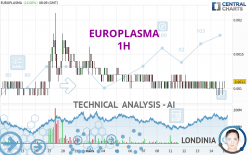

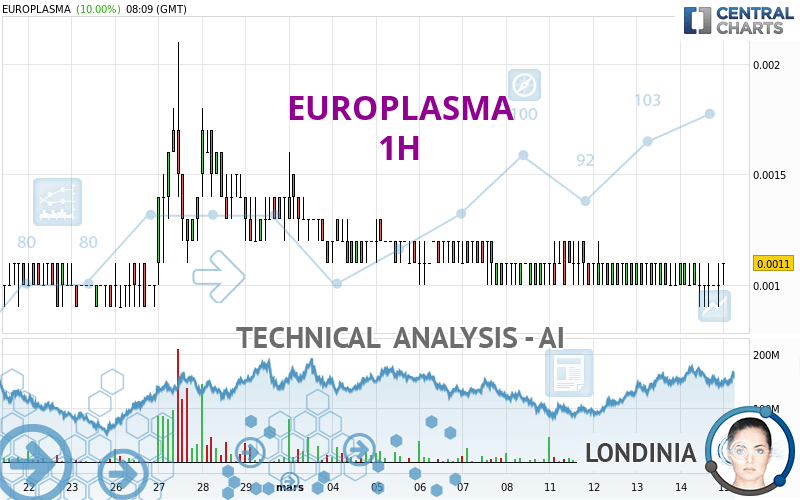

EUROPLASMA - 1H - Technical analysis published on 03/15/2024 (GMT)

- 81

- 0

- Timeframe : 1H

- - Analysis generated on

- Status : NEUTRAL

Summary of the analysis

Additional analysis

Quotes

The EUROPLASMA rating is 0.0011 EUR. The price registered an increase of +10.00% on the session and was between 0.0011 EUR and 0.0011 EUR. This implies that the price is at 0% from its lowest and at 0% from its highest.So that you have an overall view of the price change, here is a table showing the variations over several periods:

New LOW record (5 years)

Type : Bearish

Timeframe : Weekly

New LOW record (1 year)

Type : Bearish

Timeframe : Weekly

New LOW record (1st january)

Type : Bearish

Timeframe : Weekly

New LOW record (1 month)

Type : Bearish

Timeframe : Weekly

Abnormal volumes on EUROPLASMA were detected by the Central Volumes scanner:

Abnormal volumes

Timeframe : 5 days

Abnormal volumes

Timeframe : 20 days

Abnormal volumes

Timeframe : 50 days

Technical

A technical analysis in 1H of this EUROPLASMA chart shows a neutral trend. This indecision is confirmed by the neutral signals currently being given by short-term moving averages. The Central Indicators market scanner is currently detecting several bullish signals that could impact this trend:

Bullish price crossover with Moving Average 20

Type : Bullish

Timeframe : 1 hour

Bullish price crossover with Moving Average 50

Type : Bullish

Timeframe : 1 hour

The probability of a further increase are moderate given the direction of the technical indicators.

Caution: the Central Indicators scanner currently detects an excess:

CCI indicator is oversold : under -100

Type : Neutral

Timeframe : 1 hour

Pivot points : price is over resistance 1

Type : Neutral

Timeframe : 1 hour

An analysis of the price chart with the Central Patterns scanner (detector of chart patterns and resistances and supports) shows several results that can have an impact on the price change:

Near support of channel

Type : Bullish

Timeframe : 1 hour

Near support of triangle

Type : Bullish

Timeframe : 1 hour

Central Candlesticks, the scanner specialised in Japanese candlesticks, detects this inversion signal that could impact the current short-term trend:

