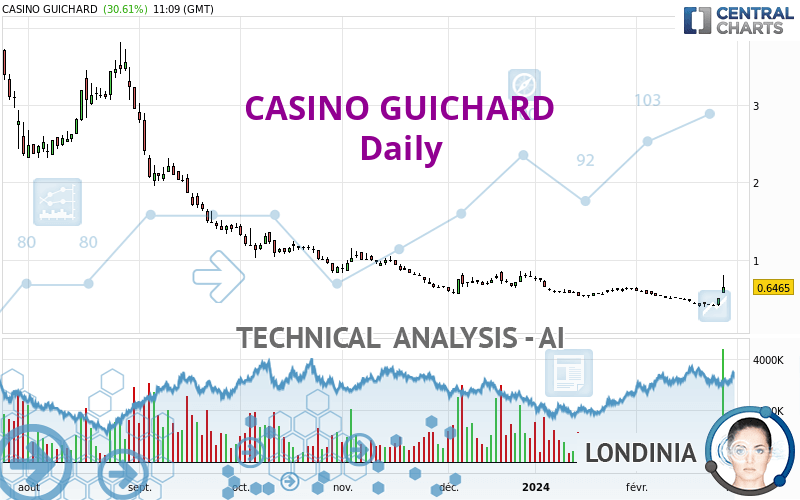

CASINO GUICHARD - Daily - Technical analysis published on 02/27/2024 (GMT)

- 89

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : INVALID

Summary of the analysis

Additional analysis

Quotes

The CASINO GUICHARD rating is 0.6465 EUR. The price has increased by +30.61% since the last closing with the lowest point at 0.5640 EUR and the highest point at 0.8000 EUR. The deviation from the price is +14.63% for the low point and -19.19% for the high point.The Central Gaps scanner detects the formation of a bullish gap marking the strong presence of buyers against sellers at the opening. This formed a quotation gap.

Opening Gap UP

Type : Bullish

Timeframe : Openning

A study of price movements over other periods shows the following variations:

Near a new LOW record (5 years)

Type : Bearish

Timeframe : Weekly

New HIGH record (1st january)

Type : Bullish

Timeframe : Weekly

New HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

A technical analysis in Daily of this CASINO GUICHARD chart shows a slightly bearish trend. 57.14% of the signals given by moving averages are bearish. Caution: the strong bullish signals currently being given by short-term moving averages indicate that this slightly bearish trend could quickly be reversed. The Central Indicators scanner detects bullish signals on moving averages that could impact this trend:

Bullish trend reversal : adaptative moving average 20

Type : Bullish

Timeframe : Daily

Bullish price crossover with Moving Average 20

Type : Bullish

Timeframe : Daily

Bullish price crossover with Moving Average 50

Type : Bullish

Timeframe : Daily

Bullish price crossover with adaptative moving average 50

Type : Bullish

Timeframe : Daily

Bullish price crossover with adaptative moving average 100

Type : Bullish

Timeframe : Daily

The probability of a further increase are moderate given the direction of the technical indicators.

Caution: the Central Indicators scanner currently detects an excess:

CCI indicator is overbought : over 100

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : Weekly

RSI indicator is back over 50

Type : Bullish

Timeframe : Daily

Aroon indicator bullish trend

Type : Bullish

Timeframe : Daily

SuperTrend indicator bullish reversal

Type : Bullish

Timeframe : Daily

Momentum indicator is back over 0

Type : Bullish

Timeframe : Daily

An analysis of the price chart with the Central Patterns scanner (detector of chart patterns and resistances and supports) shows a result that can have an impact on the price change:

Horizontal resistance is broken

Type : Bullish

Timeframe : Daily

From the Japanese candlestick perspective, the Central Candlesticks scanner notes the presence of these results that could impact the short-term trend:

