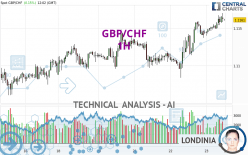

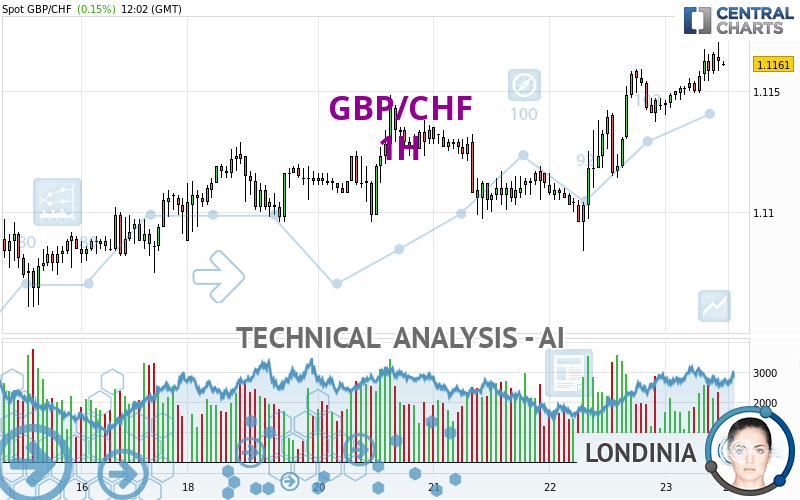

GBP/CHF - 1H - Technical analysis published on 02/23/2024 (GMT)

- 87

- 0

Click here for a new analysis!

- Timeframe : 1H

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

The GBP/CHF rating is 1.1161 CHF. On the day, this instrument gained +0.15% and was between 1.1140 CHF and 1.1170 CHF. This implies that the price is at +0.19% from its lowest and at -0.08% from its highest.Here is a more detailed summary of the historical variations registered by GBP/CHF:

Near a new LOW record (1 year)

Type : Bearish

Timeframe : Weekly

Near a new LOW record (1st january)

Type : Bearish

Timeframe : Weekly

Near a new LOW record (1 month)

Type : Bearish

Timeframe : Weekly

Technical

Technical analysis of this 1H chart of GBP/CHF indicates that the overall trend is strongly bullish. 92.86% of the signals given by moving averages are bullish. The overall trend is supported by the strong bullish signals from short-term moving averages. The Central Indicators market scanner currently does not detect any result that concerns moving averages.

The probability of a further increase is high given the direction of the technical indicators.

Caution: the Central Indicators scanner currently detects an excess:

CCI indicator is overbought : over 100

Type : Neutral

Timeframe : 1 hour

Previous candle closed over Bollinger bands

Type : Neutral

Timeframe : 1 hour

CCI indicator: bearish divergence

Type : Bearish

Timeframe : 1 hour

MACD indicator: bearish divergence

Type : Bearish

Timeframe : 1 hour

RSI indicator: bearish divergence

Type : Bearish

Timeframe : 1 hour

Price is back over the pivot point

Type : Bullish

Timeframe : Weekly

The Central Patterns scanner, which studies chart patterns, resistances and supports, has identified these signals:

Near horizontal resistance

Type : Bearish

Timeframe : 1 hour

Resistance of channel is broken

Type : Bullish

Timeframe : 1 hour

The presence of a bearish pattern in Japanese candlesticks detected by Central Candlesticks that could cause a correction in the very short term was also detected:

