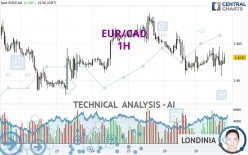

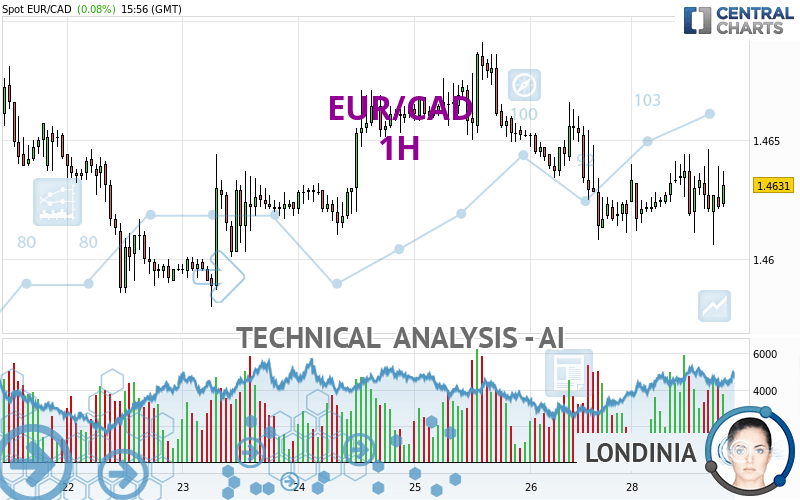

EUR/CAD - 1H - Technical analysis published on 04/29/2024 (GMT)

- 76

- 0

- Timeframe : 1H

- - Analysis generated on

- Status : NEUTRAL

Summary of the analysis

Additional analysis

Quotes

The EUR/CAD rating is 1.4631 CAD. The price registered an increase of +0.08% on the session and was between 1.4606 CAD and 1.4646 CAD. This implies that the price is at +0.17% from its lowest and at -0.10% from its highest.The Central Gaps scanner detects a bullish opening marking the presence of buyers ahead of sellers at the opening but not sufficiently marked to allow the price to register a quotation gap.

Bullish opening

Type : Bullish

Timeframe : Openning

Here is a more detailed summary of the historical variations registered by EUR/CAD:

Near a new LOW record (1 year)

Type : Bearish

Timeframe : Weekly

Near a new HIGH record (1st january)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

Technical analysis of EUR/CAD in 1H shows an overall slightly bearish trend. 60.71% of the signals given by moving averages are bearish. As the signals currently given by short-term moving averages are rather neutral, the slightly bearish trend could return to neutral. An assessment of moving averages reveals several bullish signals that could impact this trend:

Bullish price crossover with Moving Average 20

Type : Bullish

Timeframe : 1 hour

Bullish price crossover with adaptative moving average 100

Type : Bullish

Timeframe : 1 hour

An assessment of technical indicators shows a slightly bullish signal.

Caution: the Central Indicators scanner currently detects an excess:

MACD indicator: bullish divergence

Type : Bullish

Timeframe : 1 hour

RSI indicator is back over 50

Type : Bullish

Timeframe : 1 hour

Price is back over the pivot point

Type : Bullish

Timeframe : 1 hour

Momentum indicator is back over 0

Type : Bullish

Timeframe : 1 hour

Williams %R indicator is back over -50

Type : Bullish

Timeframe : 1 hour

The analysis of the price chart with Central Patterns scanners does not return any result.