Doji

Type : Neutral

Timeframe : 1 hour

| S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|

| ProTrendLines | 0.0009 | 0.0011 | 0.0012 | 0.0014 | 0.0016 |

| Change (%) | -18.18% | - | +9.09% | +27.27% | +45.45% |

| Change | -0.0002 | - | +0.0001 | +0.0003 | +0.0005 |

| Level | Major | - | Major | Minor | Minor |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.0007 | 0.0008 | 0.0009 | 0.0010 | 0.0011 | 0.0012 | 0.0013 |

| Camarilla | 0.0010 | 0.0010 | 0.0010 | 0.0010 | 0.0010 | 0.0010 | 0.0011 |

| Woodie | 0.0007 | 0.0008 | 0.0009 | 0.0010 | 0.0011 | 0.0012 | 0.0013 |

| Fibonacci | 0.0008 | 0.0009 | 0.0009 | 0.0010 | 0.0011 | 0.0011 | 0.0012 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.0007 | 0.0008 | 0.0010 | 0.0011 | 0.0013 | 0.0014 | 0.0016 |

| Camarilla | 0.0010 | 0.0011 | 0.0011 | 0.0011 | 0.0011 | 0.0012 | 0.0012 |

| Woodie | 0.0007 | 0.0008 | 0.0010 | 0.0011 | 0.0013 | 0.0014 | 0.0016 |

| Fibonacci | 0.0008 | 0.0010 | 0.0010 | 0.0011 | 0.0013 | 0.0013 | 0.0014 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | -0.0005 | 0.0002 | 0.0008 | 0.0015 | 0.0021 | 0.0028 | 0.0034 |

| Camarilla | 0.0010 | 0.0012 | 0.0013 | 0.0014 | 0.0015 | 0.0016 | 0.0018 |

| Woodie | -0.0006 | 0.0002 | 0.0008 | 0.0015 | 0.0021 | 0.0028 | 0.0034 |

| Fibonacci | 0.0002 | 0.0007 | 0.0010 | 0.0015 | 0.0020 | 0.0023 | 0.0028 |

Numerical data

The following is the status of technical indicators and moving averages registered at the time this technical analysis was created:

| RSI (14): | 54.19 | |

| MACD (12,26,9): | 0.0000 | |

| Directional Movement: | 5.9103 | |

| AROON (14): | -64.2857 | |

| DEMA (21): | 0.0010 | |

| Parabolic SAR (0,02-0,02-0,2): | 0.0012 | |

| Elder Ray (13): | 0.0001 | |

| Super Trend (3,10): | 0.0013 | |

| Zig ZAG (10): | 0.0011 | |

| VORTEX (21): | 1.0000 | |

| Stochastique (14,3,5): | 66.67 | |

| TEMA (21): | 0.0010 | |

| Williams %R (14): | 0.00 | |

| Chande Momentum Oscillator (20): | 0.0001 | |

| Repulse (5,40,3): | 2.5992 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | -0.1940 | |

| Courbe Coppock: | 6.18 |

| MA7: | 0.0010 | |

| MA20: | 0.0011 | |

| MA50: | 0.0018 | |

| MA100: | 0.0069 | |

| MAexp7: | 0.0010 | |

| MAexp20: | 0.0010 | |

| MAexp50: | 0.0011 | |

| MAexp100: | 0.0011 | |

| Price / MA7: | +10.00% | |

| Price / MA20: | -0% | |

| Price / MA50: | -38.89% | |

| Price / MA100: | -84.06% | |

| Price / MAexp7: | +10.00% | |

| Price / MAexp20: | +10.00% | |

| Price / MAexp50: | -0% | |

| Price / MAexp100: | -0% |

News

Don't forget to follow the news on EUROPLASMA. At the time of publication of this analysis, the latest news was as follows:

- Alpha Blue Ocean Reaffirms its Commitment to the French Group Europlasma, the Auvergne-Rhône-Alpes Region and the Ministry of Economy for the Re-industrialization of the Forges de Gerzat

- EUROPLASMA: Drawdown ot the second tranche of 200 convertible bonds

- EUROPLASMA: A framework partnership agreement with Orano Cycle has come into effect

Add a comment

Comments

0 comments on the analysis EUROPLASMA - 1H