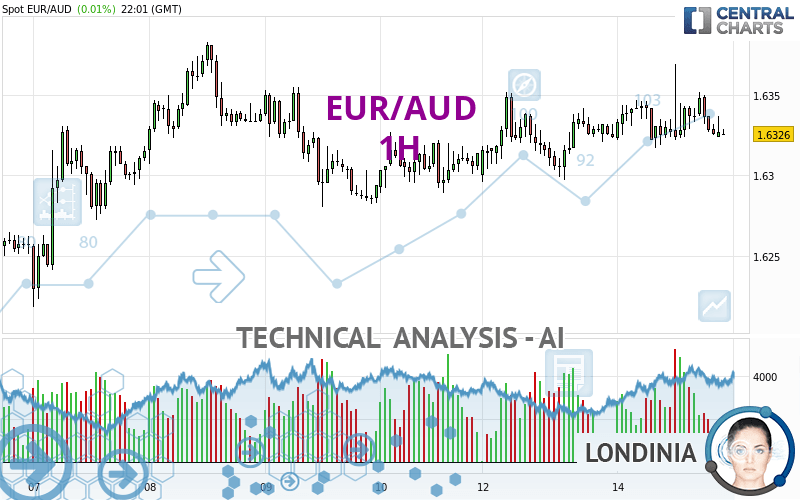

EUR/AUD - 1H - Technical analysis published on 05/14/2024 (GMT)

- 62

- 0

Click here for a new analysis!

- Timeframe : 1H

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

The EUR/AUD price is 1.6326 AUD. The price registered an increase of +0.01% on the session with the lowest point at 1.6317 AUD and the highest point at 1.6369 AUD. The deviation from the price is +0.06% for the low point and -0.26% for the high point.The Central Gaps scanner detects a bearish opening marking the presence of sellers ahead of buyers at the opening but not sufficiently marked to allow the price to register a quotation gap.

Bearish opening

Type : Bearish

Timeframe : Openning

Here is a more detailed summary of the historical variations registered by EUR/AUD:

Near a new HIGH record (1 year)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1st january)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

A technical analysis in 1H of this EUR/AUD chart shows a neutral trend. This indecision could turn into a bearish trend due to the strong bearish signals currently being given by short-term moving averages. The Central Indicators market scanner is currently detecting several bearish signals that could impact this trend:

Bearish trend reversal : Moving Average 20

Type : Bearish

Timeframe : 1 hour

Bearish trend reversal : adaptative moving average 50

Type : Bearish

Timeframe : 1 hour

An assessment of technical indicators does not currently provide any relevant information to suggest whether the signal given by the technical indicators is more bullish or bearish.

But beware of excesses. The Central Indicators scanner currently detects this:

Williams %R indicator is oversold : under -80

Type : Neutral

Timeframe : 1 hour

Parabolic SAR indicator bearish reversal

Type : Bearish

Timeframe : 1 hour

Price is back over the pivot point

Type : Bullish

Timeframe : Weekly

Momentum indicator is back over 0

Type : Bullish

Timeframe : 1 hour

Central Patterns, the market scanner focusing on chart patterns, resistances and supports found these results:

Near horizontal resistance

Type : Bearish

Timeframe : 1 hour

Resistance of channel is broken

Type : Bullish

Timeframe : 1 hour

From the Japanese candlestick perspective, the Central Candlesticks scanner notes the presence of these results that could impact the short-term trend:

White hanging man / hammer

Type : Neutral

Timeframe : 1 hour

Piercing line

Type : Bullish

Timeframe : 1 hour

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 1.6240 | 1.6279 | 1.6322 | 1.6326 | 1.6353 | 1.6382 | 1.6411 |

| Change (%) | -0.53% | -0.29% | -0.02% | - | +0.17% | +0.34% | +0.52% |

| Change | -0.0086 | -0.0047 | -0.0004 | - | +0.0027 | +0.0056 | +0.0085 |

| Level | Minor | Major | Minor | - | Major | Major | Minor |

To determine price objectives, it is also possible to use the pivot points. Here is the price position in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.6240 | 1.6268 | 1.6296 | 1.6324 | 1.6352 | 1.6380 | 1.6408 |

