | 1.0973 | 1.1002 | 1.1015 | 1.1044 | 1.1057 | 1.1086 |

| Fibonacci | 1.0970 | 1.0986 | 1.0996 | 1.1012 | 1.1028 | 1.1038 | 1.1054 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.0884 | 1.0919 | 1.0958 | 1.0993 | 1.1032 | 1.1067 | 1.1106 |

| Camarilla | 1.0977 | 1.0983 | 1.0990 | 1.0997 | 1.1004 | 1.1011 | 1.1017 |

| Woodie | 1.0886 | 1.0920 | 1.0960 | 1.0994 | 1.1034 | 1.1068 | 1.1108 |

| Fibonacci | 1.0919 | 1.0947 | 1.0965 | 1.0993 | 1.1021 | 1.1039 | 1.1067 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.0747 | 1.0802 | 1.0909 | 1.0964 | 1.1071 | 1.1126 | 1.1233 |

| Camarilla | 1.0972 | 1.0986 | 1.1001 | 1.1016 | 1.1031 | 1.1046 | 1.1061 |

| Woodie | 1.0773 | 1.0815 | 1.0935 | 1.0977 | 1.1097 | 1.1139 | 1.1259 |

| Fibonacci | 1.0802 | 1.0864 | 1.0902 | 1.0964 | 1.1026 | 1.1064 | 1.1126 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

| RSI (14): | 26.77 | |

| MACD (12,26,9): | -0.0002 | |

| Directional Movement: | -30.1890 | |

| AROON (14): | -100.0000 | |

| DEMA (21): | 1.1017 | |

| Parabolic SAR (0,02-0,02-0,2): | 1.1026 | |

| Elder Ray (13): | -0.0012 | |

| Super Trend (3,10): | 1.1028 | |

| Zig ZAG (10): | 1.0990 | |

| VORTEX (21): | 0.7385 | |

| Stochastique (14,3,5): | 20.80 | |

| TEMA (21): | 1.1013 | |

| Williams %R (14): | -88.37 | |

| Chande Momentum Oscillator (20): | -0.0032 | |

| Repulse (5,40,3): | -0.3575 | |

| ROCnROLL: | 2 | |

| TRIX (15,9): | -0.0005 | |

| Courbe Coppock: | 0.17 |

| MA7: | 1.1006 | |

| MA20: | 1.0945 | |

| MA50: | 1.0865 | |

| MA100: | 1.0794 | |

| MAexp7: | 1.1006 | |

| MAexp20: | 1.1020 | |

| MAexp50: | 1.1020 | |

| MAexp100: | 1.1018 | |

| Price / MA7: | -0.13% | |

| Price / MA20: | +0.43% | |

| Price / MA50: | +1.17% | |

| Price / MA100: | +1.83% | |

| Price / MAexp7: | -0.13% | |

| Price / MAexp20: | -0.25% | |

| Price / MAexp50: | -0.25% | |

| Price / MAexp100: | -0.24% |

News

The latest news and videos published on AUD/NZD at the time of the analysis were as follows:

-

Trading volatility: AUD/NZD on RBNZ rate decision

Trading volatility: AUD/NZD on RBNZ rate decision

-

Trade of the Week: long AUD/NZD

Trade of the Week: long AUD/NZD

-

#AUDNZD at six-week high as RBA considers raising rates...

#AUDNZD at six-week high as RBA considers raising rates...

-

Trading the Trend: short AUD/NZD

Trading the Trend: short AUD/NZD

-

Australian Dollar Analysis: AUD/USD and AUD/NZD May Bounce Before Selloff Resumes

Australian Dollar Analysis: AUD/USD and AUD/NZD May Bounce Before Selloff Resumes

Add a comment

Comments

0 comments on the analysis AUD/NZD - 15 min.