The Central Candlesticks scanner, specialised in Japanese candlesticks, did not identify any signals.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 1.4580 | 1.4608 | 1.4624 | 1.4631 | 1.4644 | 1.4657 | 1.4691 |

| Change (%) | -0.35% | -0.16% | -0.05% | - | +0.09% | +0.18% | +0.41% |

| Change | -0.0051 | -0.0023 | -0.0007 | - | +0.0013 | +0.0026 | +0.0060 |

| Level | Minor | Intermediate | Major | - | Intermediate | Minor | Intermediate |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.4538 | 1.4573 | 1.4596 | 1.4631 | 1.4654 | 1.4689 | 1.4712 |

| Camarilla | 1.4603 | 1.4608 | 1.4614 | 1.4619 | 1.4624 | 1.4630 | 1.4635 |

| Woodie | 1.4532 | 1.4570 | 1.4590 | 1.4628 | 1.4648 | 1.4686 | 1.4706 |

| Fibonacci | 1.4573 | 1.4595 | 1.4609 | 1.4631 | 1.4653 | 1.4667 | 1.4689 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.4458 | 1.4519 | 1.4569 | 1.4630 | 1.4680 | 1.4741 | 1.4791 |

| Camarilla | 1.4589 | 1.4599 | 1.4609 | 1.4619 | 1.4629 | 1.4639 | 1.4650 |

| Woodie | 1.4453 | 1.4516 | 1.4564 | 1.4627 | 1.4675 | 1.4738 | 1.4786 |

| Fibonacci | 1.4519 | 1.4561 | 1.4588 | 1.4630 | 1.4672 | 1.4699 | 1.4741 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.4345 | 1.4465 | 1.4540 | 1.4660 | 1.4735 | 1.4855 | 1.4930 |

| Camarilla | 1.4561 | 1.4579 | 1.4597 | 1.4615 | 1.4633 | 1.4651 | 1.4669 |

| Woodie | 1.4323 | 1.4454 | 1.4518 | 1.4649 | 1.4713 | 1.4844 | 1.4908 |

| Fibonacci | 1.4465 | 1.4540 | 1.4586 | 1.4660 | 1.4735 | 1.4781 | 1.4855 |

Numerical data

The following are the details of the technical indicators and moving averages that were collected to generate this technical analysis:

| RSI (14): | 49.89 | |

| MACD (12,26,9): | -0.0002 | |

| Directional Movement: | -4.7996 | |

| AROON (14): | -7.1429 | |

| DEMA (21): | 1.4625 | |

| Parabolic SAR (0,02-0,02-0,2): | 1.4645 | |

| Elder Ray (13): | 0.0003 | |

| Super Trend (3,10): | 1.4657 | |

| Zig ZAG (10): | 1.4632 | |

| VORTEX (21): | 1.0000 | |

| Stochastique (14,3,5): | 52.50 | |

| TEMA (21): | 1.4627 | |

| Williams %R (14): | -35.00 | |

| Chande Momentum Oscillator (20): | 0.0005 | |

| Repulse (5,40,3): | -0.0011 | |

| ROCnROLL: | -1 | |

| TRIX (15,9): | -0.0026 | |

| Courbe Coppock: | 0.05 |

| MA7: | 1.4634 | |

| MA20: | 1.4665 | |

| MA50: | 1.4681 | |

| MA100: | 1.4643 | |

| MAexp7: | 1.4628 | |

| MAexp20: | 1.4628 | |

| MAexp50: | 1.4633 | |

| MAexp100: | 1.4637 | |

| Price / MA7: | -0.02% | |

| Price / MA20: | -0.23% | |

| Price / MA50: | -0.34% | |

| Price / MA100: | -0.08% | |

| Price / MAexp7: | +0.02% | |

| Price / MAexp20: | +0.02% | |

| Price / MAexp50: | -0.01% | |

| Price / MAexp100: | -0.04% |

News

Don't forget to follow the news on EUR/CAD. At the time of publication of this analysis, the latest news was as follows:

-

Forex Analysis: EUR/USD, GBP/USD, EUR/CAD - Amana Capital

Forex Analysis: EUR/USD, GBP/USD, EUR/CAD - Amana Capital

-

Why I'm looking to sell EURCAD: Coleman

Why I'm looking to sell EURCAD: Coleman

-

EUR/CAD To Hold Steady

EUR/CAD To Hold Steady

-

EUR/CAD Bullish Breakthrough

EUR/CAD Bullish Breakthrough

-

Bullish Divergence – EURCAD

Bullish Divergence – EURCAD

Add a comment

Comments

0 comments on the analysis EUR/CAD - 1H