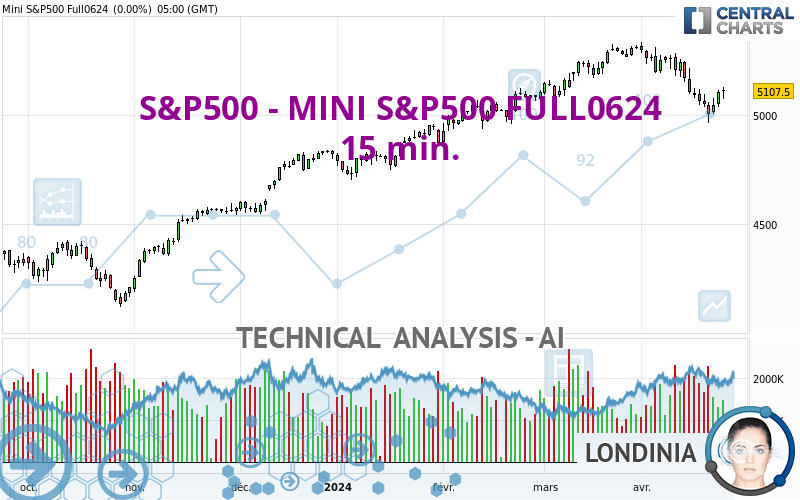

S&P500 - MINI S&P500 FULL0624 - 15 min. - Technical analysis published on 04/25/2024 (GMT)

- 67

- 0

- Timeframe : 15 min.

- - Analysis generated on

- Status : NEUTRAL

Summary of the analysis

Additional analysis

Quotes

The S&P500 - MINI S&P500 FULL0624 rating is 5,082.00 USD. The price registered a decrease of -0.50% on the session with the lowest point at 5,022.25 USD and the highest point at 5,086.50 USD. The deviation from the price is +1.19% for the low point and -0.09% for the high point.The Central Gaps scanner detects the formation of a bearish gap marking the strong presence of sellers ahead of buyers at the opening. This formed a quotation gap.

Opening Gap DOWN

Type : Bearish

Timeframe : Openning

A study of price movements over other periods shows the following variations:

Near a new HIGH record (5 years)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1 year)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1st january)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

A technical analysis in 15 min. of this S&P500 - MINI S&P500 FULL0624 chart shows a slightly bearish trend. 53.57% of the signals given by moving averages are bearish. Caution: the slightly bullish signals currently given by short-term moving averages could cause a reversal of the trend. The Central Indicators scanner detects bullish and bearish signals on moving averages that could impact this trend:

Bullish trend reversal : Moving Average 20

Type : Bullish

Timeframe : 15 minutes

Bullish trend reversal : Moving Average 50

Type : Bullish

Timeframe : 15 minutes

Bullish trend reversal : adaptative moving average 100

Type : Bullish

Timeframe : 15 minutes

Bearish price crossover with Moving Average 50

Type : Bearish

Timeframe : 15 minutes

Bearish price crossover with adaptative moving average 100

Type : Bearish

Timeframe : 15 minutes

In fact, according to the parameters integrated into the Central Analyzer system, 12 technical indicators out of 18 analysed are currently bullish. But beware of excesses. The Central Indicators scanner currently detects this:

CCI indicator is overbought : over 100

Type : Neutral

Timeframe : 15 minutes

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : 15 minutes

Pivot points : price is under support 1

Type : Neutral

Timeframe : 15 minutes

MACD indicator is back over 0

Type : Bullish

Timeframe : 15 minutes

Ichimoku - Bullish crossover : Tenkan & Kijun

Type : Bullish

Timeframe : 15 minutes

Price is back over the pivot point

Type : Bullish

Timeframe : Weekly

The analysis of the price chart with Central Patterns scanners does not return any result.