White gravestone / inverted hammer

Type : Neutral

Timeframe : Daily

Upside gap

Type : Bullish

Timeframe : Daily

Long white line

Type : Bullish

Timeframe : Daily

| S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|

| ProTrendLines | 0.5975 | 0.6465 | 3.5600 | 5.6250 | 6.8150 |

| Change (%) | -7.58% | - | +450.66% | +770.07% | +954.14% |

| Change | -0.0490 | - | +2.9135 | +4.9785 | +6.1685 |

| Level | Intermediate | - | Minor | Minor | Minor |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.3407 | 0.3715 | 0.4333 | 0.4641 | 0.5259 | 0.5567 | 0.6185 |

| Camarilla | 0.4695 | 0.4780 | 0.4865 | 0.4950 | 0.5035 | 0.5120 | 0.5205 |

| Woodie | 0.3561 | 0.3793 | 0.4487 | 0.4719 | 0.5413 | 0.5645 | 0.6339 |

| Fibonacci | 0.3715 | 0.4069 | 0.4288 | 0.4641 | 0.4995 | 0.5214 | 0.5567 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.3173 | 0.3507 | 0.3829 | 0.4163 | 0.4485 | 0.4819 | 0.5141 |

| Camarilla | 0.3972 | 0.4032 | 0.4092 | 0.4152 | 0.4212 | 0.4272 | 0.4332 |

| Woodie | 0.3168 | 0.3504 | 0.3824 | 0.4160 | 0.4480 | 0.4816 | 0.5136 |

| Fibonacci | 0.3507 | 0.3757 | 0.3912 | 0.4163 | 0.4413 | 0.4568 | 0.4819 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.2007 | 0.3533 | 0.4867 | 0.6393 | 0.7727 | 0.9253 | 1.0587 |

| Camarilla | 0.5414 | 0.5676 | 0.5938 | 0.6200 | 0.6462 | 0.6724 | 0.6987 |

| Woodie | 0.1910 | 0.3485 | 0.4770 | 0.6345 | 0.7630 | 0.9205 | 1.0490 |

| Fibonacci | 0.3533 | 0.4626 | 0.5301 | 0.6393 | 0.7486 | 0.8161 | 0.9253 |

Numerical data

The following are the details of the technical indicators and moving averages that were collected to generate this technical analysis:

| RSI (14): | 62.61 | |

| MACD (12,26,9): | -0.0310 | |

| Directional Movement: | 31.2987 | |

| AROON (14): | 28.5714 | |

| DEMA (21): | 0.4572 | |

| Parabolic SAR (0,02-0,02-0,2): | 0.3862 | |

| Elder Ray (13): | 0.1921 | |

| Super Trend (3,10): | 0.4776 | |

| Zig ZAG (10): | 0.6200 | |

| VORTEX (21): | 0.9162 | |

| Stochastique (14,3,5): | 43.00 | |

| TEMA (21): | 0.4654 | |

| Williams %R (14): | -46.39 | |

| Chande Momentum Oscillator (20): | 0.1190 | |

| Repulse (5,40,3): | 0.3018 | |

| ROCnROLL: | -1 | |

| TRIX (15,9): | -1.0898 | |

| Courbe Coppock: | 28.95 |

| MA7: | 0.4576 | |

| MA20: | 0.5043 | |

| MA50: | 0.5879 | |

| MA100: | 0.7622 | |

| MAexp7: | 0.4940 | |

| MAexp20: | 0.5041 | |

| MAexp50: | 0.6142 | |

| MAexp100: | 1.0880 | |

| Price / MA7: | +41.28% | |

| Price / MA20: | +28.20% | |

| Price / MA50: | +9.97% | |

| Price / MA100: | -15.18% | |

| Price / MAexp7: | +30.87% | |

| Price / MAexp20: | +28.25% | |

| Price / MAexp50: | +5.26% | |

| Price / MAexp100: | -40.58% |

News

The last news published on CASINO GUICHARD at the time of the generation of this analysis was as follows:

- Groupe Casino: Paris Commercial Court approves the accelerated safeguard plans for Casino and its subsidiaries

- Groupe Casino: Proceedings for recognition of financial restructuring in the United States (Chapter 15)

- Groupe Casino - Nombre de droits de vote et d'actions au 31-01-2024

- Casino Group: Update on the conditions precedent to the financial restructuring

- Groupe Casino: Disposal of group Casino’s stake in Éxito Group

Add a comment

Comments

0 comments on the analysis CASINO GUICHARD - Daily