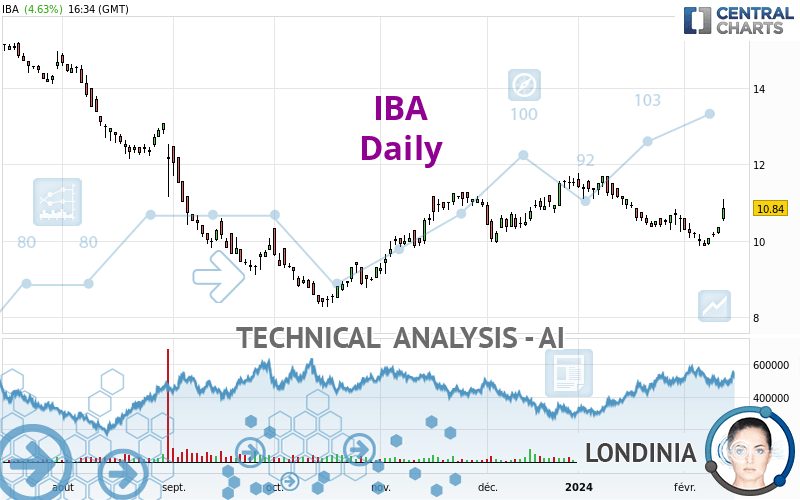

IBA - Daily - Technical analysis published on 02/14/2024 (GMT)

- 90

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : INVALID

Summary of the analysis

Additional analysis

Quotes

The IBA price is 10.84 EUR. On the day, this instrument gained +4.63% and was between 10.50 EUR and 11.08 EUR. This implies that the price is at +3.24% from its lowest and at -2.17% from its highest.The Central Gaps scanner detects a bullish gap which is a sign that buyers have taken the lead in the very short term.

Opening Gap UP

Type : Bullish

Timeframe : Openning

A study of price movements over other periods shows the following variations:

Near a new HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Abnormal volumes on IBA were detected by the Central Volumes scanner:

Abnormal volumes

Timeframe : 5 days

Technical

Technical analysis of IBA in Daily shows an overall slightly bullish trend. Only 53.57% of the signals given by moving averages are bullish. This slightly bullish trend is not supported by the signals currently being given by short-term moving averages. The Central Indicators market scanner is currently detecting several bullish signals that could impact this trend:

Bullish price crossover with Moving Average 20

Type : Bullish

Timeframe : Daily

Bullish price crossover with Moving Average 50

Type : Bullish

Timeframe : Daily

Bullish price crossover with adaptative moving average 50

Type : Bullish

Timeframe : Daily

Bullish price crossover with adaptative moving average 100

Type : Bullish

Timeframe : Daily

The technical indicators are bullish. There is still some doubt about the price increase.

But beware of excesses. The Central Indicators scanner currently detects this:

CCI indicator is overbought : over 100

Type : Neutral

Timeframe : Daily

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : Weekly

RSI indicator is back over 50

Type : Bullish

Timeframe : Daily

MACD crosses UP its Moving Average

Type : Bullish

Timeframe : Daily

Parabolic SAR indicator bullish reversal

Type : Bullish

Timeframe : Daily

Aroon indicator bullish trend

Type : Bullish

Timeframe : Daily

SuperTrend indicator bullish reversal

Type : Bullish

Timeframe : Daily

Momentum indicator is back over 0

Type : Bullish

Timeframe : Daily

An analysis of the price chart with the Central Patterns scanner (detector of chart patterns and resistances and supports) shows several results that can have an impact on the price change:

Near resistance of channel

Type : Bearish

Timeframe : Daily

Near resistance of triangle

Type : Bearish

Timeframe : Daily

For a small rebound in the very short term, the Central Candlesticks scanner currently notes the presence of this bullish pattern in Japanese candlesticks:

Upside gap

Type : Bullish

Timeframe : Daily

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 8.39 | 9.87 | 10.72 | 10.84 | 11.78 | 13.37 | 14.75 |

| Change (%) | -22.60% | -8.95% | -1.11% | - | +8.67% | +23.34% | +36.07% |

| Change | -2.45 | -0.97 | -0.12 | - | +0.94 | +2.53 | +3.91 |

| Level | Major | Major | Intermediate | - | Major | Intermediate | Intermediate |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 9.95 | 10.23 | 10.53 | 10.81 | 11.11 | 11.39 | 11.69 |

| Camarilla | 10.68 | 10.73 | 10.79 | 10.84 | 10.89 | 10.95 | 11.00 |

| Woodie | 9.97 | 10.24 | 10.55 | 10.82 | 11.13 | 11.40 | 11.71 |

| Fibonacci | 10.23 | 10.45 | 10.59 | 10.81 | 11.03 | 11.17 | 11.39 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 9.57 | 9.71 | 9.93 | 10.07 | 10.29 | 10.43 | 10.65 |

| Camarilla | 10.04 | 10.07 | 10.11 | 10.14 | 10.17 | 10.21 | 10.24 |

| Woodie | 9.60 | 9.73 | 9.96 | 10.09 | 10.32 | 10.45 | 10.68 |

| Fibonacci | 9.71 | 9.85 | 9.94 | 10.07 | 10.21 | 10.30 | 10.43 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 8.37 | 9.29 | 9.93 | 10.85 | 11.49 | 12.41 | 13.05 |

| Camarilla | 10.13 | 10.27 | 10.42 | 10.56 | 10.70 | 10.85 | 10.99 |

| Woodie | 8.22 | 9.22 | 9.78 | 10.78 | 11.34 | 12.34 | 12.90 |

| Fibonacci | 9.29 | 9.89 | 10.26 | 10.85 | 11.45 | 11.82 | 12.41 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

| RSI (14): | 57.52 | |

| MACD (12,26,9): | -0.1500 | |

| Directional Movement: | 13.29 | |

| AROON (14): | 35.71 | |

| DEMA (21): | 10.25 | |

| Parabolic SAR (0,02-0,02-0,2): | 9.86 | |

| Elder Ray (13): | 0.41 | |

| Super Trend (3,10): | 9.86 | |

| Zig ZAG (10): | 10.84 | |

| VORTEX (21): | 0.8600 | |

| Stochastique (14,3,5): | 53.86 | |

| TEMA (21): | 10.15 | |

| Williams %R (14): | -19.67 | |

| Chande Momentum Oscillator (20): | 0.36 | |

| Repulse (5,40,3): | 3.7500 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | -0.2700 | |

| Courbe Coppock: | 5.93 |

| MA7: | 10.20 | |

| MA20: | 10.41 | |

| MA50: | 10.75 | |

| MA100: | 10.23 | |

| MAexp7: | 10.36 | |

| MAexp20: | 10.46 | |

| MAexp50: | 10.61 | |

| MAexp100: | 10.92 | |

| Price / MA7: | +6.27% | |

| Price / MA20: | +4.13% | |

| Price / MA50: | +0.84% | |

| Price / MA100: | +5.96% | |

| Price / MAexp7: | +4.63% | |

| Price / MAexp20: | +3.63% | |

| Price / MAexp50: | +2.17% | |

| Price / MAexp100: | -0.73% |

News

Don't forget to follow the news on IBA. At the time of publication of this analysis, the latest news was as follows:

- PanTera signs agreement with Bayer for the supply of actinium-225

- IBA acquires Radcal Corporation to expand Medical Imaging Quality Assurance offering and strengthen US presence

- IBA – TRANSPARENCY NOTIFICATION

- IBA - Regulated Information

- IBA – Transparency Notification

Add a comment

Comments

0 comments on the analysis IBA - Daily