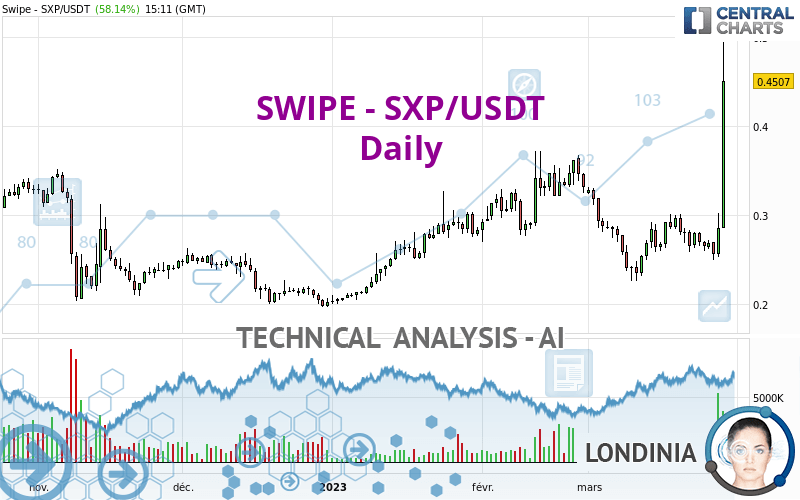

SXP - SXP/USDT - Daily - Technical analysis published on 03/29/2023 (GMT)

- 117

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

The SWIPE - SXP/USDT price is 0.450700 USDT. On the day, this instrument gained +58.14% and was traded between 0.285200 USDT and 0.494800 USDT over the period. The price is currently at +58.03% from its lowest and -8.91% from its highest.A bullish opening was detected by the Central Gaps scanner. Buyers are trying to impose a bullish momentum in the very short term.

Bullish opening

Type : Bullish

Timeframe : Openning

A study of price movements over other periods shows the following variations:

Near a new HIGH record (1 year)

Type : Bullish

Timeframe : Weekly

New HIGH record (1st january)

Type : Bullish

Timeframe : Weekly

New HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

Technical analysis of SWIPE - SXP/USDT in Daily shows a strongly overall bullish trend. 89.29% of the signals given by moving averages are bullish. This strongly bullish trend is supported by the strong bullish signals given by short-term moving averages. The Central Indicators scanner detects bullish signals on moving averages that could impact this trend:

Bullish trend reversal : Moving Average 20

Type : Bullish

Timeframe : Daily

Bullish trend reversal : Moving Average 50

Type : Bullish

Timeframe : Daily

Bullish trend reversal : adaptative moving average 20

Type : Bullish

Timeframe : Daily

Bullish trend reversal : adaptative moving average 50

Type : Bullish

Timeframe : Daily

Bullish trend reversal : adaptative moving average 100

Type : Bullish

Timeframe : Daily

Bullish price crossover with Moving Average 50

Type : Bullish

Timeframe : Daily

Bullish price crossover with adaptative moving average 50

Type : Bullish

Timeframe : Daily

An assessment of technical indicators shows a strong bullish signal.

But beware of excesses. The Central Indicators scanner currently detects this:

RSI indicator is overbought : over 70

Type : Neutral

Timeframe : Daily

CCI indicator is overbought : over 100

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : Weekly

Ichimoku : price is over the cloud

Type : Bullish

Timeframe : Daily

SuperTrend indicator bullish reversal

Type : Bullish

Timeframe : Daily

MACD indicator is back over 0

Type : Bullish

Timeframe : Daily

An analysis of the price chart with the Central Patterns scanner (detector of chart patterns and resistances and supports) shows a result that can have an impact on the price change:

Resistance of channel is broken

Type : Bullish

Timeframe : Daily

Central Candlesticks, the scanner specialised in Japanese candlesticks, detects these bullish signals that could support the hypothesis of a small rebound in the very short term:

