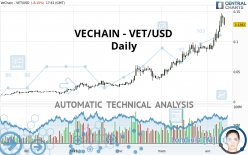

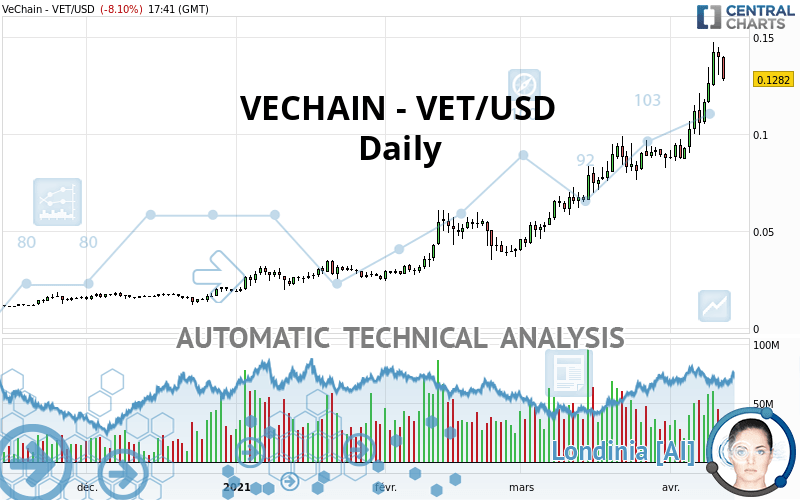

VECHAIN - VET/USD - Daily - Technical analysis published on 04/12/2021 (GMT)

- 263

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

The VECHAIN - VET/USD price is 0.128200 USD. The price is lower by -8.10% since the last closing and was traded between 0.127200 USD and 0.140300 USD over the period. The price is currently at +0.79% from its lowest and -8.62% from its highest.The Central Gaps scanner detects a bullish opening marking the presence of buyers ahead of sellers at the opening but not sufficiently marked to allow the price to register a quotation gap.

Bullish opening

Type : Bullish

Timeframe : Openning

So that you have an overall view of the price change, here is a table showing the variations over several periods:

Technical

Technical analysis of VECHAIN - VET/USD in Daily shows a strongly overall bullish trend. 92.86% of the signals given by moving averages are bullish. The overall trend is supported by the strong bullish signals from short-term moving averages. The Central Indicators market scanner currently does not detect any result that concerns moving averages.

The probability of a further increase is high given the direction of the technical indicators.

Caution: the Central Indicators scanner currently detects an excess:

RSI indicator is overbought : over 70

Type : Neutral

Timeframe : Daily

CCI indicator is overbought : over 100

Type : Neutral

Timeframe : Daily

Previous candle closed over Bollinger bands

Type : Neutral

Timeframe : Daily

CCI indicator: bearish divergence

Type : Bearish

Timeframe : Daily

RSI indicator: bearish divergence

Type : Bearish

Timeframe : Daily

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : Weekly

Pivot points : price is under support 3

Type : Neutral

Timeframe : Daily

No signals are given by Central Patterns, a market scanner specialised in chart patterns, resistances and supports.

For a small setback in the very short term, the Central Candlesticks scanner currently notes the presence of this bearish pattern in Japanese candlesticks:

Bearish harami

Type : Bearish

Timeframe : Daily

| S3 | S2 | S1 | Price | R1 | |

|---|---|---|---|---|---|

| ProTrendLines | 0.039100 | 0.054997 | 0.093600 | 0.128200 | 2.290000 |

| Change (%) | -69.50% | -57.10% | -26.99% | - | +1,686.27% |

| Change | -0.089100 | -0.073203 | -0.034600 | - | +2.161800 |

| Level | Minor | Minor | Major | - | Intermediate |

To determine price objectives, it is also possible to use the pivot points. Here is the price position in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.117167 | 0.123833 | 0.131667 | 0.138333 | 0.146167 | 0.152833 | 0.160667 |

| Camarilla | 0.135513 | 0.136842 | 0.138171 | 0.139500 | 0.140829 | 0.142158 | 0.143488 |

| Woodie | 0.117750 | 0.124125 | 0.132250 | 0.138625 | 0.146750 | 0.153125 | 0.161250 |

| Fibonacci | 0.123833 | 0.129372 | 0.132794 | 0.138333 | 0.143872 | 0.147294 | 0.152833 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.043650 | 0.065420 | 0.103860 | 0.125630 | 0.164070 | 0.185840 | 0.224280 |

| Camarilla | 0.125742 | 0.131262 | 0.136781 | 0.142300 | 0.147819 | 0.153339 | 0.158858 |

| Woodie | 0.051985 | 0.069588 | 0.112195 | 0.129798 | 0.172405 | 0.190008 | 0.232615 |

| Fibonacci | 0.065420 | 0.088420 | 0.102630 | 0.125630 | 0.148630 | 0.162840 | 0.185840 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | -0.007640 | 0.015930 | 0.051860 | 0.075430 | 0.111360 | 0.134930 | 0.170860 |

| Camarilla | 0.071428 | 0.076882 | 0.082336 | 0.087790 | 0.093244 | 0.098698 | 0.104153 |

| Woodie | -0.001460 | 0.019020 | 0.058040 | 0.078520 | 0.117540 | 0.138020 | 0.177040 |

| Fibonacci | 0.015930 | 0.038659 | 0.052701 | 0.075430 | 0.098159 | 0.112201 | 0.134930 |

Numerical data

The following are the details of the technical indicators and moving averages that were collected to generate this technical analysis:

| RSI (14): | 69.90 | |

| MACD (12,26,9): | 0.0156 | |

| Directional Movement: | 31.402787 | |

| AROON (14): | 71.428573 | |

| DEMA (21): | 0.125915 | |

| Parabolic SAR (0,02-0,02-0,2): | 0.108881 | |

| Elder Ray (13): | 0.020457 | |

| Super Trend (3,10): | 0.098771 | |

| Zig ZAG (10): | 0.131500 | |

| VORTEX (21): | 1.1958 | |

| Stochastique (14,3,5): | 84.85 | |

| TEMA (21): | 0.131940 | |

| Williams %R (14): | -25.66 | |

| Chande Momentum Oscillator (20): | 0.042710 | |

| Repulse (5,40,3): | 1.6993 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | 2.1061 | |

| Courbe Coppock: | 81.28 |

| MA7: | 0.124643 | |

| MA20: | 0.102124 | |

| MA50: | 0.077825 | |

| MA100: | 0.055817 | |

| MAexp7: | 0.124853 | |

| MAexp20: | 0.106663 | |

| MAexp50: | 0.084302 | |

| MAexp100: | 0.064250 | |

| Price / MA7: | +2.85% | |

| Price / MA20: | +25.53% | |

| Price / MA50: | +64.73% | |

| Price / MA100: | +129.68% | |

| Price / MAexp7: | +2.68% | |

| Price / MAexp20: | +20.19% | |

| Price / MAexp50: | +52.07% | |

| Price / MAexp100: | +99.53% |

Add a comment

Comments

0 comments on the analysis VECHAIN - VET/USD - Daily