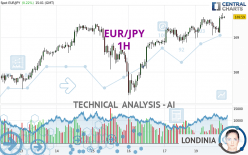

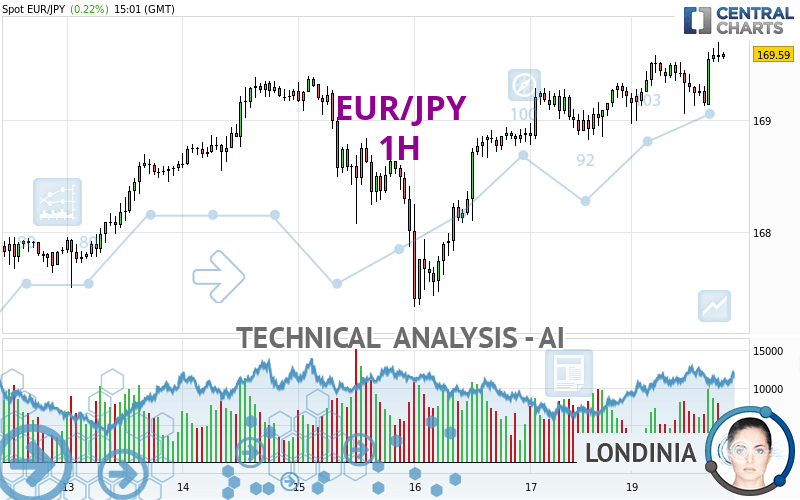

EUR/JPY - 1H - Technical analysis published on 05/20/2024 (GMT)

- 65

- 0

Click here for a new analysis!

- Timeframe : 1H

- - Analysis generated on

- Status : LEVEL MAINTAINED

Summary of the analysis

Additional analysis

Quotes

EUR/JPY rating 169.59 JPY. The price registered an increase of +0.22% on the session and was between 168.97 JPY and 169.70 JPY. This implies that the price is at +0.37% from its lowest and at -0.06% from its highest.A bearish opening was detected by the Central Gaps scanner. Sellers are trying to impose a bearish trend in the very short term.

Bearish opening

Type : Bearish

Timeframe : Openning

A study of price movements over other periods shows the following variations:

Near a new HIGH record (5 years)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1 year)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1st january)

Type : Bullish

Timeframe : Weekly

Near a new LOW record (1 month)

Type : Bearish

Timeframe : Weekly

Technical

Technical analysis of EUR/JPY in 1H shows a strongly overall bullish trend. The signals given by the moving averages are 92.86% bullish. This strong bullish trend is confirmed by the strong signals currently being given by short-term moving averages. There is no crossing of moving average by the price or crossing of moving averages between themselves.

Technical indicators are strongly bullish, suggesting that the price increase should continue.

Caution: the Central Indicators scanner currently detects an excess:

CCI indicator is overbought : over 100

Type : Neutral

Timeframe : 1 hour

CCI indicator: bearish divergence

Type : Bearish

Timeframe : 1 hour

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : 1 hour

Pivot points : price is over resistance 1

Type : Neutral

Timeframe : 1 hour

MACD crosses UP its Moving Average

Type : Bullish

Timeframe : 1 hour

Central Patterns, the market scanner focusing on chart patterns, resistances and supports found these results:

Near horizontal resistance

Type : Bearish

Timeframe : 1 hour

Resistance of channel is broken

Type : Bullish

Timeframe : 1 hour

No result was found by the Central Candlesticks scanner on Japanese candlesticks.