No result was found by the Central Candlesticks scanner on Japanese candlesticks.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 5,006.00 | 5,047.75 | 5,073.75 | 5,082.00 | 5,124.25 | 5,150.00 | 5,198.69 |

| Change (%) | -1.50% | -0.67% | -0.16% | - | +0.83% | +1.34% | +2.30% |

| Change | -76.00 | -34.25 | -8.25 | - | +42.25 | +68.00 | +116.69 |

| Level | Intermediate | Minor | Major | - | Major | Minor | Major |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 5,020.42 | 5,046.33 | 5,076.92 | 5,102.83 | 5,133.42 | 5,159.33 | 5,189.92 |

| Camarilla | 5,091.96 | 5,097.14 | 5,102.32 | 5,107.50 | 5,112.68 | 5,117.86 | 5,123.04 |

| Woodie | 5,022.75 | 5,047.50 | 5,079.25 | 5,104.00 | 5,135.75 | 5,160.50 | 5,192.25 |

| Fibonacci | 5,046.33 | 5,067.92 | 5,081.25 | 5,102.83 | 5,124.42 | 5,137.75 | 5,159.33 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 4,657.33 | 4,810.42 | 4,907.08 | 5,060.17 | 5,156.83 | 5,309.92 | 5,406.58 |

| Camarilla | 4,935.07 | 4,957.96 | 4,980.86 | 5,003.75 | 5,026.64 | 5,049.54 | 5,072.43 |

| Woodie | 4,629.13 | 4,796.31 | 4,878.88 | 5,046.06 | 5,128.63 | 5,295.81 | 5,378.38 |

| Fibonacci | 4,810.42 | 4,905.82 | 4,964.76 | 5,060.17 | 5,155.57 | 5,214.51 | 5,309.92 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 4,964.25 | 5,045.75 | 5,170.50 | 5,252.00 | 5,376.75 | 5,458.25 | 5,583.00 |

| Camarilla | 5,238.53 | 5,257.44 | 5,276.34 | 5,295.25 | 5,314.16 | 5,333.06 | 5,351.97 |

| Woodie | 4,985.88 | 5,056.56 | 5,192.13 | 5,262.81 | 5,398.38 | 5,469.06 | 5,604.63 |

| Fibonacci | 5,045.75 | 5,124.54 | 5,173.21 | 5,252.00 | 5,330.79 | 5,379.46 | 5,458.25 |

Numerical data

The following is the status of technical indicators and moving averages registered at the time this technical analysis was created:

| RSI (14): | 53.55 | |

| MACD (12,26,9): | -0.4600 | |

| Directional Movement: | 2.86 | |

| AROON (14): | 85.72 | |

| DEMA (21): | 5,051.59 | |

| Parabolic SAR (0,02-0,02-0,2): | 5,035.79 | |

| Elder Ray (13): | 6.53 | |

| Super Trend (3,10): | 5,037.68 | |

| Zig ZAG (10): | 5,061.50 | |

| VORTEX (21): | 0.9400 | |

| Stochastique (14,3,5): | 87.18 | |

| TEMA (21): | 5,057.64 | |

| Williams %R (14): | -15.70 | |

| Chande Momentum Oscillator (20): | 28.75 | |

| Repulse (5,40,3): | 0.1400 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | -0.0100 | |

| Courbe Coppock: | 0.86 |

| MA7: | 5,065.82 | |

| MA20: | 5,168.40 | |

| MA50: | 5,182.31 | |

| MA100: | 5,041.73 | |

| MAexp7: | 5,061.45 | |

| MAexp20: | 5,054.78 | |

| MAexp50: | 5,061.48 | |

| MAexp100: | 5,070.99 | |

| Price / MA7: | +0.32% | |

| Price / MA20: | -1.67% | |

| Price / MA50: | -1.94% | |

| Price / MA100: | +0.80% | |

| Price / MAexp7: | +0.41% | |

| Price / MAexp20: | +0.54% | |

| Price / MAexp50: | +0.41% | |

| Price / MAexp100: | +0.22% |

Add a comment

Comments

0 comments on the analysis S&P500 - MINI S&P500 FULL0624 - 15 min.