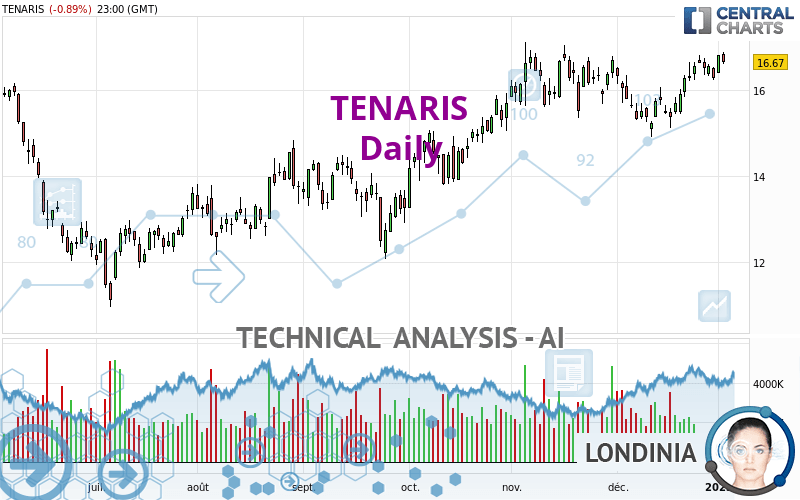

TENARIS - Daily - Technical analysis published on 01/03/2023 (GMT)

- 120

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : INVALID

Summary of the analysis

Additional analysis

Quotes

The TENARIS rating is 16.670 EUR. The price registered a decrease of -0.89% on the session with the lowest point at 16.625 EUR and the highest point at 16.890 EUR. The deviation from the price is +0.27% for the low point and -1.30% for the high point.The Central Gaps scanner detects a bullish gap which is a sign that buyers have taken the lead in the very short term.

Opening Gap UP

Type : Bullish

Timeframe : Openning

Here is a more detailed summary of the historical variations registered by TENARIS:

Near a new HIGH record (5 years)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1 year)

Type : Bullish

Timeframe : Weekly

Near a new LOW record (1st january)

Type : Bearish

Timeframe : Weekly

New HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

Technical analysis of this Daily chart of TENARIS indicates that the overall trend is strongly bullish. The signals given by the moving averages are 89.29% bullish. This strong bullish trend is confirmed by the strong signals currently being given by short-term moving averages. The Central Indicators market scanner is currently detecting a bullish signal that could impact this trend:

Bullish trend reversal : Moving Average 20

Type : Bullish

Timeframe : Daily

In fact, 14 technical indicators on 18 studied are currently bullish. But beware of excesses. The Central Indicators scanner currently detects this:

CCI indicator is overbought : over 100

Type : Neutral

Timeframe : Daily

CCI indicator: bearish divergence

Type : Bearish

Timeframe : Daily

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 1

Type : Neutral

Timeframe : Weekly

Central Patterns, the market scanner focusing on chart patterns, resistances and supports found these results:

Near resistance of channel

Type : Bearish

Timeframe : Daily

Horizontal resistance is broken

Type : Bullish

Timeframe : Daily

The Central Candlesticks scanner which studies Japanese candlesticks did not detect anything.

| S3 | S2 | S1 | Price | R1 | |

|---|---|---|---|---|---|

| ProTrendLines | 13.339 | 14.579 | 15.706 | 16.670 | 16.790 |

| Change (%) | -19.98% | -12.54% | -5.78% | - | +0.72% |

| Change | -3.331 | -2.091 | -0.964 | - | +0.120 |

| Level | Minor | Intermediate | Major | - | Major |

To determine price objectives, it is also possible to use the pivot points. Here is the price position in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 16.112 | 16.253 | 16.537 | 16.678 | 16.962 | 17.103 | 17.387 |

