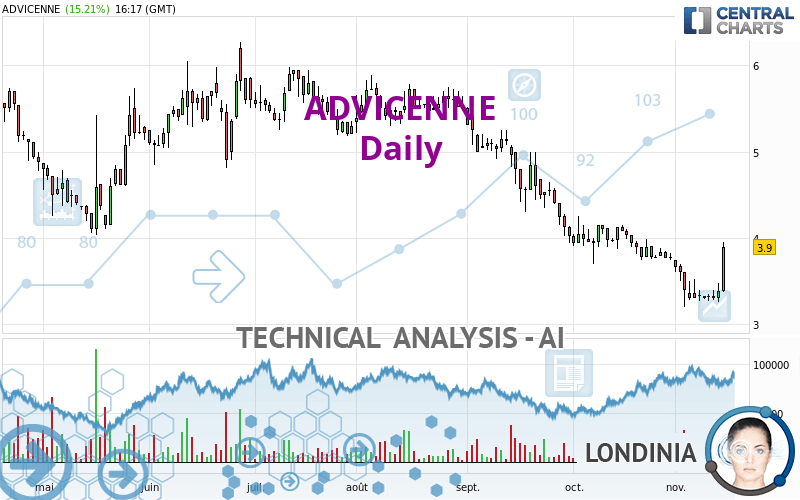

ADVICENNE - Daily - Technical analysis published on 11/15/2022 (GMT)

- 137

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

The ADVICENNE rating is 3.900 EUR. The price has increased by +15.21% since the last closing and was traded between 3.370 EUR and 3.950 EUR over the period. The price is currently at +15.73% from its lowest and -1.27% from its highest.So that you have an overall view of the price change, here is a table showing the variations over several periods:

Near a new LOW record (5 years)

Type : Bearish

Timeframe : Weekly

Technical

A technical analysis in Daily of this ADVICENNE chart shows a bearish trend. 75.00% of the signals given by moving averages are bearish. Caution: as the signals currently given by short-term moving averages are rather neutral, the bearish trend could slow down. The Central Indicators scanner detects bullish signals on moving averages that could impact this trend:

Bullish price crossover with Moving Average 20

Type : Bullish

Timeframe : Daily

Bullish price crossover with adaptative moving average 20

Type : Bullish

Timeframe : Daily

Bullish price crossover with adaptative moving average 50

Type : Bullish

Timeframe : Daily

Technical indicators are slightly bullish. There is therefore considerable uncertainty about the continuation of the increase.

Caution: the Central Indicators scanner currently detects an excess:

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : Weekly

RSI indicator is back over 50

Type : Bullish

Timeframe : Daily

Parabolic SAR indicator bullish reversal

Type : Bullish

Timeframe : Daily

Aroon indicator bullish trend

Type : Bullish

Timeframe : Daily

SuperTrend indicator bullish reversal

Type : Bullish

Timeframe : Daily

Momentum indicator is back over 0

Type : Bullish

Timeframe : Daily

The analysis of the price chart with Central Patterns scanners does not return any result.

The presence of a bullish Japanese candlestick pattern detected by Central Candlesticks that could cause a very short term rebound was also detected:

Long white line

Type : Bullish

Timeframe : Daily

| S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|

| ProTrendLines | 3.300 | 3.900 | 4.115 | 5.194 | 5.711 |

| Change (%) | -15.38% | - | +5.51% | +33.18% | +46.44% |

| Change | -0.600 | - | +0.215 | +1.294 | +1.811 |

| Level | Major | - | Major | Minor | Intermediate |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 3.057 | 3.158 | 3.272 | 3.373 | 3.487 | 3.588 | 3.702 |

| Camarilla | 3.326 | 3.346 | 3.365 | 3.385 | 3.405 | 3.424 | 3.444 |

| Woodie | 3.063 | 3.161 | 3.278 | 3.376 | 3.493 | 3.591 | 3.708 |

| Fibonacci | 3.158 | 3.241 | 3.291 | 3.373 | 3.456 | 3.506 | 3.588 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 2.948 | 3.107 | 3.203 | 3.362 | 3.458 | 3.617 | 3.713 |

| Camarilla | 3.230 | 3.253 | 3.277 | 3.300 | 3.323 | 3.347 | 3.370 |

| Woodie | 2.918 | 3.091 | 3.173 | 3.346 | 3.428 | 3.601 | 3.683 |

| Fibonacci | 3.107 | 3.204 | 3.264 | 3.362 | 3.459 | 3.519 | 3.617 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 3.013 | 3.357 | 3.563 | 3.907 | 4.113 | 4.457 | 4.663 |

| Camarilla | 3.619 | 3.669 | 3.720 | 3.770 | 3.820 | 3.871 | 3.921 |

| Woodie | 2.945 | 3.323 | 3.495 | 3.873 | 4.045 | 4.423 | 4.595 |

| Fibonacci | 3.357 | 3.567 | 3.697 | 3.907 | 4.117 | 4.247 | 4.457 |

Numerical data

The following is the status of technical indicators and moving averages registered at the time this technical analysis was created:

| RSI (14): | 56.33 | |

| MACD (12,26,9): | -0.1880 | |

| Directional Movement: | 6.130 | |

| AROON (14): | 57.143 | |

| DEMA (21): | 3.354 | |

| Parabolic SAR (0,02-0,02-0,2): | 3.200 | |

| Elder Ray (13): | 0.121 | |

| Super Trend (3,10): | 3.057 | |

| Zig ZAG (10): | 3.895 | |

| VORTEX (21): | 0.7920 | |

| Stochastique (14,3,5): | 44.59 | |

| TEMA (21): | 3.398 | |

| Williams %R (14): | -7.33 | |

| Chande Momentum Oscillator (20): | 0.125 | |

| Repulse (5,40,3): | 17.1590 | |

| ROCnROLL: | -1 | |

| TRIX (15,9): | -0.8270 | |

| Courbe Coppock: | 20.56 |

| MA7: | 3.411 | |

| MA20: | 3.615 | |

| MA50: | 4.097 | |

| MA100: | 4.807 | |

| MAexp7: | 3.511 | |

| MAexp20: | 3.629 | |

| MAexp50: | 4.059 | |

| MAexp100: | 4.581 | |

| Price / MA7: | +14.34% | |

| Price / MA20: | +7.88% | |

| Price / MA50: | -4.81% | |

| Price / MA100: | -18.87% | |

| Price / MAexp7: | +11.08% | |

| Price / MAexp20: | +7.47% | |

| Price / MAexp50: | -3.92% | |

| Price / MAexp100: | -14.87% |

News

The latest news and videos published on ADVICENNE at the time of the analysis were as follows:

- Advicenne Announces Its Upcoming Participation in Two of the Most Important International Investor Conferences

- Advicenne Announces the Extension of the Intellectual Property of Its Drug Sibnayal®

- Advicenne Reports Its First Half Financial Results as of June 30, 2022

- Advicenne Updates on Availability of Sibnayal® to Patients and Caregivers in Great Britain

- Advicenne Announces Commercial Launch of Sibnayal® in Great Britain

Add a comment

Comments

0 comments on the analysis ADVICENNE - Daily