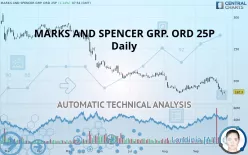

MARKS AND SPENCER GRP. ORD 1P - Daily - Technical analysis published on 09/27/2019 (GMT)

- 460

- 0

- Who voted?

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

MARKS AND SPENCER GRP. ORD 25P rating 182.30 GBX. On the day, this instrument gained +1.14% with the lowest point at 179.30 GBX and the highest point at 182.90 GBX. The deviation from the price is +1.67% for the low point and -0.33% for the high point.The Central Gaps scanner detects a bullish opening marking the presence of buyers ahead of sellers at the opening but not sufficiently marked to allow the price to register a quotation gap.

Bullish opening

Type : Bullish

Timeframe : Openning

A study of price movements over other periods shows the following variations:

New LOW record (5 years)

Type : Bearish

Timeframe : Weekly

Near a new LOW record (1st january)

Type : Bearish

Timeframe : Weekly

Near a new LOW record (1 month)

Type : Bearish

Timeframe : Weekly

Technical

A technical analysis in Daily of this MARKS AND SPENCER GRP. ORD 25P chart shows a sharp bearish trend. The signals given by moving averages are 92.86% bearish. This strong bearish trend is confirmed by the strong signals currently being given by short-term moving averages. The Central Indicators scanner does not detect any result on moving averages that would impact this trend.

In fact, Central Analyzer took into account 18 technical indicators and the result was as follows: 4 are bullish, 4 are neutral and 10 are bearish. Caution: the Central Indicators scanner currently detects an excess:

CCI indicator is oversold : under -100

Type : Neutral

Timeframe : Daily

Williams %R indicator is oversold : under -80

Type : Neutral

Timeframe : Daily

Pivot points : price is under support 3

Type : Neutral

Timeframe : Weekly

Central Patterns, the market scanner focusing on chart patterns, resistances and supports found these results:

Near support of triangle

Type : Bullish

Timeframe : Daily

Horizontal support is broken

Type : Bearish

Timeframe : Daily

Support of channel is broken

Type : Bearish

Timeframe : Daily

The Central Candlesticks scanner currently notes the presence of this pattern in Japanese candlesticks that could mark the end of the short-term trend currently underway:

Doji

Type : Neutral

Timeframe : Daily

| S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|

| ProTrendLines | 180.35 | 182.30 | 200.00 | 265.32 | 290.29 |

| Change (%) | -1.07% | - | +9.71% | +45.54% | +59.24% |

| Change | -1.95 | - | +17.70 | +83.02 | +107.99 |

| Level | Minor | - | Major | Minor | Minor |

To determine price objectives, it is also possible to use the pivot points. Here is the price position in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 172.12 | 174.48 | 177.37 | 179.73 | 182.62 | 184.98 | 187.87 |

| Camarilla | 178.81 | 179.29 | 179.77 | 180.25 | 180.73 | 181.21 | 181.69 |

| Woodie | 172.38 | 174.61 | 177.63 | 179.86 | 182.88 | 185.11 | 188.13 |

| Fibonacci | 174.48 | 176.49 | 177.73 | 179.73 | 181.74 | 182.98 | 184.98 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 182.32 | 189.08 | 192.47 | 199.23 | 202.62 | 209.38 | 212.77 |

| Camarilla | 193.06 | 193.99 | 194.92 | 195.85 | 196.78 | 197.71 | 198.64 |

| Woodie | 180.63 | 188.24 | 190.78 | 198.39 | 200.93 | 208.54 | 211.08 |

| Fibonacci | 189.08 | 192.96 | 195.36 | 199.23 | 203.11 | 205.51 | 209.38 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 145.13 | 162.42 | 177.33 | 194.62 | 209.53 | 226.82 | 241.73 |

| Camarilla | 183.40 | 186.35 | 189.30 | 192.25 | 195.20 | 198.15 | 201.11 |

| Woodie | 143.95 | 161.83 | 176.15 | 194.03 | 208.35 | 226.23 | 240.55 |

| Fibonacci | 162.42 | 174.72 | 182.32 | 194.62 | 206.92 | 214.52 | 226.82 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

| RSI (14): | 36.49 | |

| MACD (12,26,9): | -2.7000 | |

| Directional Movement: | -20.37 | |

| AROON (14): | -57.15 | |

| DEMA (21): | 189.31 | |

| Parabolic SAR (0,02-0,02-0,2): | 198.94 | |

| Elder Ray (13): | -9.37 | |

| Super Trend (3,10): | 196.11 | |

| Zig ZAG (10): | 182.15 | |

| VORTEX (21): | 0.8800 | |

| Stochastique (14,3,5): | 10.76 | |

| TEMA (21): | 188.14 | |

| Williams %R (14): | -81.30 | |

| Chande Momentum Oscillator (20): | -20.70 | |

| Repulse (5,40,3): | -1.2100 | |

| ROCnROLL: | 2 | |

| TRIX (15,9): | 0.0000 | |

| Courbe Coppock: | 7.22 |

| MA7: | 187.76 | |

| MA20: | 194.58 | |

| MA50: | 194.73 | |

| MA100: | 209.85 | |

| MAexp7: | 186.79 | |

| MAexp20: | 192.05 | |

| MAexp50: | 197.39 | |

| MAexp100: | 210.54 | |

| Price / MA7: | -2.91% | |

| Price / MA20: | -6.31% | |

| Price / MA50: | -6.38% | |

| Price / MA100: | -13.13% | |

| Price / MAexp7: | -2.40% | |

| Price / MAexp20: | -5.08% | |

| Price / MAexp50: | -7.64% | |

| Price / MAexp100: | -13.41% |

News

The latest news and videos published on MARKS AND SPENCER GRP. ORD 25P at the time of the analysis were as follows:

- CHARG Resource Center receives charitable donation to assist in providing services to those living with mental illness in Denver area

- Spencer Stuart Launches New Unit Formed from the Talent-Related Businesses it Acquired from Aon

- Spencer Stuart Launches New Unit Formed from the Talent-Related Businesses it Acquired from Aon

- Access to Quality Schools Highlights Lifestyle Advantages at Spencer’s Crossing in Murrieta

- Palmetto at Spencer’s Crossing Charms Buyers With Well-Planned Designs and Tempting Options

Add a comment

Comments

0 comments on the analysis MARKS AND SPENCER GRP. ORD 1P - Daily