| S3 | S2 | S1 | Price | |

|---|---|---|---|---|

| ProTrendLines | 167.97 | 168.83 | 169.54 | 169.59 |

| Change (%) | -0.96% | -0.45% | -0.03% | - |

| Change | -1.62 | -0.76 | -0.05 | - |

| Level | Minor | Minor | Major | - |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 168.34 | 168.56 | 168.89 | 169.11 | 169.44 | 169.66 | 169.99 |

| Camarilla | 169.07 | 169.12 | 169.17 | 169.22 | 169.27 | 169.32 | 169.37 |

| Woodie | 168.40 | 168.59 | 168.95 | 169.14 | 169.50 | 169.69 | 170.05 |

| Fibonacci | 168.56 | 168.77 | 168.90 | 169.11 | 169.32 | 169.45 | 169.66 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 165.83 | 166.58 | 167.90 | 168.65 | 169.97 | 170.72 | 172.04 |

| Camarilla | 168.65 | 168.84 | 169.03 | 169.22 | 169.41 | 169.60 | 169.79 |

| Woodie | 166.12 | 166.72 | 168.19 | 168.79 | 170.26 | 170.86 | 172.33 |

| Fibonacci | 166.58 | 167.37 | 167.86 | 168.65 | 169.44 | 169.93 | 170.72 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 153.81 | 158.04 | 163.16 | 167.39 | 172.51 | 176.74 | 181.86 |

| Camarilla | 165.71 | 166.57 | 167.42 | 168.28 | 169.14 | 169.99 | 170.85 |

| Woodie | 154.26 | 158.26 | 163.61 | 167.61 | 172.96 | 176.96 | 182.31 |

| Fibonacci | 158.04 | 161.61 | 163.82 | 167.39 | 170.96 | 173.17 | 176.74 |

Numerical data

The following is the status of technical indicators and moving averages registered at the time this technical analysis was created:

| RSI (14): | 62.60 | |

| MACD (12,26,9): | 0.1000 | |

| Directional Movement: | 2.29 | |

| AROON (14): | 50.00 | |

| DEMA (21): | 169.49 | |

| Parabolic SAR (0,02-0,02-0,2): | 169.09 | |

| Elder Ray (13): | 0.22 | |

| Super Trend (3,10): | 169.02 | |

| Zig ZAG (10): | 169.64 | |

| VORTEX (21): | 1.0800 | |

| Stochastique (14,3,5): | 88.24 | |

| TEMA (21): | 169.48 | |

| Williams %R (14): | -14.06 | |

| Chande Momentum Oscillator (20): | 0.15 | |

| Repulse (5,40,3): | 0.0900 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | 0.0100 | |

| Courbe Coppock: | 0.09 |

| MA7: | 168.76 | |

| MA20: | 167.40 | |

| MA50: | 165.19 | |

| MA100: | 162.93 | |

| MAexp7: | 169.44 | |

| MAexp20: | 169.35 | |

| MAexp50: | 169.15 | |

| MAexp100: | 168.86 | |

| Price / MA7: | +0.49% | |

| Price / MA20: | +1.31% | |

| Price / MA50: | +2.66% | |

| Price / MA100: | +4.09% | |

| Price / MAexp7: | +0.09% | |

| Price / MAexp20: | +0.14% | |

| Price / MAexp50: | +0.26% | |

| Price / MAexp100: | +0.43% |

News

The latest news and videos published on EUR/JPY at the time of the analysis were as follows:

-

Technical Analysis: 02/04/2024 - EURJPY pulls back towards crucial trendline

Technical Analysis: 02/04/2024 - EURJPY pulls back towards crucial trendline

-

EUR/JPY Forecast April 1, 2024

EUR/JPY Forecast April 1, 2024

-

Technical Analysis: 27/03/2024 - Will EURJPY re-test the 16-year high soon?

Technical Analysis: 27/03/2024 - Will EURJPY re-test the 16-year high soon?

-

Technical Analysis: 12/03/2024 - EURJPY drops below ascending channel

Technical Analysis: 12/03/2024 - EURJPY drops below ascending channel

-

Technical Analysis: 05/03/2024 - EURJPY recovers from mild pullback

Technical Analysis: 05/03/2024 - EURJPY recovers from mild pullback

Add a comment

Comments

0 comments on the analysis EUR/JPY - 1H