| Camarilla | 16.703 | 16.742 | 16.781 | 16.820 | 16.859 | 16.898 | 16.937 |

| Woodie | 16.183 | 16.289 | 16.608 | 16.714 | 17.033 | 17.139 | 17.458 |

| Fibonacci | 16.253 | 16.416 | 16.516 | 16.678 | 16.841 | 16.941 | 17.103 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 15.500 | 15.875 | 16.080 | 16.455 | 16.660 | 17.035 | 17.240 |

| Camarilla | 16.126 | 16.179 | 16.232 | 16.285 | 16.338 | 16.391 | 16.445 |

| Woodie | 15.415 | 15.833 | 15.995 | 16.413 | 16.575 | 16.993 | 17.155 |

| Fibonacci | 15.875 | 16.097 | 16.233 | 16.455 | 16.677 | 16.813 | 17.035 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 13.258 | 14.082 | 15.183 | 16.007 | 17.108 | 17.932 | 19.033 |

| Camarilla | 15.756 | 15.932 | 16.109 | 16.285 | 16.462 | 16.638 | 16.814 |

| Woodie | 13.398 | 14.151 | 15.323 | 16.076 | 17.248 | 18.001 | 19.173 |

| Fibonacci | 14.082 | 14.817 | 15.271 | 16.007 | 16.742 | 17.196 | 17.932 |

Numerical data

The following are the details of the technical indicators and moving averages that were collected to generate this technical analysis:

| RSI (14): | 58.97 | |

| MACD (12,26,9): | 0.2240 | |

| Directional Movement: | 8.284 | |

| AROON (14): | 78.571 | |

| DEMA (21): | 16.490 | |

| Parabolic SAR (0,02-0,02-0,2): | 15.742 | |

| Elder Ray (13): | 0.422 | |

| Super Trend (3,10): | 15.532 | |

| Zig ZAG (10): | 16.725 | |

| VORTEX (21): | 1.0330 | |

| Stochastique (14,3,5): | 87.44 | |

| TEMA (21): | 16.578 | |

| Williams %R (14): | -9.07 | |

| Chande Momentum Oscillator (20): | 1.250 | |

| Repulse (5,40,3): | 1.0190 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | 0.1020 | |

| Courbe Coppock: | 13.13 |

| MA7: | 16.588 | |

| MA20: | 15.995 | |

| MA50: | 16.067 | |

| MA100: | 14.987 | |

| MAexp7: | 16.528 | |

| MAexp20: | 16.233 | |

| MAexp50: | 15.836 | |

| MAexp100: | 15.183 | |

| Price / MA7: | +0.49% | |

| Price / MA20: | +4.22% | |

| Price / MA50: | +3.75% | |

| Price / MA100: | +11.23% | |

| Price / MAexp7: | +0.86% | |

| Price / MAexp20: | +2.69% | |

| Price / MAexp50: | +5.27% | |

| Price / MAexp100: | +9.79% |

News

The latest news and videos published on TENARIS at the time of the analysis were as follows:

- Glancy Prongay & Murray LLP Obtains Important Ruling for Tenaris S.A. Investors in Securities Fraud Class Action

- TENARIS 24 HOUR DEADLINE ALERT: Approximately 24 Hours Remain; ClaimsFiler Reminds Investors with Losses in Excess of $100,000 of Deadline in Class Action Lawsuit against Tenaris S.A. - TS

- TENARIS 72 HOUR DEADLINE ALERT: Approximately 72 Hours Remain; Former Louisiana Attorney General and Kahn Swick & Foti, LLC Remind Investors with Losses in Excess of $100,000 of Deadline in Class Action Lawsuit against Tenaris S.A. - TS

- Kessler Topaz Meltzer & Check, LLP: Securities Fraud Class Action Filed Against Tenaris S.A. - TS

- TS LOSS DEADLINE: Rosen Law Firm Files First Securities Class Action Lawsuit Against Tenaris S.A.; Reminds of Important Deadline - TS

Add a comment

Comments

0 comments on the analysis TENARIS - Daily