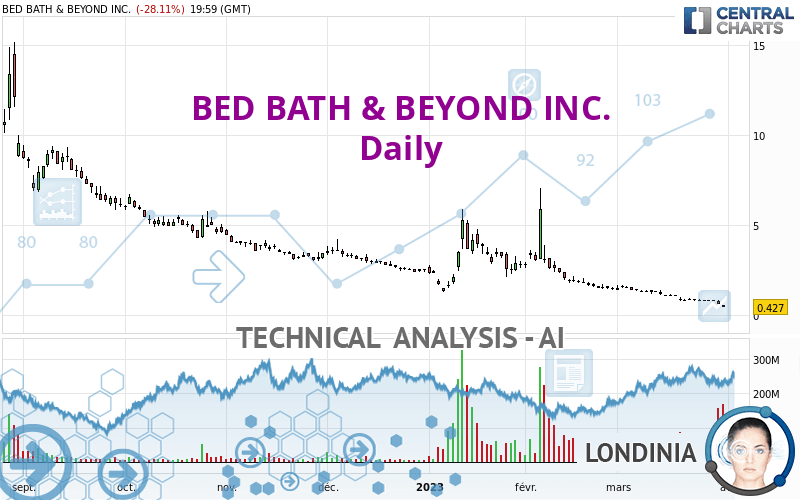

BED BATH & BEYOND INC. - Daily - Technical analysis published on 04/03/2023 (GMT)

- 99

- 0

- Timeframe : Daily

- - Analysis generated on

- Status : WITHOUT TARGET

Summary of the analysis

Additional analysis

Quotes

BED BATH & BEYOND INC. rating 0.427 USD. On the day, this instrument lost -28.11% with the lowest point at 0.420 USD and the highest point at 0.550 USD. The deviation from the price is +1.67% for the low point and -22.36% for the high point.The Central Gaps scanner detects a bearish gap which is a sign that the sellers have taken the lead in the very short term.

Opening Gap DOWN

Type : Bearish

Timeframe : Openning

Here is a more detailed summary of the historical variations registered by BED BATH & BEYOND INC.:

New LOW record (5 years)

Type : Bearish

Timeframe : Weekly

New LOW record (1 year)

Type : Bearish

Timeframe : Weekly

New LOW record (1st january)

Type : Bearish

Timeframe : Weekly

New LOW record (1 month)

Type : Bearish

Timeframe : Weekly

The Central Volumes scanner detects abnormal volumes on the asset:

Abnormal volumes

Timeframe : 5 days

Abnormal volumes

Timeframe : 50 days

Technical

Technical analysis of BED BATH & BEYOND INC. in Daily shows a overall strongly bearish trend. The signals given by moving averages are 92.86% bearish. This strong bearish trend is confirmed by the strong signals currently being given by short-term moving averages. The Central Indicators market scanner currently does not detect any result that concerns moving averages.

An assessment of technical indicators shows a bearish signal.

Caution: the Central Indicators scanner currently detects an excess:

RSI indicator is oversold : under 30

Type : Neutral

Timeframe : Daily

CCI indicator is oversold : under -100

Type : Neutral

Timeframe : Daily

Williams %R indicator is oversold : under -80

Type : Neutral

Timeframe : Daily

Pivot points : price is under support 3

Type : Neutral

Timeframe : Daily

Pivot points : price is under support 3

Type : Neutral

Timeframe : Weekly

The analysis of the price chart with Central Patterns scanners does not return any result.

