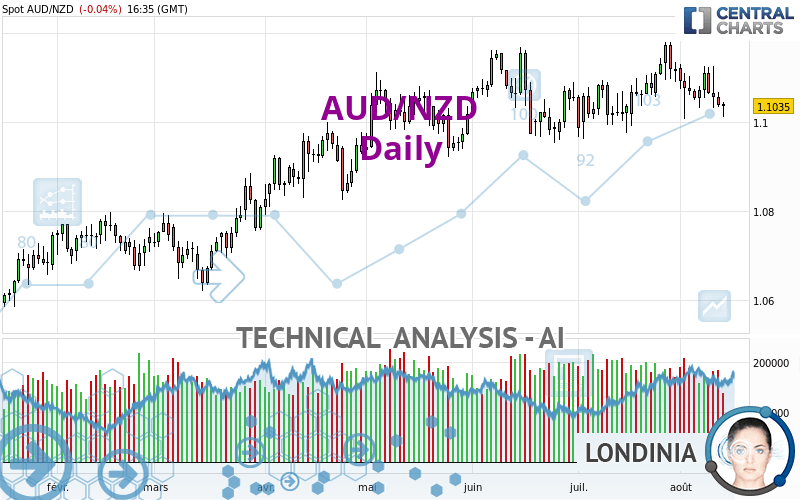

AUD/NZD - Daily - Technical analysis published on 08/12/2022 (GMT)

- 184

- 0

- Timeframe : Daily

- - Analysis generated on

- Status : NEUTRAL

Summary of the analysis

Additional analysis

Quotes

AUD/NZD rating 1.1036 NZD. On the day, this instrument lost -0.03% with the lowest point at 1.1011 NZD and the highest point at 1.1045 NZD. The deviation from the price is +0.23% for the low point and -0.08% for the high point.The Central Gaps scanner detects a bullish opening. A small advantage for buyers in the very short term.

Bullish opening

Type : Bullish

Timeframe : Openning

Here is a more detailed summary of the historical variations registered by AUD/NZD:

Near a new HIGH record (5 years)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1 year)

Type : Bullish

Timeframe : Weekly

Near a new LOW record (1st january)

Type : Bearish

Timeframe : Weekly

Near a new HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

Technical analysis of AUD/NZD in Daily shows an overall slightly bullish trend. Only 53.57% of the signals given by moving averages are bullish. This slightly bullish trend could turn neutral or reverse given the slightly bearish signals currently being given by short-term moving averages. The Central Indicators scanner detects a bearish signal on moving averages that could impact this trend:

Bearish trend reversal : adaptative moving average 50

Type : Bearish

Timeframe : Daily

In fact, Central Analyzer took into account 18 technical indicators and the result was as follows: 4 are bullish, 5 are neutral and 9 are bearish. But beware of excesses. The Central Indicators scanner currently detects this:

CCI indicator is oversold : under -100

Type : Neutral

Timeframe : Daily

Williams %R indicator is oversold : under -80

Type : Neutral

Timeframe : Daily

MACD indicator is back under 0

Type : Bearish

Timeframe : Daily

Price is back under the pivot point

Type : Bearish

Timeframe : Weekly

The Central Patterns scanner, which studies chart patterns, resistances and supports, has identified this signal:

Near support of channel

Type : Bullish

Timeframe : Daily

No result was found by the Central Candlesticks scanner on Japanese candlesticks.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 1.0592 | 1.0827 | 1.0975 | 1.1036 | 1.1071 | 1.1155 | 1.1274 |

| Change (%) | -4.02% | -1.89% | -0.55% | - | +0.32% | +1.08% | +2.16% |

| Change | -0.0444 | -0.0209 | -0.0061 | - | +0.0035 | +0.0119 | +0.0238 |

| Level | Intermediate | Major | Intermediate | - | Intermediate | Major | Minor |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.0993 | 1.1014 | 1.1026 | 1.1047 | 1.1059 | 1.1080 | 1.1092 |

