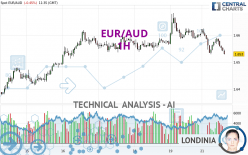

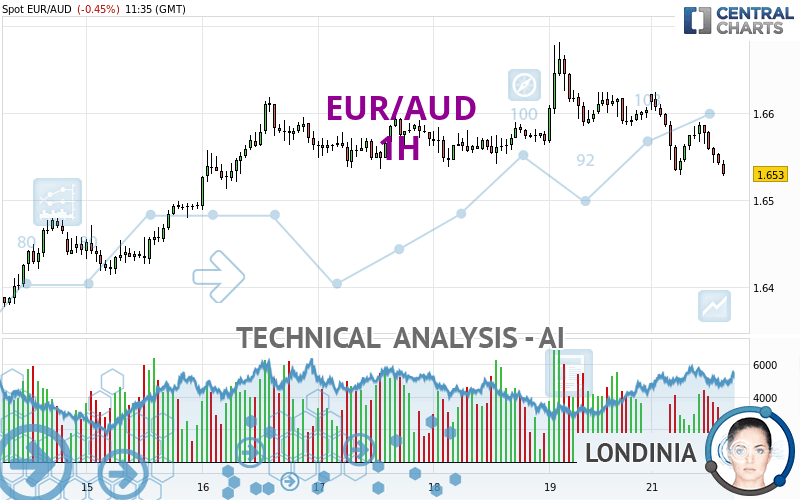

EUR/AUD - 1H - Technical analysis published on 04/22/2024 (GMT)

- 62

- 0

Click here for a new analysis!

- Timeframe : 1H

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

EUR/AUD rating 1.6530 AUD. The price registered a decrease of -0.45% on the session and was between 1.6528 AUD and 1.6624 AUD. This implies that the price is at +0.01% from its lowest and at -0.57% from its highest.The Central Gaps scanner detects a bullish opening marking the presence of buyers ahead of sellers at the opening but not sufficiently marked to allow the price to register a quotation gap.

Bullish opening

Type : Bullish

Timeframe : Openning

Here is a more detailed summary of the historical variations registered by EUR/AUD:

Near a new LOW record (1 year)

Type : Bearish

Timeframe : Weekly

Near a new LOW record (1st january)

Type : Bearish

Timeframe : Weekly

Near a new LOW record (1 month)

Type : Bearish

Timeframe : Weekly

Technical

Technical analysis of EUR/AUD in 1H shows a overall strongly bearish trend. 82.14% of the signals given by moving averages are bearish. This strongly bearish trend is supported by the strong bearish signals given by short-term moving averages. The Central Indicators scanner detects bearish signals on moving averages that could impact this trend:

Bearish trend reversal : Moving Average 100

Type : Bearish

Timeframe : 1 hour

Moving Average bearish crossovers : AMA20 & AMA50

Type : Bearish

Timeframe : 1 hour

Moving Average bearish crossovers : AMA50 & AMA100

Type : Bearish

Timeframe : 1 hour

In fact, according to the parameters integrated into the Central Analyzer system, 11 technical indicators out of 18 analysed are currently bearish. Caution: the Central Indicators scanner currently detects an excess:

CCI indicator is oversold : under -100

Type : Neutral

Timeframe : 1 hour

CCI indicator: bullish divergence

Type : Bullish

Timeframe : 1 hour

Williams %R indicator is oversold : under -80

Type : Neutral

Timeframe : 1 hour

Pivot points : price is under support 1

Type : Neutral

Timeframe : 1 hour

Price is back under the pivot point

Type : Bearish

Timeframe : Weekly

Central Patterns, the market scanner focusing on chart patterns, resistances and supports found these results:

Near horizontal support

Type : Bullish

Timeframe : 1 hour

Support of channel is broken

Type : Bearish

Timeframe : 1 hour

The Central Candlesticks scanner, specialised in Japanese candlesticks, did not identify any signals.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 1.6279 | 1.6382 | 1.6498 | 1.6530 | 1.6537 | 1.6585 | 1.6615 |

| Change (%) | -1.52% | -0.90% | -0.19% | - | +0.04% | +0.33% | +0.51% |

| Change | -0.0251 | -0.0148 | -0.0032 | - | +0.0007 | +0.0055 | +0.0085 |

| Level | Major | Major | Intermediate | - | Intermediate | Intermediate | Intermediate |

