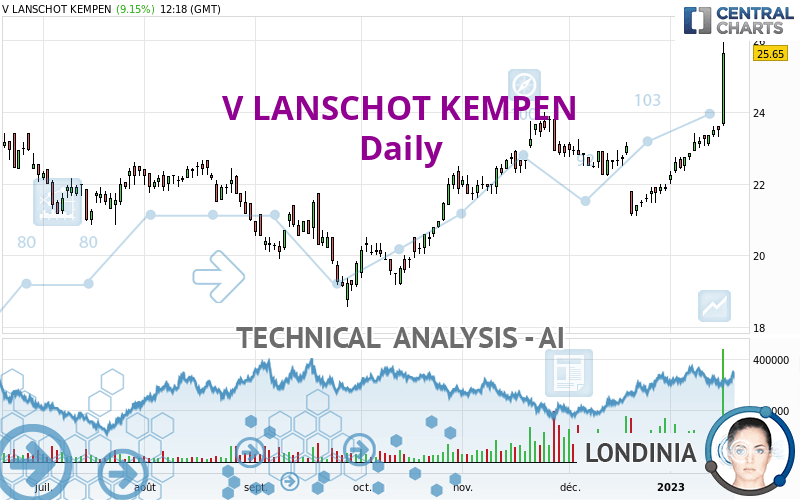

V LANSCHOT KEMPEN - Daily - Technical analysis published on 01/17/2023 (GMT)

- 128

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : LEVEL MAINTAINED

Summary of the analysis

Additional analysis

Quotes

The V LANSCHOT KEMPEN rating is 25.65 EUR. The price has increased by +9.15% since the last closing and was between 23.60 EUR and 25.95 EUR. This implies that the price is at +8.69% from its lowest and at -1.16% from its highest.The Central Gaps scanner detects the formation of a bullish gap marking the strong presence of buyers against sellers at the opening. This formed a quotation gap.

Opening Gap UP

Type : Bullish

Timeframe : Openning

A study of price movements over other periods shows the following variations:

New HIGH record (5 years)

Type : Bullish

Timeframe : Weekly

New HIGH record (1 year)

Type : Bullish

Timeframe : Weekly

New HIGH record (1st january)

Type : Bullish

Timeframe : Weekly

New HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

The Central Volumes scanner notes the presence of abnormal volumes:

Abnormal volumes

Timeframe : 5 days

Abnormal volumes

Timeframe : 20 days

Abnormal volumes

Timeframe : 50 days

Technical

Technical analysis of V LANSCHOT KEMPEN in Daily shows a strongly overall bullish trend. 92.86% of the signals given by moving averages are bullish. The overall trend is supported by the strong bullish signals from short-term moving averages. The Central Indicators market scanner currently does not detect any result that concerns moving averages.

The probability of a further increase is high given the direction of the technical indicators.

Caution: the Central Indicators scanner currently detects an excess:

RSI indicator is overbought : over 80

Type : Neutral

Timeframe : Daily

CCI indicator is overbought : over 100

Type : Neutral

Timeframe : Daily

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : Weekly

Central Patterns, the market scanner focusing on chart patterns, resistances and supports found these results:

Near horizontal resistance

Type : Bearish

Timeframe : Daily

Resistance of channel is broken

Type : Bullish

Timeframe : Daily

The presence of a bullish Japanese candlestick pattern detected by Central Candlesticks that could cause a very short term rebound was also detected:

Long white line

Type : Bullish

Timeframe : Daily

| S3 | S2 | S1 | Price | R1 | R2 | |

|---|---|---|---|---|---|---|

| ProTrendLines | 20.80 | 22.28 | 23.28 | 25.65 | 31.84 | 36.99 |

| Change (%) | -18.91% | -13.14% | -9.24% | - | +24.13% | +44.21% |

| Change | -4.85 | -3.37 | -2.37 | - | +6.19 | +11.34 |

| Level | Intermediate | Major | Major | - | Minor | Intermediate |

Pivot points can also be used to set your price objectives. Here is the price situation in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 23.03 | 23.17 | 23.33 | 23.47 | 23.63 | 23.77 | 23.93 |

| Camarilla | 23.42 | 23.45 | 23.47 | 23.50 | 23.53 | 23.56 | 23.58 |

| Woodie | 23.05 | 23.18 | 23.35 | 23.48 | 23.65 | 23.78 | 23.95 |

| Fibonacci | 23.17 | 23.28 | 23.35 | 23.47 | 23.58 | 23.65 | 23.77 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 22.37 | 22.63 | 23.07 | 23.33 | 23.77 | 24.03 | 24.47 |

| Camarilla | 23.31 | 23.37 | 23.44 | 23.50 | 23.56 | 23.63 | 23.69 |

| Woodie | 22.45 | 22.68 | 23.15 | 23.38 | 23.85 | 24.08 | 24.55 |

| Fibonacci | 22.63 | 22.90 | 23.07 | 23.33 | 23.60 | 23.77 | 24.03 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 19.87 | 20.31 | 21.11 | 21.55 | 22.35 | 22.79 | 23.59 |

| Camarilla | 21.56 | 21.67 | 21.79 | 21.90 | 22.01 | 22.13 | 22.24 |

| Woodie | 20.04 | 20.40 | 21.28 | 21.64 | 22.52 | 22.88 | 23.76 |

| Fibonacci | 20.31 | 20.79 | 21.08 | 21.55 | 22.03 | 22.32 | 22.79 |

Numerical data

The following is the status of technical indicators and moving averages registered at the time this technical analysis was created:

| RSI (14): | 88.70 | |

| MACD (12,26,9): | 0.7400 | |

| Directional Movement: | 51.24 | |

| AROON (14): | 100.00 | |

| DEMA (21): | 23.73 | |

| Parabolic SAR (0,02-0,02-0,2): | 23.09 | |

| Elder Ray (13): | 1.52 | |

| Super Trend (3,10): | 23.10 | |

| Zig ZAG (10): | 25.55 | |

| VORTEX (21): | 1.2200 | |

| Stochastique (14,3,5): | 93.76 | |

| TEMA (21): | 24.12 | |

| Williams %R (14): | -9.41 | |

| Chande Momentum Oscillator (20): | 3.70 | |

| Repulse (5,40,3): | 10.4200 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | 0.3400 | |

| Courbe Coppock: | 18.73 |

| MA7: | 23.65 | |

| MA20: | 22.57 | |

| MA50: | 21.80 | |

| MA100: | 20.51 | |

| MAexp7: | 23.81 | |

| MAexp20: | 22.85 | |

| MAexp50: | 21.89 | |

| MAexp100: | 21.21 | |

| Price / MA7: | +8.46% | |

| Price / MA20: | +13.65% | |

| Price / MA50: | +17.66% | |

| Price / MA100: | +25.06% | |

| Price / MAexp7: | +7.73% | |

| Price / MAexp20: | +12.25% | |

| Price / MAexp50: | +17.18% | |

| Price / MAexp100: | +20.93% |

News

Don't forget to follow the news on V LANSCHOT KEMPEN. At the time of publication of this analysis, the latest news was as follows:

- Van Lanschot Kempen and Mercier Vanderlinden to take next step in collaboration by accelerating acquisition of remaining stake

- Van Lanschot Kempen to return capital of €1.50 per share on 22 December 2022

- Van Lanschot Kempen: third-quarter trading update

- Van Lanschot Kempen’s shareholders agree to proposed return of capital

- Van Lanschot Kempen: net profit €48.2 million and €4.9 billion in net AuM inflows in H1 2022

Add a comment

Comments

0 comments on the analysis V LANSCHOT KEMPEN - Daily