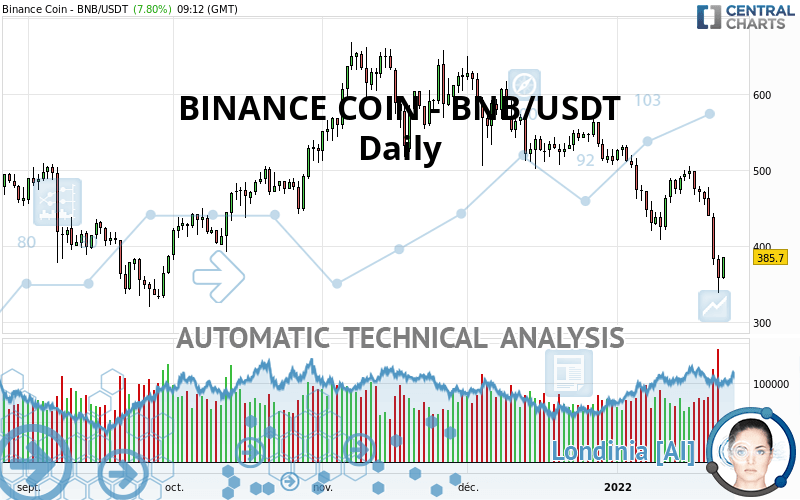

BINANCE COIN - BNB/USDT - Daily - Technical analysis published on 01/23/2022 (GMT)

- 179

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : LEVEL MAINTAINED

Summary of the analysis

Additional analysis

Quotes

The BINANCE COIN - BNB/USDT price is 385.70 USDT. On the day, this instrument gained +7.80% and was traded between 356.60 USDT and 385.74 USDT over the period. The price is currently at +8.16% from its lowest and -0.01% from its highest.A bearish opening was detected by the Central Gaps scanner. Sellers are trying to impose a bearish trend in the very short term.

Bearish opening

Type : Bearish

Timeframe : Openning

Here is a more detailed summary of the historical variations registered by BINANCE COIN - BNB/USDT:

New LOW record (1st january)

Type : Bearish

Timeframe : Weekly

New LOW record (1 month)

Type : Bearish

Timeframe : Weekly

Technical

Technical analysis of BINANCE COIN - BNB/USDT in Daily shows a overall strongly bearish trend. The signals given by moving averages are 92.86% bearish. This strong bearish trend is confirmed by the strong signals currently being given by short-term moving averages. An assessment of moving averages reveals a bearish signal that could impact this trend:

Bearish trend reversal : Moving Average 100

Type : Bearish

Timeframe : Daily

In fact, 12 technical indicators on 18 studied are currently bearish. Caution: the Central Indicators scanner currently detects an excess:

CCI indicator is oversold : under -100

Type : Neutral

Timeframe : Daily

Previous candle closed under Bollinger bands

Type : Neutral

Timeframe : Daily

CCI indicator: bullish divergence

Type : Bullish

Timeframe : Daily

RSI indicator: bullish divergence

Type : Bullish

Timeframe : Daily

Pivot points : price is under support 1

Type : Neutral

Timeframe : Weekly

Pivot points : price is under support 3

Type : Neutral

Timeframe : Daily

MACD crosses DOWN its Moving Average

Type : Bearish

Timeframe : Daily

Price is back over the pivot point

Type : Bullish

Timeframe : Daily

Momentum indicator is back under 0

Type : Bearish

Timeframe : Daily

Central Patterns, the market scanner focusing on chart patterns, resistances and supports found these results:

Horizontal support is broken

Type : Bearish

Timeframe : Daily

Support of channel is broken

Type : Bearish

Timeframe : Daily

Support of triangle is broken

Type : Bearish

Timeframe : Daily

Central Candlesticks, the scanner specialised in Japanese candlesticks, detects a bullish signal that could support the hypothesis of a small rebound in the very short term:

Bullish engulfing lines

Type : Bullish

Timeframe : Daily

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 261.92 | 333.01 | 383.61 | 385.70 | 424.67 | 504.45 | 563.62 |

| Change (%) | -32.09% | -13.66% | -0.54% | - | +10.10% | +30.79% | +46.13% |

| Change | -123.78 | -52.69 | -2.09 | - | +38.97 | +118.75 | +177.92 |

| Level | Major | Major | Minor | - | Major | Major | Minor |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 283.54 | 310.89 | 334.35 | 361.70 | 385.16 | 412.51 | 435.97 |

| Camarilla | 343.83 | 348.49 | 353.14 | 357.80 | 362.46 | 367.12 | 371.77 |

| Woodie | 281.59 | 309.92 | 332.40 | 360.73 | 383.21 | 411.54 | 434.02 |

| Fibonacci | 310.89 | 330.30 | 342.29 | 361.70 | 381.11 | 393.10 | 412.51 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 128.18 | 233.21 | 295.51 | 400.54 | 462.84 | 567.87 | 630.17 |

| Camarilla | 311.78 | 327.12 | 342.46 | 357.80 | 373.14 | 388.48 | 403.82 |

| Woodie | 106.81 | 222.53 | 274.14 | 389.86 | 441.47 | 557.19 | 608.80 |

| Fibonacci | 233.21 | 297.13 | 336.62 | 400.54 | 464.46 | 503.95 | 567.87 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 355.60 | 428.86 | 470.23 | 543.49 | 584.86 | 658.12 | 699.49 |

| Camarilla | 480.09 | 490.60 | 501.10 | 511.61 | 522.12 | 532.63 | 543.13 |

| Woodie | 339.67 | 420.89 | 454.30 | 535.52 | 568.93 | 650.15 | 683.56 |

| Fibonacci | 428.86 | 472.65 | 499.70 | 543.49 | 587.28 | 614.33 | 658.12 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

| RSI (14): | 33.05 | |

| MACD (12,26,9): | -30.8800 | |

| Directional Movement: | -31.44 | |

| AROON (14): | -42.86 | |

| DEMA (21): | 415.42 | |

| Parabolic SAR (0,02-0,02-0,2): | 489.44 | |

| Elder Ray (13): | -65.86 | |

| Super Trend (3,10): | 462.05 | |

| Zig ZAG (10): | 384.33 | |

| VORTEX (21): | 0.7500 | |

| Stochastique (14,3,5): | 15.45 | |

| TEMA (21): | 402.71 | |

| Williams %R (14): | -72.04 | |

| Chande Momentum Oscillator (20): | -78.31 | |

| Repulse (5,40,3): | -6.5500 | |

| ROCnROLL: | 2 | |

| TRIX (15,9): | -0.6400 | |

| Courbe Coppock: | 17.47 |

| MA7: | 425.11 | |

| MA20: | 453.99 | |

| MA50: | 507.16 | |

| MA100: | 536.90 | |

| MAexp7: | 413.95 | |

| MAexp20: | 453.22 | |

| MAexp50: | 492.46 | |

| MAexp100: | 500.69 | |

| Price / MA7: | -9.27% | |

| Price / MA20: | -15.04% | |

| Price / MA50: | -23.95% | |

| Price / MA100: | -28.16% | |

| Price / MAexp7: | -6.82% | |

| Price / MAexp20: | -14.90% | |

| Price / MAexp50: | -21.68% | |

| Price / MAexp100: | -22.97% |

Add a comment

Comments

0 comments on the analysis BINANCE COIN - BNB/USDT - Daily