White line without lower shadow

Type : Bullish

Timeframe : Daily

Long white line

Type : Bullish

Timeframe : Daily

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 0.322614 | 0.361167 | 0.391200 | 0.450700 | 1.423400 | 2.769000 | 4.321000 |

| Change (%) | -28.42% | -19.87% | -13.20% | - | +215.82% | +514.38% | +858.73% |

| Change | -0.128086 | -0.089533 | -0.059500 | - | +0.972700 | +2.318300 | +3.870300 |

| Level | Minor | Major | Minor | - | Minor | Minor | Minor |

Pivot points can also be used to set your price objectives. Here is the price situation in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.207067 | 0.229533 | 0.257267 | 0.279733 | 0.307467 | 0.329933 | 0.357667 |

| Camarilla | 0.271195 | 0.275797 | 0.280398 | 0.285000 | 0.289602 | 0.294203 | 0.298805 |

| Woodie | 0.209700 | 0.230850 | 0.259900 | 0.281050 | 0.310100 | 0.331250 | 0.360300 |

| Fibonacci | 0.229533 | 0.248710 | 0.260557 | 0.279733 | 0.298910 | 0.310757 | 0.329933 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.204233 | 0.231067 | 0.247733 | 0.274567 | 0.291233 | 0.318067 | 0.334733 |

| Camarilla | 0.252438 | 0.256425 | 0.260413 | 0.264400 | 0.268388 | 0.272375 | 0.276363 |

| Woodie | 0.199150 | 0.228525 | 0.242650 | 0.272025 | 0.286150 | 0.315525 | 0.329650 |

| Fibonacci | 0.231067 | 0.247684 | 0.257950 | 0.274567 | 0.291184 | 0.301450 | 0.318067 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.186067 | 0.231333 | 0.281567 | 0.326833 | 0.377067 | 0.422333 | 0.472567 |

| Camarilla | 0.305538 | 0.314292 | 0.323046 | 0.331800 | 0.340554 | 0.349308 | 0.358063 |

| Woodie | 0.188550 | 0.232575 | 0.284050 | 0.328075 | 0.379550 | 0.423575 | 0.475050 |

| Fibonacci | 0.231333 | 0.267814 | 0.290352 | 0.326833 | 0.363314 | 0.385852 | 0.422333 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

| RSI (14): | 75.06 | |

| MACD (12,26,9): | 0.0078 | |

| Directional Movement: | 42.250657 | |

| AROON (14): | 14.285714 | |

| DEMA (21): | 0.297287 | |

| Parabolic SAR (0,02-0,02-0,2): | 0.249200 | |

| Elder Ray (13): | 0.092806 | |

| Super Trend (3,10): | 0.267048 | |

| Zig ZAG (10): | 0.440800 | |

| VORTEX (21): | 1.0469 | |

| Stochastique (14,3,5): | 52.87 | |

| TEMA (21): | 0.308872 | |

| Williams %R (14): | -22.11 | |

| Chande Momentum Oscillator (20): | 0.148900 | |

| Repulse (5,40,3): | 45.7176 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | -0.2265 | |

| Courbe Coppock: | 28.11 |

| MA7: | 0.296057 | |

| MA20: | 0.278320 | |

| MA50: | 0.298140 | |

| MA100: | 0.268952 | |

| MAexp7: | 0.316422 | |

| MAexp20: | 0.290709 | |

| MAexp50: | 0.287016 | |

| MAexp100: | 0.284561 | |

| Price / MA7: | +52.23% | |

| Price / MA20: | +61.94% | |

| Price / MA50: | +51.17% | |

| Price / MA100: | +67.58% | |

| Price / MAexp7: | +42.44% | |

| Price / MAexp20: | +55.03% | |

| Price / MAexp50: | +57.03% | |

| Price / MAexp100: | +58.38% |

Add a comment

Comments

0 comments on the analysis SXP - SXP/USDT - Daily