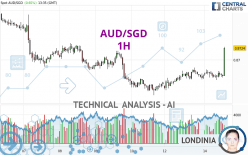

AUD/SGD - 1H - Technical analysis published on 11/14/2023 (GMT)

- 57

- 0

Click here for a new analysis!

- Timeframe : 1H

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

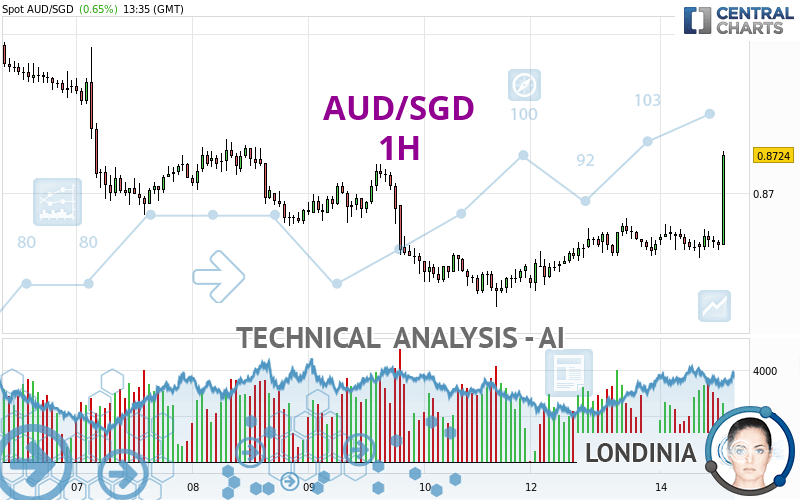

The AUD/SGD rating is 0.8724 SGD. The price has increased by +0.65% since the last closing with the lowest point at 0.8659 SGD and the highest point at 0.8726 SGD. The deviation from the price is +0.75% for the low point and -0.02% for the high point.A bullish opening was detected by the Central Gaps scanner. Buyers are trying to impose a bullish momentum in the very short term.

Bullish opening

Type : Bullish

Timeframe : Openning

A study of price movements over other periods shows the following variations:

Near a new LOW record (1 year)

Type : Bearish

Timeframe : Weekly

Near a new LOW record (1st january)

Type : Bearish

Timeframe : Weekly

Near a new HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

Technical analysis of AUD/SGD in 1H shows an overall slightly bullish trend. 57.14% of the signals given by moving averages are bullish. This slightly bullish trend could be reinforced by the strong bullish signals given by short-term moving averages. The Central Indicators market scanner is currently detecting several bullish signals that could impact this trend:

Moving Average bullish crossovers : AMA20 & AMA50

Type : Bullish

Timeframe : 1 hour

Bullish price crossover with Moving Average 20

Type : Bullish

Timeframe : 1 hour

Bullish price crossover with Moving Average 100

Type : Bullish

Timeframe : 1 hour

An assessment of technical indicators does not currently provide any relevant information on the direction of future price movements.

Caution: the Central Indicators scanner currently detects an excess:

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : 1 hour

Pivot points : price is over resistance 2

Type : Neutral

Timeframe : 1 hour

RSI indicator is back over 50

Type : Bullish

Timeframe : 1 hour

Parabolic SAR indicator bullish reversal

Type : Bullish

Timeframe : 1 hour

Ichimoku : price is over the cloud

Type : Bullish

Timeframe : 1 hour

Momentum indicator is back over 0

Type : Bullish

Timeframe : 1 hour

The Central Patterns scanner, which studies chart patterns, resistances and supports, has identified these signals:

Near horizontal resistance

Type : Bearish

Timeframe : 1 hour

Resistance of channel is broken

Type : Bullish

Timeframe : 1 hour

For a small rebound in the very short term, the Central Candlesticks scanner currently notes the presence of these bullish patterns in Japanese candlesticks:

