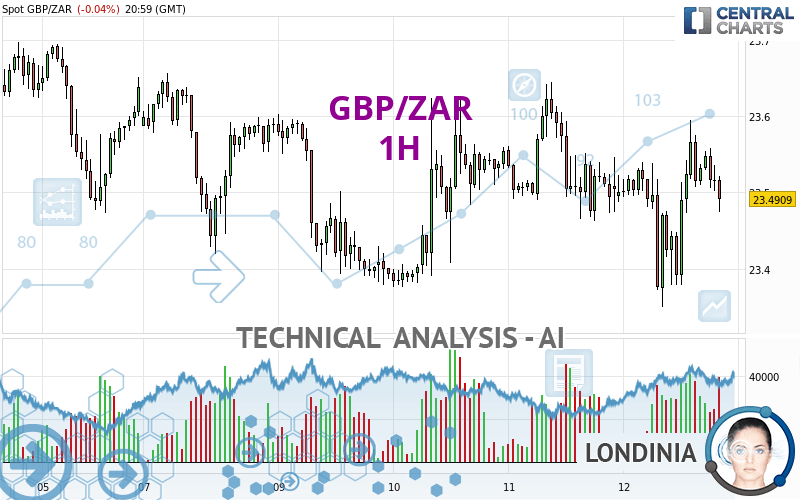

GBP/ZAR - 1H - Technical analysis published on 04/12/2024 (GMT)

- 93

- 0

Click here for a new analysis!

- Timeframe : 1H

- - Analysis generated on

- Status : INVALID

Summary of the analysis

Additional analysis

Quotes

The GBP/ZAR rating is 23.4909 ZAR. On the day, this instrument lost -0.04% with the lowest point at 23.3499 ZAR and the highest point at 23.5945 ZAR. The deviation from the price is +0.60% for the low point and -0.44% for the high point.The Central Gaps scanner detects a bearish opening. A small advantage for sellers in the very short term.

Bearish opening

Type : Bearish

Timeframe : Openning

So that you have an overall view of the price change, here is a table showing the variations over several periods:

Near a new HIGH record (5 years)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1 year)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1st january)

Type : Bullish

Timeframe : Weekly

New LOW record (1st january)

Type : Bearish

Timeframe : Weekly

Near a new HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

New LOW record (1 month)

Type : Bearish

Timeframe : Weekly

Technical

Technical analysis of GBP/ZAR in 1H shows a overall strongly bearish trend. The signals given by moving averages are 89.29% bearish. This strong bearish trend is confirmed by the strong signals currently being given by short-term moving averages. The Central Indicators market scanner is currently detecting several bearish signals that could impact this trend:

Bearish trend reversal : Moving Average 50

Type : Bearish

Timeframe : 1 hour

Bearish price crossover with Moving Average 20

Type : Bearish

Timeframe : 1 hour

Bearish price crossover with Moving Average 100

Type : Bearish

Timeframe : 1 hour

Bearish price crossover with adaptative moving average 20

Type : Bearish

Timeframe : 1 hour

Bearish price crossover with adaptative moving average 50

Type : Bearish

Timeframe : 1 hour

Bearish price crossover with adaptative moving average 100

Type : Bearish

Timeframe : 1 hour

The technical indicators are generally neutral. They do not provide relevant information on the direction of future price movements.

Central Indicators, the scanner specialised in technical indicators, has identified these signals:

RSI indicator is back under 50

Type : Bearish

Timeframe : 1 hour

Ichimoku : price is under the cloud

Type : Bearish

Timeframe : 1 hour

An analysis of the price chart with the Central Patterns scanner (detector of chart patterns and resistances and supports) shows several results that can have an impact on the price change:

Near horizontal resistance

Type : Bearish

Timeframe : 1 hour

Resistance of channel is broken

Type : Bullish

Timeframe : 1 hour

The presence of a bearish pattern in Japanese candlesticks detected by Central Candlesticks that could cause a correction in the very short term was also detected:

Bearish engulfing lines

Type : Bearish

Timeframe : 1 hour

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 23.3546 | 23.4193 | 23.4725 | 23.4909 | 23.5111 | 23.5674 | 23.6732 |

| Change (%) | -0.58% | -0.30% | -0.08% | - | +0.09% | +0.33% | +0.78% |

| Change | -0.1363 | -0.0716 | -0.0184 | - | +0.0202 | +0.0765 | +0.1823 |

| Level | Intermediate | Minor | Minor | - | Minor | Intermediate | Major |

Pivot points can also be used to set your price objectives. Here is the price situation in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 23.2459 | 23.3542 | 23.4276 | 23.5359 | 23.6093 | 23.7176 | 23.7910 |

| Camarilla | 23.4511 | 23.4678 | 23.4844 | 23.5011 | 23.5178 | 23.5344 | 23.5511 |

| Woodie | 23.2286 | 23.3455 | 23.4103 | 23.5272 | 23.5920 | 23.7089 | 23.7737 |

| Fibonacci | 23.3542 | 23.4236 | 23.4665 | 23.5359 | 23.6053 | 23.6482 | 23.7176 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 22.8474 | 23.1600 | 23.3990 | 23.7116 | 23.9506 | 24.2632 | 24.5022 |

| Camarilla | 23.4864 | 23.5370 | 23.5875 | 23.6381 | 23.6887 | 23.7392 | 23.7898 |

| Woodie | 22.8107 | 23.1416 | 23.3623 | 23.6932 | 23.9139 | 24.2448 | 24.4655 |

| Fibonacci | 23.1600 | 23.3707 | 23.5009 | 23.7116 | 23.9223 | 24.0525 | 24.2632 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 22.9390 | 23.3200 | 23.5486 | 23.9296 | 24.1582 | 24.5392 | 24.7678 |

| Camarilla | 23.6095 | 23.6653 | 23.7212 | 23.7771 | 23.8330 | 23.8889 | 23.9447 |

| Woodie | 22.8627 | 23.2819 | 23.4723 | 23.8915 | 24.0819 | 24.5011 | 24.6915 |

| Fibonacci | 23.3200 | 23.5529 | 23.6968 | 23.9296 | 24.1625 | 24.3064 | 24.5392 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

| RSI (14): | 48.55 | |

| MACD (12,26,9): | 0.0030 | |

| Directional Movement: | -2.8460 | |

| AROON (14): | 42.8572 | |

| DEMA (21): | 23.5037 | |

| Parabolic SAR (0,02-0,02-0,2): | 23.4332 | |

| Elder Ray (13): | -0.0068 | |

| Super Trend (3,10): | 23.5918 | |

| Zig ZAG (10): | 23.4909 | |

| VORTEX (21): | 0.9894 | |

| Stochastique (14,3,5): | 64.51 | |

| TEMA (21): | 23.5107 | |

| Williams %R (14): | -42.35 | |

| Chande Momentum Oscillator (20): | 0.0208 | |

| Repulse (5,40,3): | -0.1600 | |

| ROCnROLL: | 2 | |

| TRIX (15,9): | -0.0022 | |

| Courbe Coppock: | 0.27 |

| MA7: | 23.5444 | |

| MA20: | 23.7565 | |

| MA50: | 23.9156 | |

| MA100: | 23.8261 | |

| MAexp7: | 23.5105 | |

| MAexp20: | 23.5028 | |

| MAexp50: | 23.5050 | |

| MAexp100: | 23.5196 | |

| Price / MA7: | -0.23% | |

| Price / MA20: | -1.12% | |

| Price / MA50: | -1.78% | |

| Price / MA100: | -1.41% | |

| Price / MAexp7: | -0.08% | |

| Price / MAexp20: | -0.05% | |

| Price / MAexp50: | -0.06% | |

| Price / MAexp100: | -0.12% |

Add a comment

Comments

0 comments on the analysis GBP/ZAR - 1H