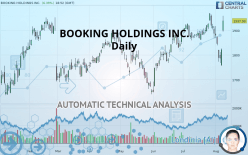

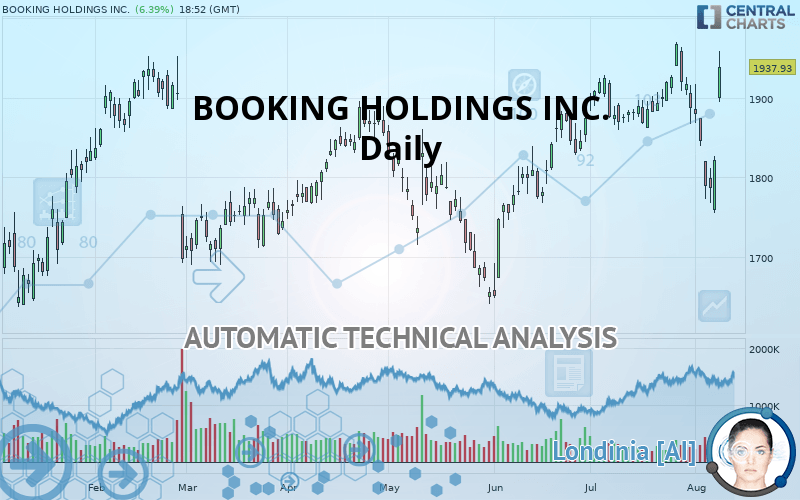

BOOKING HOLDINGS INC. - Daily - Technical analysis published on 08/08/2019 (GMT)

- Who voted?

- 357

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

BOOKING HOLDINGS INC. rating 1,937.93 USD. The price has increased by +6.39% since the last closing with the lowest point at 1,895.00 USD and the highest point at 1,958.81 USD. The deviation from the price is +2.27% for the low point and -1.07% for the high point.The Central Gaps scanner detects a bullish gap which is a sign that buyers have taken the lead in the very short term.

Opening Gap UP

Type : Bullish

Timeframe : Openning

So that you have an overall view of the price change, here is a table showing the variations over several periods:

Near a new HIGH record (1st january)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

Technical

A technical analysis in Daily of this BOOKING HOLDINGS INC. chart shows a strongly bullish trend. 92.86% of the signals given by moving averages are bullish. The overall trend is supported by the strong bullish signals from short-term moving averages. The Central Indicators market scanner is currently detecting several bullish signals that could impact this trend:

Bullish price crossover with Moving Average 100

Type : Bullish

Timeframe : Daily

Bullish price crossover with adaptative moving average 100

Type : Bullish

Timeframe : Daily

The technical indicators are generally neutral. They do not provide relevant information on the direction of future price movements.

Caution: the Central Indicators scanner currently detects an excess:

CCI indicator is oversold : under -100

Type : Neutral

Timeframe : Daily

Previous candle closed under Bollinger bands

Type : Neutral

Timeframe : Daily

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 1

Type : Neutral

Timeframe : Weekly

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : Daily

Ichimoku : price is over the cloud

Type : Bullish

Timeframe : Daily

Price is back under the pivot point

Type : Bearish

Timeframe : Weekly

An analysis of the price chart with the Central Patterns scanner (detector of chart patterns and resistances and supports) shows a result that can have an impact on the price change:

Support of channel is broken

Type : Bearish

Timeframe : Daily

Central Candlesticks, the scanner specialised in Japanese candlesticks, detects a bullish signal that could support the hypothesis of a small rebound in the very short term:

Bullish engulfing lines

Type : Bullish

Timeframe : Daily

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 1,751.15 | 1,829.98 | 1,867.79 | 1,937.93 | 1,938.80 | 2,049.00 | 2,206.09 |

| Change (%) | -9.64% | -5.57% | -3.62% | - | +0.04% | +5.73% | +13.84% |

| Change | -186.78 | -107.95 | -70.14 | - | +0.87 | +111.07 | +268.16 |

| Level | Intermediate | Minor | Major | - | Major | Minor | Major |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1,704.44 | 1,729.72 | 1,775.64 | 1,800.92 | 1,846.84 | 1,872.12 | 1,918.04 |

| Camarilla | 1,801.98 | 1,808.51 | 1,815.03 | 1,821.56 | 1,828.09 | 1,834.61 | 1,841.14 |

| Woodie | 1,714.76 | 1,734.88 | 1,785.96 | 1,806.08 | 1,857.16 | 1,877.28 | 1,928.36 |

| Fibonacci | 1,729.72 | 1,756.92 | 1,773.72 | 1,800.92 | 1,828.12 | 1,844.92 | 1,872.12 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1,679.06 | 1,759.23 | 1,802.65 | 1,882.82 | 1,926.24 | 2,006.41 | 2,049.83 |

| Camarilla | 1,812.09 | 1,823.42 | 1,834.75 | 1,846.08 | 1,857.41 | 1,868.74 | 1,880.07 |

| Woodie | 1,660.70 | 1,750.04 | 1,784.29 | 1,873.63 | 1,907.88 | 1,997.22 | 2,031.47 |

| Fibonacci | 1,759.23 | 1,806.44 | 1,835.61 | 1,882.82 | 1,930.03 | 1,959.20 | 2,006.41 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1,729.37 | 1,794.12 | 1,840.37 | 1,905.12 | 1,951.37 | 2,016.12 | 2,062.37 |

| Camarilla | 1,856.09 | 1,866.26 | 1,876.44 | 1,886.61 | 1,896.79 | 1,906.96 | 1,917.14 |

| Woodie | 1,720.11 | 1,789.50 | 1,831.11 | 1,900.50 | 1,942.11 | 2,011.50 | 2,053.11 |

| Fibonacci | 1,794.12 | 1,836.53 | 1,862.72 | 1,905.12 | 1,947.53 | 1,973.72 | 2,016.12 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

| RSI (14): | 59.43 | |

| MACD (12,26,9): | -1.3800 | |

| Directional Movement: | 10.20 | |

| AROON (14): | -57.15 | |

| DEMA (21): | 1,875.97 | |

| Parabolic SAR (0,02-0,02-0,2): | 1,755.00 | |

| Elder Ray (13): | 56.84 | |

| Super Trend (3,10): | 1,772.33 | |

| Zig ZAG (10): | 1,936.11 | |

| VORTEX (21): | 0.9400 | |

| Stochastique (14,3,5): | 41.72 | |

| TEMA (21): | 1,859.82 | |

| Williams %R (14): | -12.95 | |

| Chande Momentum Oscillator (20): | 41.38 | |

| Repulse (5,40,3): | 4.0800 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | 0.0600 | |

| Courbe Coppock: | 3.00 |

| MA7: | 1,850.01 | |

| MA20: | 1,883.89 | |

| MA50: | 1,845.19 | |

| MA100: | 1,817.49 | |

| MAexp7: | 1,864.23 | |

| MAexp20: | 1,872.49 | |

| MAexp50: | 1,854.77 | |

| MAexp100: | 1,835.71 | |

| Price / MA7: | +4.75% | |

| Price / MA20: | +2.87% | |

| Price / MA50: | +5.03% | |

| Price / MA100: | +6.63% | |

| Price / MAexp7: | +3.95% | |

| Price / MAexp20: | +3.49% | |

| Price / MAexp50: | +4.48% | |

| Price / MAexp100: | +5.57% |

Add a comment

Comments

0 comments on the analysis BOOKING HOLDINGS INC. - Daily