| Camarilla | 1.1030 | 1.1033 | 1.1036 | 1.1039 | 1.1042 | 1.1045 | 1.1048 |

| Woodie | 1.0990 | 1.1012 | 1.1023 | 1.1045 | 1.1056 | 1.1078 | 1.1089 |

| Fibonacci | 1.1014 | 1.1026 | 1.1034 | 1.1047 | 1.1059 | 1.1067 | 1.1080 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.0887 | 1.0947 | 1.1010 | 1.1070 | 1.1133 | 1.1193 | 1.1256 |

| Camarilla | 1.1039 | 1.1051 | 1.1062 | 1.1073 | 1.1084 | 1.1096 | 1.1107 |

| Woodie | 1.0889 | 1.0948 | 1.1012 | 1.1071 | 1.1135 | 1.1194 | 1.1258 |

| Fibonacci | 1.0947 | 1.0994 | 1.1023 | 1.1070 | 1.1117 | 1.1146 | 1.1193 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.0773 | 1.0868 | 1.0991 | 1.1086 | 1.1209 | 1.1304 | 1.1427 |

| Camarilla | 1.1055 | 1.1075 | 1.1095 | 1.1115 | 1.1135 | 1.1155 | 1.1175 |

| Woodie | 1.0788 | 1.0875 | 1.1006 | 1.1093 | 1.1224 | 1.1311 | 1.1442 |

| Fibonacci | 1.0868 | 1.0951 | 1.1002 | 1.1086 | 1.1169 | 1.1220 | 1.1304 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

| RSI (14): | 44.26 | |

| MACD (12,26,9): | -0.0001 | |

| Directional Movement: | -5.4558 | |

| AROON (14): | -21.4285 | |

| DEMA (21): | 1.1073 | |

| Parabolic SAR (0,02-0,02-0,2): | 1.1154 | |

| Elder Ray (13): | -0.0040 | |

| Super Trend (3,10): | 1.0959 | |

| Zig ZAG (10): | 1.1035 | |

| VORTEX (21): | 1.0066 | |

| Stochastique (14,3,5): | 21.39 | |

| TEMA (21): | 1.1062 | |

| Williams %R (14): | -83.82 | |

| Chande Momentum Oscillator (20): | -0.0136 | |

| Repulse (5,40,3): | -0.3006 | |

| ROCnROLL: | 2 | |

| TRIX (15,9): | 0.0114 | |

| Courbe Coppock: | 0.55 |

| MA7: | 1.1062 | |

| MA20: | 1.1084 | |

| MA50: | 1.1062 | |

| MA100: | 1.1009 | |

| MAexp7: | 1.1059 | |

| MAexp20: | 1.1069 | |

| MAexp50: | 1.1050 | |

| MAexp100: | 1.0984 | |

| Price / MA7: | -0.24% | |

| Price / MA20: | -0.43% | |

| Price / MA50: | -0.24% | |

| Price / MA100: | +0.25% | |

| Price / MAexp7: | -0.21% | |

| Price / MAexp20: | -0.30% | |

| Price / MAexp50: | -0.13% | |

| Price / MAexp100: | +0.47% |

News

The latest news and videos published on AUD/NZD at the time of the analysis were as follows:

-

Australian Dollar Analysis: AUD/USD and AUD/NZD May Bounce Before Selloff Resumes

Australian Dollar Analysis: AUD/USD and AUD/NZD May Bounce Before Selloff Resumes

-

EURUSD, USDJPY and AUDNZD Absorb ECB, Risk Trends, Key Data

EURUSD, USDJPY and AUDNZD Absorb ECB, Risk Trends, Key Data

-

Technical Analysis for EUR/USD, USD/CAD, AUD/NZD & More

Technical Analysis for EUR/USD, USD/CAD, AUD/NZD & More

-

Charts for Next Week – EUR/USD, USD/JPY, AUD/NZD & More

Charts for Next Week – EUR/USD, USD/JPY, AUD/NZD & More

-

Trading Outlook – USD, Euro, Pound, AUD/NZD and More

Trading Outlook – USD, Euro, Pound, AUD/NZD and More

Add a comment

Comments

0 comments on the analysis AUD/NZD - Daily