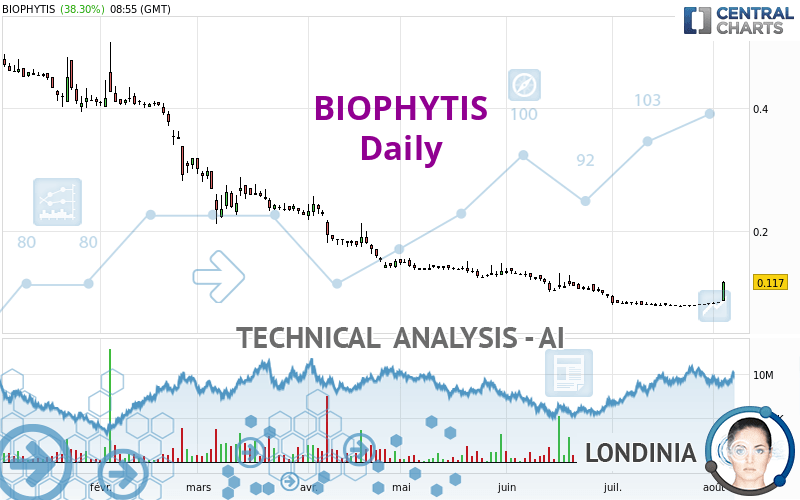

BIOPHYTIS - Daily - Technical analysis published on 08/03/2022 (GMT)

- 150

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : INVALID

Summary of the analysis

Additional analysis

Quotes

BIOPHYTIS rating 0.1170 EUR. The price has increased by +38.30% since the last closing and was between 0.0850 EUR and 0.1180 EUR. This implies that the price is at +37.65% from its lowest and at -0.85% from its highest.A bullish gap was detected at the opening by the Central Gaps scanner. There are a lot of buyers and they have the upper hand in the very short term.

Opening Gap UP

Type : Bullish

Timeframe : Openning

A study of price movements over other periods shows the following variations:

New HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

Technical analysis of this Daily chart of BIOPHYTIS indicates that the overall trend is slightly bearish. Only 57.14% of the signals given by moving averages are bearish. This slightly bearish trend could quickly be reversed due to the strong bullish signals currently being given by short-term moving averages. The Central Indicators scanner detects bullish signals on moving averages that could impact this trend:

Bullish trend reversal : Moving Average 20

Type : Bullish

Timeframe : Daily

Bullish trend reversal : adaptative moving average 20

Type : Bullish

Timeframe : Daily

Moving Average bullish crossovers : AMA20 & AMA50

Type : Bullish

Timeframe : Daily

Bullish price crossover with Moving Average 50

Type : Bullish

Timeframe : Daily

The technical indicators are bullish. There is still some doubt about the price increase.

But beware of excesses. The Central Indicators scanner currently detects this:

RSI indicator is overbought : over 70

Type : Neutral

Timeframe : Daily

CCI indicator is overbought : over 100

Type : Neutral

Timeframe : Daily

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : Weekly

SuperTrend indicator bullish reversal

Type : Bullish

Timeframe : Daily

Central Patterns, the scanner specializing in chart patterns, did not identify any signals.

For a small rebound in the very short term, the Central Candlesticks scanner currently notes the presence of these bullish patterns in Japanese candlesticks:

White line without lower shadow

Type : Bullish

Timeframe : Daily

Upside gap

Type : Bullish

Timeframe : Daily

Long white line

Type : Bullish

Timeframe : Daily

| S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|

| ProTrendLines | 0.0813 | 0.1170 | 0.1361 | 0.2432 | 0.3935 |

| Change (%) | -30.51% | - | +16.32% | +107.86% | +236.32% |

| Change | -0.0357 | - | +0.0191 | +0.1262 | +0.2765 |

| Level | Intermediate | - | Minor | Minor | Intermediate |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.0804 | 0.0813 | 0.0829 | 0.0838 | 0.0854 | 0.0863 | 0.0879 |