Bearish harami

Type : Bearish

Timeframe : 1 hour

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 1.1119 | 1.1148 | 1.1159 | 1.1161 | 1.1174 | 1.1185 | 1.1231 |

| Change (%) | -0.38% | -0.12% | -0.02% | - | +0.12% | +0.22% | +0.63% |

| Change | -0.0042 | -0.0013 | -0.0002 | - | +0.0013 | +0.0024 | +0.0070 |

| Level | Intermediate | Major | Minor | - | Major | Major | Minor |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.1024 | 1.1054 | 1.1099 | 1.1129 | 1.1174 | 1.1204 | 1.1249 |

| Camarilla | 1.1123 | 1.1130 | 1.1137 | 1.1144 | 1.1151 | 1.1158 | 1.1165 |

| Woodie | 1.1032 | 1.1058 | 1.1107 | 1.1133 | 1.1182 | 1.1208 | 1.1257 |

| Fibonacci | 1.1054 | 1.1083 | 1.1100 | 1.1129 | 1.1158 | 1.1175 | 1.1204 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.0870 | 1.0950 | 1.1025 | 1.1105 | 1.1180 | 1.1260 | 1.1335 |

| Camarilla | 1.1057 | 1.1072 | 1.1086 | 1.1100 | 1.1114 | 1.1128 | 1.1143 |

| Woodie | 1.0868 | 1.0949 | 1.1023 | 1.1104 | 1.1178 | 1.1259 | 1.1333 |

| Fibonacci | 1.0950 | 1.1009 | 1.1046 | 1.1105 | 1.1164 | 1.1201 | 1.1260 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.0345 | 1.0514 | 1.0724 | 1.0893 | 1.1103 | 1.1272 | 1.1482 |

| Camarilla | 1.0831 | 1.0866 | 1.0900 | 1.0935 | 1.0970 | 1.1005 | 1.1039 |

| Woodie | 1.0367 | 1.0524 | 1.0746 | 1.0903 | 1.1125 | 1.1282 | 1.1504 |

| Fibonacci | 1.0514 | 1.0658 | 1.0748 | 1.0893 | 1.1037 | 1.1127 | 1.1272 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

| RSI (14): | 60.53 | |

| MACD (12,26,9): | 0.0009 | |

| Directional Movement: | 16.6643 | |

| AROON (14): | 92.8571 | |

| DEMA (21): | 1.1161 | |

| Parabolic SAR (0,02-0,02-0,2): | 1.1154 | |

| Elder Ray (13): | 0.0010 | |

| Super Trend (3,10): | 1.1136 | |

| Zig ZAG (10): | 1.1160 | |

| VORTEX (21): | 1.2299 | |

| Stochastique (14,3,5): | 79.70 | |

| TEMA (21): | 1.1164 | |

| Williams %R (14): | -24.24 | |

| Chande Momentum Oscillator (20): | 0.0018 | |

| Repulse (5,40,3): | 0.0290 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | 0.0117 | |

| Courbe Coppock: | 0.24 |

| MA7: | 1.1121 | |

| MA20: | 1.1045 | |

| MA50: | 1.0957 | |

| MA100: | 1.0992 | |

| MAexp7: | 1.1159 | |

| MAexp20: | 1.1149 | |

| MAexp50: | 1.1136 | |

| MAexp100: | 1.1125 | |

| Price / MA7: | +0.36% | |

| Price / MA20: | +1.05% | |

| Price / MA50: | +1.86% | |

| Price / MA100: | +1.54% | |

| Price / MAexp7: | +0.02% | |

| Price / MAexp20: | +0.11% | |

| Price / MAexp50: | +0.22% | |

| Price / MAexp100: | +0.32% |

News

Don't forget to follow the news on GBP/CHF. At the time of publication of this analysis, the latest news was as follows:

-

GBP/CHF Forecast December 14, 2023

GBP/CHF Forecast December 14, 2023

-

GBP/CHF Forecast December24, 2021

GBP/CHF Forecast December24, 2021

-

Weekly Technical Analysis: 23/07/2019 - USDJPY, GBPCHF, NZDUSD

Weekly Technical Analysis: 23/07/2019 - USDJPY, GBPCHF, NZDUSD

-

GBP/CHF Is a Preferred Setup Because of its Lack of Key Events (Quick Take Video)

GBP/CHF Is a Preferred Setup Because of its Lack of Key Events (Quick Take Video)

Add a comment

Comments

0 comments on the analysis GBP/CHF - 1H