For a small setback in the very short term, the Central Candlesticks scanner currently notes the presence of this bearish pattern in Japanese candlesticks:

Downside gap

Type : Bearish

Timeframe : Daily

| Price | R1 | R2 | R3 | |

|---|---|---|---|---|

| ProTrendLines | 0.427 | 2.520 | 7.181 | 13.350 |

| Change (%) | - | +490.16% | +1,581.73% | +3,026.46% |

| Change | - | +2.093 | +6.754 | +12.923 |

| Level | - | Minor | Intermediate | Minor |

To determine price objectives, it is also possible to use the pivot points. Here is the price position in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.251 | 0.336 | 0.381 | 0.466 | 0.511 | 0.596 | 0.641 |

| Camarilla | 0.391 | 0.403 | 0.415 | 0.427 | 0.439 | 0.451 | 0.463 |

| Woodie | 0.232 | 0.326 | 0.362 | 0.456 | 0.492 | 0.586 | 0.622 |

| Fibonacci | 0.336 | 0.385 | 0.416 | 0.466 | 0.515 | 0.546 | 0.596 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.542 | 0.655 | 0.735 | 0.848 | 0.928 | 1.041 | 1.121 |

| Camarilla | 0.763 | 0.781 | 0.798 | 0.816 | 0.834 | 0.851 | 0.869 |

| Woodie | 0.527 | 0.647 | 0.720 | 0.840 | 0.913 | 1.033 | 1.106 |

| Fibonacci | 0.655 | 0.728 | 0.774 | 0.848 | 0.921 | 0.967 | 1.041 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | -6.167 | -2.403 | -0.497 | 3.267 | 5.173 | 8.937 | 10.843 |

| Camarilla | -0.149 | 0.371 | 0.890 | 1.410 | 1.930 | 2.450 | 2.969 |

| Woodie | -7.095 | -2.868 | -1.425 | 2.803 | 4.245 | 8.473 | 9.915 |

| Fibonacci | -2.403 | -0.237 | 1.101 | 3.267 | 5.433 | 6.771 | 8.937 |

Numerical data

The following is the status of technical indicators and moving averages registered at the time this technical analysis was created:

| RSI (14): | 26.16 | |

| MACD (12,26,9): | -0.3330 | |

| Directional Movement: | -16.071 | |

| AROON (14): | -92.857 | |

| DEMA (21): | 0.532 | |

| Parabolic SAR (0,02-0,02-0,2): | 0.810 | |

| Elder Ray (13): | -0.340 | |

| Super Trend (3,10): | 0.943 | |

| Zig ZAG (10): | 0.427 | |

| VORTEX (21): | 0.5990 | |

| Stochastique (14,3,5): | 2.49 | |

| TEMA (21): | 0.528 | |

| Williams %R (14): | -99.24 | |

| Chande Momentum Oscillator (20): | -0.603 | |

| Repulse (5,40,3): | -69.0950 | |

| ROCnROLL: | 2 | |

| TRIX (15,9): | -3.1330 | |

| Courbe Coppock: | 89.51 |

| MA7: | 0.715 | |

| MA20: | 0.978 | |

| MA50: | 1.842 | |

| MA100: | 2.492 | |

| MAexp7: | 0.687 | |

| MAexp20: | 0.992 | |

| MAexp50: | 1.665 | |

| MAexp100: | 2.786 | |

| Price / MA7: | -40.28% | |

| Price / MA20: | -56.34% | |

| Price / MA50: | -76.82% | |

| Price / MA100: | -82.87% | |

| Price / MAexp7: | -37.85% | |

| Price / MAexp20: | -56.96% | |

| Price / MAexp50: | -74.35% | |

| Price / MAexp100: | -84.67% |

News

The latest news and videos published on BED BATH & BEYOND INC. at the time of the analysis were as follows:

- Find Everything You Need for Spring Gatherings and Celebrations at Bed Bath & Beyond® and buybuy BABY®

- Bed Bath & Beyond Inc. Enters into Committed Equity Facility for Additional Funding

- Bed Bath & Beyond Inc. Launches New $300 Million At-the-Market Offering Program

- Make Spring Cleaning a Breeze with Must-Have Products from Bed Bath & Beyond®

- Bed Bath & Beyond Inc. Announces Special Shareholder Meeting to Approve Reverse Stock Split

Add a comment

Comments

0 comments on the analysis BED BATH & BEYOND INC. - Daily