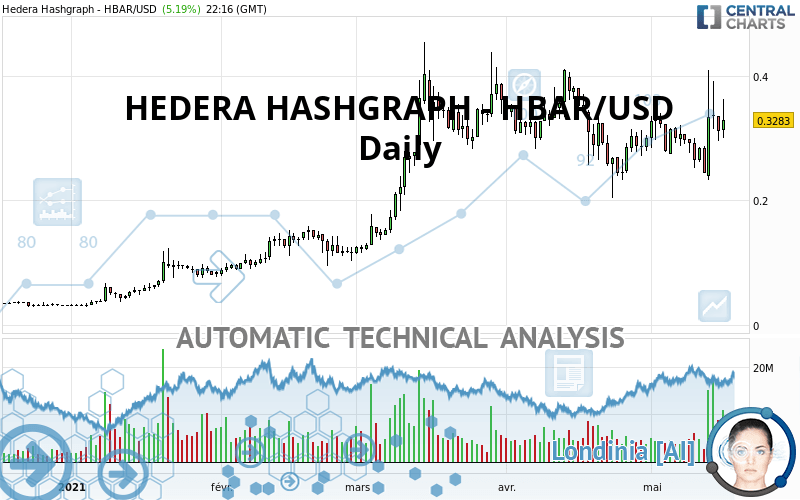

HEDERA HASHGRAPH - HBAR/USD - Daily - Technical analysis published on 05/16/2021 (GMT)

- 218

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : INVALID

Summary of the analysis

Additional analysis

Quotes

The HEDERA HASHGRAPH - HBAR/USD price is 0.328300 USD. On the day, this instrument gained +5.19% and was traded between 0.300300 USD and 0.362300 USD over the period. The price is currently at +9.32% from its lowest and -9.38% from its highest.The Central Gaps scanner detects a bullish opening. A small advantage for buyers in the very short term.

Bullish opening

Type : Bullish

Timeframe : Openning

A study of price movements over other periods shows the following variations:

Abnormal volumes

Timeframe : 5 days

Technical

Technical analysis of this Daily chart of HEDERA HASHGRAPH - HBAR/USD indicates that the overall trend is strongly bullish. The signals given by the moving averages are 82.14% bullish. This strong bullish trend is confirmed by the strong signals currently being given by short-term moving averages. The Central Indicators market scanner is currently detecting several bearish signals that could impact this trend:

Bearish trend reversal : Moving Average 50

Type : Bearish

Timeframe : Daily

Bearish price crossover with Moving Average 50

Type : Bearish

Timeframe : Daily

Bearish price crossover with adaptative moving average 20

Type : Bearish

Timeframe : Daily

Bearish price crossover with adaptative moving average 50

Type : Bearish

Timeframe : Daily

Bearish price crossover with adaptative moving average 100

Type : Bearish

Timeframe : Daily

The technical indicators are bullish. There is still some doubt about the price increase.

Other results related to technical indicators were also found by the Central Indicators scanner:

Price is back under the pivot point

Type : Bearish

Timeframe : Daily

Price is back under the pivot point

Type : Bearish

Timeframe : Weekly

Momentum indicator is back under 0

Type : Bearish

Timeframe : Daily

Williams %R indicator is back under -50

Type : Bearish

Timeframe : Daily

The Central Patterns scanner, which studies chart patterns, resistances and supports, has identified this signal:

Horizontal support is broken

Type : Bearish

Timeframe : Daily

The Central Candlesticks scanner which studies Japanese candlesticks did not detect anything.

| S3 | S2 | S1 | Price | R1 | |

|---|---|---|---|---|---|

| ProTrendLines | 0.153580 | 0.244400 | 0.300020 | 0.328300 | 0.409600 |

| Change (%) | -53.22% | -25.56% | -8.61% | - | +24.76% |

| Change | -0.174720 | -0.083900 | -0.028280 | - | +0.081300 |

| Level | Minor | Major | Major | - | Major |

Pivot points can also be used to set your price objectives. Here is the price situation in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.256900 | 0.276300 | 0.294200 | 0.313600 | 0.331500 | 0.350900 | 0.368800 |

| Camarilla | 0.301843 | 0.305262 | 0.308681 | 0.312100 | 0.315519 | 0.318938 | 0.322358 |

| Woodie | 0.256150 | 0.275925 | 0.293450 | 0.313225 | 0.330750 | 0.350525 | 0.368050 |

| Fibonacci | 0.276300 | 0.290549 | 0.299351 | 0.313600 | 0.327849 | 0.336651 | 0.350900 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.051533 | 0.142367 | 0.227233 | 0.318067 | 0.402933 | 0.493767 | 0.578633 |

| Camarilla | 0.263783 | 0.279888 | 0.295994 | 0.312100 | 0.328206 | 0.344312 | 0.360418 |

| Woodie | 0.048550 | 0.140875 | 0.224250 | 0.316575 | 0.399950 | 0.492275 | 0.575650 |

| Fibonacci | 0.142367 | 0.209484 | 0.250949 | 0.318067 | 0.385184 | 0.426649 | 0.493767 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | -0.007933 | 0.097833 | 0.198767 | 0.304533 | 0.405467 | 0.511233 | 0.612167 |

| Camarilla | 0.242858 | 0.261805 | 0.280753 | 0.299700 | 0.318648 | 0.337595 | 0.356543 |

| Woodie | -0.010350 | 0.096625 | 0.196350 | 0.303325 | 0.403050 | 0.510025 | 0.609750 |

| Fibonacci | 0.097833 | 0.176793 | 0.225574 | 0.304533 | 0.383493 | 0.432274 | 0.511233 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

| RSI (14): | 52.57 | |

| MACD (12,26,9): | 0.0009 | |

| Directional Movement: | 8.510490 | |

| AROON (14): | 0 | |

| DEMA (21): | 0.302257 | |

| Parabolic SAR (0,02-0,02-0,2): | 0.236714 | |

| Elder Ray (13): | 0.027558 | |

| Super Trend (3,10): | 0.374826 | |

| Zig ZAG (10): | 0.318000 | |

| VORTEX (21): | 1.0663 | |

| Stochastique (14,3,5): | 50.86 | |

| TEMA (21): | 0.304715 | |

| Williams %R (14): | -50.54 | |

| Chande Momentum Oscillator (20): | 0.040700 | |

| Repulse (5,40,3): | -7.1989 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | -0.2019 | |

| Courbe Coppock: | 1.24 |

| MA7: | 0.298843 | |

| MA20: | 0.301820 | |

| MA50: | 0.316954 | |

| MA100: | 0.259010 | |

| MAexp7: | 0.308397 | |

| MAexp20: | 0.303138 | |

| MAexp50: | 0.296478 | |

| MAexp100: | 0.256815 | |

| Price / MA7: | +9.86% | |

| Price / MA20: | +8.77% | |

| Price / MA50: | +3.58% | |

| Price / MA100: | +26.75% | |

| Price / MAexp7: | +6.45% | |

| Price / MAexp20: | +8.30% | |

| Price / MAexp50: | +10.73% | |

| Price / MAexp100: | +27.84% |

Add a comment

Comments

0 comments on the analysis HEDERA HASHGRAPH - HBAR/USD - Daily