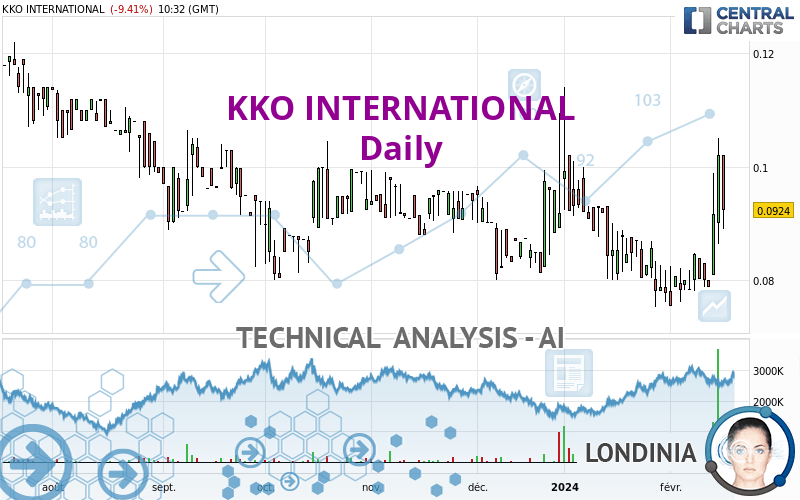

KKO INTERNATIONAL - Daily - Technical analysis published on 02/16/2024 (GMT)

- 78

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : INVALID

Summary of the analysis

Additional analysis

Quotes

The KKO INTERNATIONAL price is 0.0924 EUR. The price registered a decrease of -9.41% on the session with the lowest point at 0.0890 EUR and the highest point at 0.1020 EUR. The deviation from the price is +3.82% for the low point and -9.41% for the high point.So that you have an overall view of the price change, here is a table showing the variations over several periods:

Near a new HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

The Central Volumes scanner detects abnormal volumes on the asset:

Abnormal volumes

Timeframe : 5 days

Abnormal volumes

Timeframe : 20 days

Abnormal volumes

Timeframe : 50 days

Technical

Technical analysis of KKO INTERNATIONAL in Daily shows a neutral overall trend. The strong bullish signals currently being given by short-term moving averages could allow the overall trend to return to bullish. An assessment of moving averages reveals several bearish signals that could impact this trend:

Bearish price crossover with Moving Average 100

Type : Bearish

Timeframe : Daily

Bearish price crossover with adaptative moving average 50

Type : Bearish

Timeframe : Daily

Bearish price crossover with adaptative moving average 100

Type : Bearish

Timeframe : Daily

An assessment of technical indicators shows a strong bullish signal.

Caution: the Central Indicators scanner currently detects an excess:

CCI indicator is overbought : over 100

Type : Neutral

Timeframe : Daily

Previous candle closed over Bollinger bands

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 2

Type : Neutral

Timeframe : Weekly

Pivot points : price is under support 1

Type : Neutral

Timeframe : Daily

Ichimoku : price is under the cloud

Type : Bearish

Timeframe : Daily

Williams %R indicator is back under -50

Type : Bearish

Timeframe : Daily

The Central Patterns scanner, which studies chart patterns, resistances and supports, has identified these signals:

Resistance of channel is broken

Type : Bullish

Timeframe : Daily

Horizontal support is broken

Type : Bearish

Timeframe : Daily

The Central Candlesticks scanner, specialised in Japanese candlesticks, did not identify any signals.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 0.0754 | 0.0808 | 0.0906 | 0.0924 | 0.0995 | 0.1050 | 0.1146 |

| Change (%) | -18.40% | -12.55% | -1.95% | - | +7.68% | +13.64% | +24.03% |

| Change | -0.0170 | -0.0116 | -0.0018 | - | +0.0071 | +0.0126 | +0.0222 |

| Level | Minor | Intermediate | Minor | - | Intermediate | Minor | Minor |

Pivot points can also be used to set your price objectives. Here is the price situation in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.0720 | 0.0792 | 0.0906 | 0.0978 | 0.1092 | 0.1164 | 0.1278 |

| Camarilla | 0.0969 | 0.0986 | 0.1003 | 0.1020 | 0.1037 | 0.1054 | 0.1071 |

| Woodie | 0.0741 | 0.0803 | 0.0927 | 0.0989 | 0.1113 | 0.1175 | 0.1299 |

| Fibonacci | 0.0792 | 0.0863 | 0.0907 | 0.0978 | 0.1049 | 0.1093 | 0.1164 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.0671 | 0.0715 | 0.0759 | 0.0803 | 0.0847 | 0.0891 | 0.0935 |

| Camarilla | 0.0778 | 0.0786 | 0.0794 | 0.0802 | 0.0810 | 0.0818 | 0.0826 |

| Woodie | 0.0670 | 0.0715 | 0.0758 | 0.0803 | 0.0846 | 0.0891 | 0.0934 |

| Fibonacci | 0.0715 | 0.0749 | 0.0770 | 0.0803 | 0.0837 | 0.0858 | 0.0891 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.0251 | 0.0501 | 0.0639 | 0.0889 | 0.1027 | 0.1277 | 0.1415 |

| Camarilla | 0.0669 | 0.0705 | 0.0740 | 0.0776 | 0.0812 | 0.0847 | 0.0883 |

| Woodie | 0.0194 | 0.0473 | 0.0582 | 0.0861 | 0.0970 | 0.1249 | 0.1358 |

| Fibonacci | 0.0501 | 0.0650 | 0.0741 | 0.0889 | 0.1038 | 0.1129 | 0.1277 |

Numerical data

The following are the details of the technical indicators and moving averages that were collected to generate this technical analysis:

| RSI (14): | 53.24 | |

| MACD (12,26,9): | 0.0008 | |

| Directional Movement: | 17.7992 | |

| AROON (14): | 92.8571 | |

| DEMA (21): | 0.0850 | |

| Parabolic SAR (0,02-0,02-0,2): | 0.0785 | |

| Elder Ray (13): | 0.0099 | |

| Super Trend (3,10): | 0.0724 | |

| Zig ZAG (10): | 0.0890 | |

| VORTEX (21): | 0.9901 | |

| Stochastique (14,3,5): | 68.46 | |

| TEMA (21): | 0.0873 | |

| Williams %R (14): | -54.05 | |

| Chande Momentum Oscillator (20): | 0.0114 | |

| Repulse (5,40,3): | -5.7233 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | -0.2422 | |

| Courbe Coppock: | 14.15 |

| MA7: | 0.0866 | |

| MA20: | 0.0827 | |

| MA50: | 0.0864 | |

| MA100: | 0.0894 | |

| MAexp7: | 0.0885 | |

| MAexp20: | 0.0850 | |

| MAexp50: | 0.0866 | |

| MAexp100: | 0.0911 | |

| Price / MA7: | +6.70% | |

| Price / MA20: | +11.73% | |

| Price / MA50: | +6.94% | |

| Price / MA100: | +3.36% | |

| Price / MAexp7: | +4.41% | |

| Price / MAexp20: | +8.71% | |

| Price / MAexp50: | +6.70% | |

| Price / MAexp100: | +1.43% |

Add a comment

Comments

0 comments on the analysis KKO INTERNATIONAL - Daily