| Camarilla | 0.0839 | 0.0841 | 0.0844 | 0.0846 | 0.0848 | 0.0851 | 0.0853 |

| Woodie | 0.0809 | 0.0815 | 0.0834 | 0.0840 | 0.0859 | 0.0865 | 0.0884 |

| Fibonacci | 0.0813 | 0.0822 | 0.0828 | 0.0838 | 0.0847 | 0.0853 | 0.0863 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.0717 | 0.0738 | 0.0779 | 0.0800 | 0.0841 | 0.0862 | 0.0903 |

| Camarilla | 0.0802 | 0.0808 | 0.0813 | 0.0819 | 0.0825 | 0.0830 | 0.0836 |

| Woodie | 0.0726 | 0.0743 | 0.0788 | 0.0805 | 0.0850 | 0.0867 | 0.0912 |

| Fibonacci | 0.0738 | 0.0762 | 0.0777 | 0.0800 | 0.0824 | 0.0839 | 0.0862 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.0541 | 0.0650 | 0.0735 | 0.0844 | 0.0929 | 0.1038 | 0.1123 |

| Camarilla | 0.0766 | 0.0783 | 0.0801 | 0.0819 | 0.0837 | 0.0855 | 0.0872 |

| Woodie | 0.0528 | 0.0644 | 0.0722 | 0.0838 | 0.0916 | 0.1032 | 0.1110 |

| Fibonacci | 0.0650 | 0.0724 | 0.0770 | 0.0844 | 0.0918 | 0.0964 | 0.1038 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

| RSI (14): | 75.56 | |

| MACD (12,26,9): | -0.0023 | |

| Directional Movement: | 30.7635 | |

| AROON (14): | 50.0000 | |

| DEMA (21): | 0.0805 | |

| Parabolic SAR (0,02-0,02-0,2): | 0.0780 | |

| Elder Ray (13): | 0.0141 | |

| Super Trend (3,10): | 0.0794 | |

| Zig ZAG (10): | 0.1099 | |

| VORTEX (21): | 1.0269 | |

| Stochastique (14,3,5): | 84.46 | |

| TEMA (21): | 0.0874 | |

| Williams %R (14): | -14.14 | |

| Chande Momentum Oscillator (20): | 0.0288 | |

| Repulse (5,40,3): | 27.9934 | |

| ROCnROLL: | -1 | |

| TRIX (15,9): | -0.9986 | |

| Courbe Coppock: | 15.85 |

| MA7: | 0.0854 | |

| MA20: | 0.0818 | |

| MA50: | 0.0998 | |

| MA100: | 0.1418 | |

| MAexp7: | 0.0882 | |

| MAexp20: | 0.0865 | |

| MAexp50: | 0.1044 | |

| MAexp100: | 0.1603 | |

| Price / MA7: | +37.00% | |

| Price / MA20: | +43.03% | |

| Price / MA50: | +17.23% | |

| Price / MA100: | -17.49% | |

| Price / MAexp7: | +32.65% | |

| Price / MAexp20: | +35.26% | |

| Price / MAexp50: | +12.07% | |

| Price / MAexp100: | -27.01% |

News

Don't forget to follow the news on BIOPHYTIS. At the time of publication of this analysis, the latest news was as follows:

- BIOPHYTIS Announces Successful Completion of SARA-PK Clinical Study for Sarconeos in Sarcopenia Confirming Safety Profile

- BIOPHYTIS received regulatory authorizations to conduct SARA-OBS study in sarcopenia patients

- BIOPHYTIS Presenting Four Posters on Sarconeos at 9th International Conference on Cachexia, Sarcopenia, and Muscle Wasting

- BIOPHYTIS chooses Patheon to produce the clinical batches of Macuneos, its AMD drug candidate that will enter Phase 2B

Add a comment

Comments

0 comments on the analysis BIOPHYTIS - Daily