White line without lower shadow

Type : Bullish

Timeframe : 1 hour

Long white line

Type : Bullish

Timeframe : 1 hour

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 0.8620 | 0.8661 | 0.8685 | 0.8724 | 0.8758 | 0.8792 | 0.8829 |

| Change (%) | -1.19% | -0.72% | -0.45% | - | +0.39% | +0.78% | +1.20% |

| Change | -0.0104 | -0.0063 | -0.0039 | - | +0.0034 | +0.0068 | +0.0105 |

| Level | Major | Minor | Major | - | Minor | Minor | Major |

To determine price objectives, it is also possible to use the pivot points. Here is the price position in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.8597 | 0.8617 | 0.8643 | 0.8663 | 0.8689 | 0.8709 | 0.8735 |

| Camarilla | 0.8655 | 0.8660 | 0.8664 | 0.8668 | 0.8672 | 0.8676 | 0.8681 |

| Woodie | 0.8599 | 0.8619 | 0.8645 | 0.8665 | 0.8691 | 0.8711 | 0.8737 |

| Fibonacci | 0.8617 | 0.8635 | 0.8646 | 0.8663 | 0.8681 | 0.8692 | 0.8709 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.8388 | 0.8508 | 0.8581 | 0.8701 | 0.8774 | 0.8894 | 0.8967 |

| Camarilla | 0.8601 | 0.8619 | 0.8636 | 0.8654 | 0.8672 | 0.8689 | 0.8707 |

| Woodie | 0.8365 | 0.8496 | 0.8558 | 0.8689 | 0.8751 | 0.8882 | 0.8944 |

| Fibonacci | 0.8508 | 0.8582 | 0.8627 | 0.8701 | 0.8775 | 0.8820 | 0.8894 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.8394 | 0.8502 | 0.8591 | 0.8699 | 0.8788 | 0.8896 | 0.8985 |

| Camarilla | 0.8625 | 0.8643 | 0.8661 | 0.8679 | 0.8697 | 0.8715 | 0.8733 |

| Woodie | 0.8384 | 0.8497 | 0.8581 | 0.8694 | 0.8778 | 0.8891 | 0.8975 |

| Fibonacci | 0.8502 | 0.8578 | 0.8624 | 0.8699 | 0.8775 | 0.8821 | 0.8896 |

Numerical data

The following is the status of technical indicators and moving averages registered at the time this technical analysis was created:

| RSI (14): | 58.25 | |

| MACD (12,26,9): | 0.0001 | |

| Directional Movement: | 5.4424 | |

| AROON (14): | -50.0000 | |

| DEMA (21): | 0.8671 | |

| Parabolic SAR (0,02-0,02-0,2): | 0.8659 | |

| Elder Ray (13): | 0.0003 | |

| Super Trend (3,10): | 0.8650 | |

| Zig ZAG (10): | 0.8674 | |

| VORTEX (21): | 0.9667 | |

| Stochastique (14,3,5): | 50.79 | |

| TEMA (21): | 0.8671 | |

| Williams %R (14): | -33.33 | |

| Chande Momentum Oscillator (20): | -0.0001 | |

| Repulse (5,40,3): | 0.0595 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | 0.0031 | |

| Courbe Coppock: | 0.01 |

| MA7: | 0.8688 | |

| MA20: | 0.8697 | |

| MA50: | 0.8721 | |

| MA100: | 0.8793 | |

| MAexp7: | 0.8670 | |

| MAexp20: | 0.8669 | |

| MAexp50: | 0.8668 | |

| MAexp100: | 0.8677 | |

| Price / MA7: | +0.41% | |

| Price / MA20: | +0.31% | |

| Price / MA50: | +0.03% | |

| Price / MA100: | -0.78% | |

| Price / MAexp7: | +0.62% | |

| Price / MAexp20: | +0.63% | |

| Price / MAexp50: | +0.65% | |

| Price / MAexp100: | +0.54% |

Add a comment

Comments

0 comments on the analysis AUD/SGD - 1H