| Camarilla | 1.6309 | 1.6314 | 1.6319 | 1.6324 | 1.6329 | 1.6334 | 1.6339 |

| Woodie | 1.6240 | 1.6268 | 1.6296 | 1.6324 | 1.6352 | 1.6380 | 1.6408 |

| Fibonacci | 1.6268 | 1.6289 | 1.6303 | 1.6324 | 1.6345 | 1.6359 | 1.6380 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.6062 | 1.6140 | 1.6227 | 1.6305 | 1.6392 | 1.6470 | 1.6557 |

| Camarilla | 1.6269 | 1.6284 | 1.6299 | 1.6314 | 1.6329 | 1.6344 | 1.6359 |

| Woodie | 1.6067 | 1.6142 | 1.6232 | 1.6307 | 1.6397 | 1.6472 | 1.6562 |

| Fibonacci | 1.6140 | 1.6203 | 1.6242 | 1.6305 | 1.6368 | 1.6407 | 1.6470 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.5891 | 1.6091 | 1.6282 | 1.6482 | 1.6673 | 1.6873 | 1.7064 |

| Camarilla | 1.6366 | 1.6401 | 1.6437 | 1.6473 | 1.6509 | 1.6545 | 1.6581 |

| Woodie | 1.5887 | 1.6089 | 1.6278 | 1.6480 | 1.6669 | 1.6871 | 1.7060 |

| Fibonacci | 1.6091 | 1.6240 | 1.6333 | 1.6482 | 1.6631 | 1.6724 | 1.6873 |

Numerical data

The following is the status of technical indicators and moving averages registered at the time this technical analysis was created:

| RSI (14): | 46.55 | |

| MACD (12,26,9): | 0.0001 | |

| Directional Movement: | 8.8318 | |

| AROON (14): | 28.5714 | |

| DEMA (21): | 1.6334 | |

| Parabolic SAR (0,02-0,02-0,2): | 1.6369 | |

| Elder Ray (13): | -0.0002 | |

| Super Trend (3,10): | 1.6309 | |

| Zig ZAG (10): | 1.6326 | |

| VORTEX (21): | 1.0032 | |

| Stochastique (14,3,5): | 18.59 | |

| TEMA (21): | 1.6332 | |

| Williams %R (14): | -82.69 | |

| Chande Momentum Oscillator (20): | 0.0001 | |

| Repulse (5,40,3): | -0.0964 | |

| ROCnROLL: | -1 | |

| TRIX (15,9): | 0.0020 | |

| Courbe Coppock: | 0.02 |

| MA7: | 1.6310 | |

| MA20: | 1.6402 | |

| MA50: | 1.6479 | |

| MA100: | 1.6474 | |

| MAexp7: | 1.6331 | |

| MAexp20: | 1.6332 | |

| MAexp50: | 1.6328 | |

| MAexp100: | 1.6326 | |

| Price / MA7: | +0.10% | |

| Price / MA20: | -0.46% | |

| Price / MA50: | -0.93% | |

| Price / MA100: | -0.90% | |

| Price / MAexp7: | -0.03% | |

| Price / MAexp20: | -0.04% | |

| Price / MAexp50: | -0.01% | |

| Price / MAexp100: | -0% |

News

The latest news and videos published on EUR/AUD at the time of the analysis were as follows:

-

Both Dollar and S&P 500 Edge Higher after Factory Report, EURAUD A Pair to Watch

Both Dollar and S&P 500 Edge Higher after Factory Report, EURAUD A Pair to Watch

-

Weekly Technical Analysis: 19/08/2019 - GBPJPY, USDCAD, EURAUD

Weekly Technical Analysis: 19/08/2019 - GBPJPY, USDCAD, EURAUD

-

An Underappreciated Technical and Fundamental Appeal of EURAUD

An Underappreciated Technical and Fundamental Appeal of EURAUD

-

Trading Sentiment: Poor for EUR, AUD and GBP | Webinar

Trading Sentiment: Poor for EUR, AUD and GBP | Webinar

-

EURAUD and EURCAD Weekly Trend Flow

EURAUD and EURCAD Weekly Trend Flow

Add a comment

Comments

0 comments on the analysis EUR/AUD - 1H