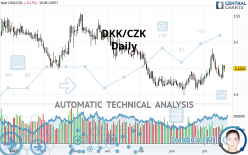

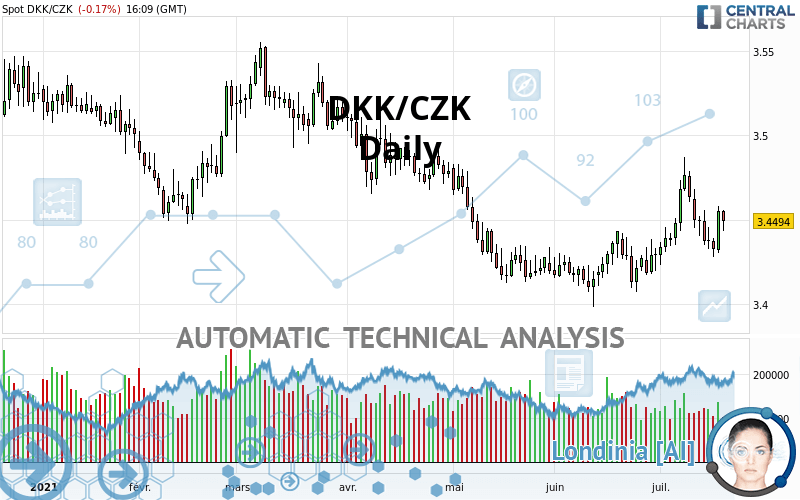

DKK/CZK - Daily - Technical analysis published on 07/20/2021 (GMT)

- 186

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : LEVEL MAINTAINED

Summary of the analysis

Additional analysis

Quotes

DKK/CZK rating 3.4494 CZK. The price is lower by -0.17% since the last closing with the lowest point at 3.4433 CZK and the highest point at 3.4557 CZK. The deviation from the price is +0.18% for the low point and -0.18% for the high point.The Central Gaps scanner detects a bullish opening marking the presence of buyers ahead of sellers at the opening but not sufficiently marked to allow the price to register a quotation gap.

Bullish opening

Type : Bullish

Timeframe : Openning

So that you have an overall view of the price change, here is a table showing the variations over several periods:

Near a new LOW record (5 years)

Type : Bearish

Timeframe : Weekly

Technical

Technical analysis of DKK/CZK in Daily shows a neutral overall trend. The strong bullish signals currently being given by short-term moving averages could allow the overall trend to return to bullish. The Central Indicators market scanner is currently detecting several bullish signals that could impact this trend:

Bullish trend reversal : Moving Average 50

Type : Bullish

Timeframe : Daily

Bullish trend reversal : adaptative moving average 20

Type : Bullish

Timeframe : Daily

Bullish trend reversal : adaptative moving average 50

Type : Bullish

Timeframe : Daily

Bullish price crossover with Moving Average 20

Type : Bullish

Timeframe : Daily

Bullish price crossover with adaptative moving average 20

Type : Bullish

Timeframe : Daily

Bullish price crossover with adaptative moving average 50

Type : Bullish

Timeframe : Daily

In fact, only 8 technical indicators out of 18 studied are currently positioned bullish. Other results related to technical indicators were also found by the Central Indicators scanner:

RSI indicator is back over 50

Type : Bullish

Timeframe : Daily

Price is back over the pivot point

Type : Bullish

Timeframe : Daily

Price is back under the pivot point

Type : Bearish

Timeframe : Weekly

Williams %R indicator is back over -50

Type : Bullish

Timeframe : Daily

The Central Patterns scanner, which studies chart patterns, resistances and supports, has identified this signal:

Near support of channel

Type : Bullish

Timeframe : Daily

For a small rebound in the very short term, the Central Candlesticks scanner currently notes the presence of this bullish pattern in Japanese candlesticks:

Bullish engulfing lines

Type : Bullish

Timeframe : Daily

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 3.2199 | 3.3246 | 3.4079 | 3.4494 | 3.4535 | 3.5030 | 3.5520 |

| Change (%) | -6.65% | -3.62% | -1.20% | - | +0.12% | +1.55% | +2.97% |

| Change | -0.2295 | -0.1248 | -0.0415 | - | +0.0041 | +0.0536 | +0.1026 |

| Level | Intermediate | Intermediate | Major | - | Major | Major | Major |

To determine price objectives, it is also possible to use the pivot points. Here is the price position in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 3.4093 | 3.4198 | 3.4375 | 3.4480 | 3.4657 | 3.4762 | 3.4939 |

| Camarilla | 3.4476 | 3.4501 | 3.4527 | 3.4553 | 3.4579 | 3.4605 | 3.4631 |

| Woodie | 3.4130 | 3.4216 | 3.4412 | 3.4498 | 3.4694 | 3.4780 | 3.4976 |

| Fibonacci | 3.4198 | 3.4305 | 3.4372 | 3.4480 | 3.4587 | 3.4654 | 3.4762 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 3.3768 | 3.4023 | 3.4173 | 3.4428 | 3.4578 | 3.4833 | 3.4983 |

| Camarilla | 3.4213 | 3.4250 | 3.4287 | 3.4324 | 3.4361 | 3.4398 | 3.4435 |

| Woodie | 3.3717 | 3.3997 | 3.4122 | 3.4402 | 3.4527 | 3.4807 | 3.4932 |

| Fibonacci | 3.4023 | 3.4177 | 3.4273 | 3.4428 | 3.4582 | 3.4678 | 3.4833 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 3.3586 | 3.3785 | 3.4039 | 3.4238 | 3.4492 | 3.4691 | 3.4945 |

| Camarilla | 3.4169 | 3.4211 | 3.4253 | 3.4294 | 3.4336 | 3.4377 | 3.4419 |

| Woodie | 3.3615 | 3.3799 | 3.4068 | 3.4252 | 3.4521 | 3.4705 | 3.4974 |

| Fibonacci | 3.3785 | 3.3958 | 3.4065 | 3.4238 | 3.4411 | 3.4518 | 3.4691 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

| RSI (14): | 54.41 | |

| MACD (12,26,9): | 0.0045 | |

| Directional Movement: | 7.7358 | |

| AROON (14): | 42.8571 | |

| DEMA (21): | 3.4484 | |

| Parabolic SAR (0,02-0,02-0,2): | 3.4818 | |

| Elder Ray (13): | 0.0042 | |

| Super Trend (3,10): | 3.4272 | |

| Zig ZAG (10): | 3.4495 | |

| VORTEX (21): | 1.0459 | |

| Stochastique (14,3,5): | 37.65 | |

| TEMA (21): | 3.4529 | |

| Williams %R (14): | -59.97 | |

| Chande Momentum Oscillator (20): | 0.0096 | |

| Repulse (5,40,3): | 0.2395 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | 0.0225 | |

| Courbe Coppock: | 1.10 |

| MA7: | 3.4446 | |

| MA20: | 3.4410 | |

| MA50: | 3.4304 | |

| MA100: | 3.4636 | |

| MAexp7: | 3.4469 | |

| MAexp20: | 3.4428 | |

| MAexp50: | 3.4429 | |

| MAexp100: | 3.4585 | |

| Price / MA7: | +0.14% | |

| Price / MA20: | +0.24% | |

| Price / MA50: | +0.55% | |

| Price / MA100: | -0.41% | |

| Price / MAexp7: | +0.07% | |

| Price / MAexp20: | +0.19% | |

| Price / MAexp50: | +0.19% | |

| Price / MAexp100: | -0.26% |

Add a comment

Comments

0 comments on the analysis DKK/CZK - Daily