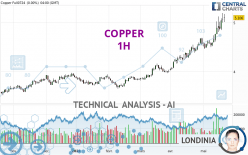

COPPER - 1H - Technical analysis published on 05/22/2024 (GMT)

- 75

- 0

Click here for a new analysis!

- Timeframe : 1H

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

The COPPER rating is 4.8435 USD. On the day, this instrument lost -5.14% with the lowest point at 4.8380 USD and the highest point at 5.1330 USD. The deviation from the price is +0.11% for the low point and -5.64% for the high point.A bearish opening was detected by the Central Gaps scanner. Sellers are trying to impose a bearish trend in the very short term.

Bearish opening

Type : Bearish

Timeframe : Openning

So that you have an overall view of the price change, here is a table showing the variations over several periods:

New HIGH record (5 years)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1 year)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1st january)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

A technical analysis in 1H of this COPPER chart shows a sharp bearish trend. 85.71% of the signals given by moving averages are bearish. This strongly bearish trend is supported by the strong bearish signals given by short-term moving averages. The Central Indicators scanner detects a bearish signal on moving averages that could impact this trend:

Moving Average bearish crossovers : AMA50 & AMA100

Type : Bearish

Timeframe : 1 hour

An assessment of technical indicators shows a strong bearish signal.

Caution: the Central Indicators scanner currently detects an excess:

RSI indicator is oversold : under 20

Type : Neutral

Timeframe : 1 hour

CCI indicator is oversold : under -100

Type : Neutral

Timeframe : 1 hour

Previous candle closed under Bollinger bands

Type : Neutral

Timeframe : 1 hour

Williams %R indicator is oversold : under -80

Type : Neutral

Timeframe : 1 hour

Pivot points : price is under support 3

Type : Neutral

Timeframe : 1 hour

Price is back under the pivot point

Type : Bearish

Timeframe : Weekly

No signals are given by Central Patterns, a market scanner specialised in chart patterns, resistances and supports.

The Central Candlesticks scanner which studies Japanese candlesticks did not detect anything.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 4.6150 | 4.6765 | 4.8140 | 4.8435 | 4.9430 | 5.0662 | 5.1280 |

| Change (%) | -4.72% | -3.45% | -0.61% | - | +2.05% | +4.60% | +5.87% |

| Change | -0.2285 | -0.1670 | -0.0295 | - | +0.0995 | +0.2227 | +0.2845 |

| Level | Intermediate | Intermediate | Intermediate | - | Major | Intermediate | Minor |

Pivot points can also be used to set your price objectives. Here is the price situation in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 4.8522 | 4.9323 | 5.0192 | 5.0993 | 5.1862 | 5.2663 | 5.3532 |

| Camarilla | 5.0601 | 5.0754 | 5.0907 | 5.1060 | 5.1213 | 5.1366 | 5.1519 |

| Woodie | 4.8555 | 4.9340 | 5.0225 | 5.1010 | 5.1895 | 5.2680 | 5.3565 |

| Fibonacci | 4.9323 | 4.9961 | 5.0355 | 5.0993 | 5.1631 | 5.2025 | 5.2663 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 4.2227 | 4.4193 | 4.7347 | 4.9313 | 5.2467 | 5.4433 | 5.7587 |

| Camarilla | 4.9092 | 4.9561 | 5.0031 | 5.0500 | 5.0969 | 5.1439 | 5.1908 |

| Woodie | 4.2820 | 4.4490 | 4.7940 | 4.9610 | 5.3060 | 5.4730 | 5.8180 |

| Fibonacci | 4.4193 | 4.6149 | 4.7358 | 4.9313 | 5.1269 | 5.2478 | 5.4433 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 3.5288 | 3.7917 | 4.1688 | 4.4317 | 4.8088 | 5.0717 | 5.4488 |

| Camarilla | 4.3700 | 4.4287 | 4.4873 | 4.5460 | 4.6047 | 4.6633 | 4.7220 |

| Woodie | 3.5860 | 3.8203 | 4.2260 | 4.4603 | 4.8660 | 5.1003 | 5.5060 |

| Fibonacci | 3.7917 | 4.0362 | 4.1872 | 4.4317 | 4.6762 | 4.8272 | 5.0717 |

Numerical data

The following are the details of the technical indicators and moving averages that were collected to generate this technical analysis:

| RSI (14): | 23.00 | |

| MACD (12,26,9): | -0.0529 | |

| Directional Movement: | -36.4720 | |

| AROON (14): | -85.7142 | |

| DEMA (21): | 4.9371 | |

| Parabolic SAR (0,02-0,02-0,2): | 4.9835 | |

| Elder Ray (13): | -0.1084 | |

| Super Trend (3,10): | 4.9727 | |

| Zig ZAG (10): | 4.8630 | |

| VORTEX (21): | 0.6460 | |

| Stochastique (14,3,5): | 5.67 | |

| TEMA (21): | 4.8904 | |

| Williams %R (14): | -94.58 | |

| Chande Momentum Oscillator (20): | -0.2060 | |

| Repulse (5,40,3): | -1.8224 | |

| ROCnROLL: | 2 | |

| TRIX (15,9): | -0.0879 | |

| Courbe Coppock: | 6.56 |

| MA7: | 4.9687 | |

| MA20: | 4.7253 | |

| MA50: | 4.4188 | |

| MA100: | 4.1324 | |

| MAexp7: | 4.9179 | |

| MAexp20: | 4.9953 | |

| MAexp50: | 5.0351 | |

| MAexp100: | 5.0120 | |

| Price / MA7: | -2.52% | |

| Price / MA20: | +2.50% | |

| Price / MA50: | +9.61% | |

| Price / MA100: | +17.21% | |

| Price / MAexp7: | -1.51% | |

| Price / MAexp20: | -3.04% | |

| Price / MAexp50: | -3.81% | |

| Price / MAexp100: | -3.36% |

News

The last news published on COPPER at the time of the generation of this analysis was as follows:

-

Gold & Copper Hit Record Highs! Is Inflation Coming Back?

Gold & Copper Hit Record Highs! Is Inflation Coming Back?

-

Sweden's Sámi pay the price in Europe's quest for copper

Sweden's Sámi pay the price in Europe's quest for copper

-

Why Glencore have joined the bidding war to buy Anglo American. #copper #Glencore #trading

Why Glencore have joined the bidding war to buy Anglo American. #copper #Glencore #trading

-

What does BHP’s deal to buy Anglo American mean for the mining and London markets? #Mining #Copper

What does BHP’s deal to buy Anglo American mean for the mining and London markets? #Mining #Copper

-

‘Copper likely to stay above $9,000‘ – Meyer

‘Copper likely to stay above $9,000‘ – Meyer

Add a comment

Comments

0 comments on the analysis COPPER - 1H