To determine price objectives, it is also possible to use the pivot points. Here is the price position in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.6437 | 1.6501 | 1.6553 | 1.6617 | 1.6669 | 1.6733 | 1.6785 |

| Camarilla | 1.6572 | 1.6583 | 1.6593 | 1.6604 | 1.6615 | 1.6625 | 1.6636 |

| Woodie | 1.6430 | 1.6498 | 1.6546 | 1.6614 | 1.6662 | 1.6730 | 1.6778 |

| Fibonacci | 1.6501 | 1.6546 | 1.6573 | 1.6617 | 1.6662 | 1.6689 | 1.6733 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.6183 | 1.6299 | 1.6451 | 1.6567 | 1.6719 | 1.6835 | 1.6987 |

| Camarilla | 1.6530 | 1.6555 | 1.6579 | 1.6604 | 1.6629 | 1.6653 | 1.6678 |

| Woodie | 1.6202 | 1.6308 | 1.6470 | 1.6576 | 1.6738 | 1.6844 | 1.7006 |

| Fibonacci | 1.6299 | 1.6401 | 1.6464 | 1.6567 | 1.6669 | 1.6732 | 1.6835 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.6112 | 1.6276 | 1.6416 | 1.6580 | 1.6720 | 1.6884 | 1.7024 |

| Camarilla | 1.6472 | 1.6500 | 1.6528 | 1.6556 | 1.6584 | 1.6612 | 1.6640 |

| Woodie | 1.6100 | 1.6270 | 1.6404 | 1.6574 | 1.6708 | 1.6878 | 1.7012 |

| Fibonacci | 1.6276 | 1.6392 | 1.6464 | 1.6580 | 1.6696 | 1.6768 | 1.6884 |

Numerical data

The following is the status of technical indicators and moving averages registered at the time this technical analysis was created:

| RSI (14): | 35.48 | |

| MACD (12,26,9): | -0.0012 | |

| Directional Movement: | -10.2443 | |

| AROON (14): | -35.7143 | |

| DEMA (21): | 1.6557 | |

| Parabolic SAR (0,02-0,02-0,2): | 1.6535 | |

| Elder Ray (13): | -0.0024 | |

| Super Trend (3,10): | 1.6598 | |

| Zig ZAG (10): | 1.6538 | |

| VORTEX (21): | 0.8658 | |

| Stochastique (14,3,5): | 16.64 | |

| TEMA (21): | 1.6546 | |

| Williams %R (14): | -86.59 | |

| Chande Momentum Oscillator (20): | -0.0046 | |

| Repulse (5,40,3): | -0.0947 | |

| ROCnROLL: | 2 | |

| TRIX (15,9): | -0.0075 | |

| Courbe Coppock: | 0.48 |

| MA7: | 1.6543 | |

| MA20: | 1.6515 | |

| MA50: | 1.6545 | |

| MA100: | 1.6470 | |

| MAexp7: | 1.6555 | |

| MAexp20: | 1.6571 | |

| MAexp50: | 1.6578 | |

| MAexp100: | 1.6564 | |

| Price / MA7: | -0.08% | |

| Price / MA20: | +0.09% | |

| Price / MA50: | -0.09% | |

| Price / MA100: | +0.36% | |

| Price / MAexp7: | -0.15% | |

| Price / MAexp20: | -0.25% | |

| Price / MAexp50: | -0.29% | |

| Price / MAexp100: | -0.21% |

News

The last news published on EUR/AUD at the time of the generation of this analysis was as follows:

-

Both Dollar and S&P 500 Edge Higher after Factory Report, EURAUD A Pair to Watch

Both Dollar and S&P 500 Edge Higher after Factory Report, EURAUD A Pair to Watch

-

Weekly Technical Analysis: 19/08/2019 - GBPJPY, USDCAD, EURAUD

Weekly Technical Analysis: 19/08/2019 - GBPJPY, USDCAD, EURAUD

-

An Underappreciated Technical and Fundamental Appeal of EURAUD

An Underappreciated Technical and Fundamental Appeal of EURAUD

-

Trading Sentiment: Poor for EUR, AUD and GBP | Webinar

Trading Sentiment: Poor for EUR, AUD and GBP | Webinar

-

EURAUD and EURCAD Weekly Trend Flow

EURAUD and EURCAD Weekly Trend Flow

Add a comment

Comments

0 comments on the analysis EUR/AUD - 1H