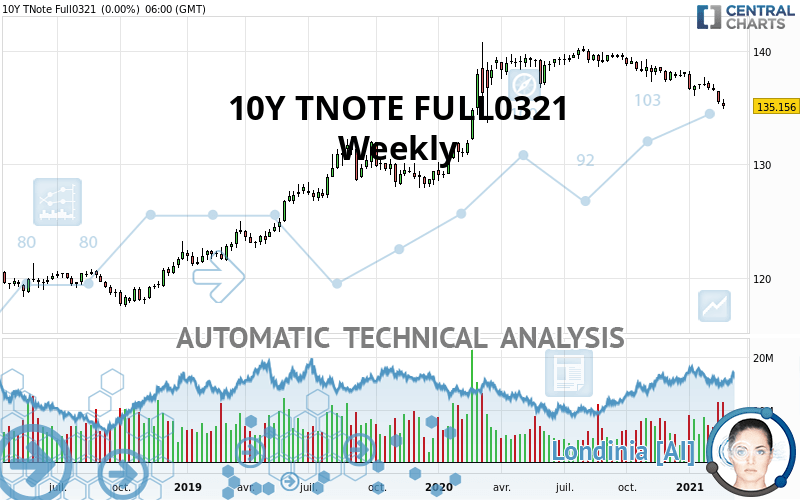

10Y TNOTE FULL0624 - Weekly - Technical analysis published on 02/25/2021 (GMT)

- 130

- 0

Click here for a new analysis!

- Timeframe : Weekly

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

10Y TNOTE FULL0321 rating 134.188 USD. The price registered a decrease of -1.28% over 5 days with the lowest point at 135.031 USD and the highest point at 135.594 USD. The deviation from the price is -0.62% for the low point and -1.04% for the high point.The Central Gaps scanner detects a bearish opening marking the presence of sellers ahead of buyers at the opening but not sufficiently marked to allow the price to register a quotation gap.

Bearish opening

Type : Bearish

Timeframe : Openning

A study of price movements over other periods shows the following variations:

Near a new HIGH record (5 years)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1st january)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

The Central Volumes scanner notes the presence of abnormal volumes:

Abnormal volumes

Timeframe : 5 days

Technical

A technical analysis in Weekly of this 10Y TNOTE FULL0321 chart shows a neutral trend. The strong bearish signals currently being given by short-term moving averages could allow the overall trend to return to a bearish trend. The Central Indicators scanner detects a bearish signal on moving averages that could impact this trend:

Bearish trend reversal : Moving Average 50

Type : Bearish

Timeframe : Weekly

In fact, 14 technical indicators on 18 studied are currently positioned bearish. Caution: the Central Indicators scanner currently detects an excess:

RSI indicator is oversold : under 30

Type : Neutral

Timeframe : Weekly

CCI indicator is oversold : under -100

Type : Neutral

Timeframe : Weekly

Williams %R indicator is oversold : under -80

Type : Neutral

Timeframe : Weekly

Pivot points : price is under support 2

Type : Neutral

Timeframe : Weekly

Ichimoku : price is under the cloud

Type : Bearish

Timeframe : Weekly

No signals are given by Central Patterns, a market scanner specialised in chart patterns, resistances and supports.

The Central Candlesticks scanner, specialised in Japanese candlesticks, did not identify any signals.

| S3 | S2 | S1 | Price | R1 | R2 | |

|---|---|---|---|---|---|---|

| ProTrendLines | 121.234 | 127.925 | 133.863 | 134.188 | 137.094 | 140.328 |

| Change (%) | -9.65% | -4.67% | -0.24% | - | +2.17% | +4.58% |

| Change | -12.954 | -6.263 | -0.325 | - | +2.906 | +6.140 |

| Level | Minor | Major | Major | - | Minor | Major |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 133.974 | 134.417 | 134.833 | 135.276 | 135.693 | 136.136 | 136.553 |

| Camarilla | 135.014 | 135.092 | 135.171 | 135.250 | 135.329 | 135.408 | 135.486 |

| Woodie | 133.961 | 134.410 | 134.820 | 135.270 | 135.680 | 136.129 | 136.539 |

| Fibonacci | 134.417 | 134.745 | 134.948 | 135.276 | 135.605 | 135.807 | 136.136 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 133.890 | 134.609 | 135.031 | 135.750 | 136.172 | 136.891 | 137.313 |

| Camarilla | 135.139 | 135.244 | 135.348 | 135.453 | 135.558 | 135.662 | 135.767 |

| Woodie | 133.742 | 134.535 | 134.883 | 135.676 | 136.024 | 136.817 | 137.165 |

| Fibonacci | 134.609 | 135.045 | 135.314 | 135.750 | 136.186 | 136.455 | 136.891 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 133.948 | 134.989 | 136.089 | 137.130 | 138.230 | 139.271 | 140.371 |

| Camarilla | 136.599 | 136.796 | 136.992 | 137.188 | 137.384 | 137.581 | 137.777 |

| Woodie | 133.977 | 135.004 | 136.118 | 137.145 | 138.259 | 139.286 | 140.400 |

| Fibonacci | 134.989 | 135.807 | 136.313 | 137.130 | 137.948 | 138.454 | 139.271 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

| RSI (14): | 26.22 | |

| MACD (12,26,9): | -0.6970 | |

| Directional Movement: | -29.016 | |

| AROON (14): | -100.000 | |

| DEMA (21): | 136.409 | |

| Parabolic SAR (0,02-0,02-0,2): | 137.151 | |

| Elder Ray (13): | -1.744 | |

| Super Trend (3,10): | 137.735 | |

| Zig ZAG (10): | 134.188 | |

| VORTEX (21): | 0.7330 | |

| Stochastique (14,3,5): | 7.91 | |

| TEMA (21): | 135.341 | |

| Williams %R (14): | -98.94 | |

| Chande Momentum Oscillator (20): | -3.188 | |

| Repulse (5,40,3): | -2.2630 | |

| ROCnROLL: | 2 | |

| TRIX (15,9): | -0.0400 | |

| Courbe Coppock: | 3.19 |

| MA7: | 135.344 | |

| MA20: | 136.281 | |

| MA50: | 136.907 | |

| MA100: | 137.608 | |

| MAexp7: | 135.996 | |

| MAexp20: | 137.114 | |

| MAexp50: | 136.695 | |

| MAexp100: | 134.024 | |

| Price / MA7: | -0.85% | |

| Price / MA20: | -1.54% | |

| Price / MA50: | -1.99% | |

| Price / MA100: | -2.49% | |

| Price / MAexp7: | -1.33% | |

| Price / MAexp20: | -2.13% | |

| Price / MAexp50: | -1.83% | |

| Price / MAexp100: | +0.12% |

Add a comment

Comments

0 comments on the analysis 10Y TNOTE FULL0624 - Weekly