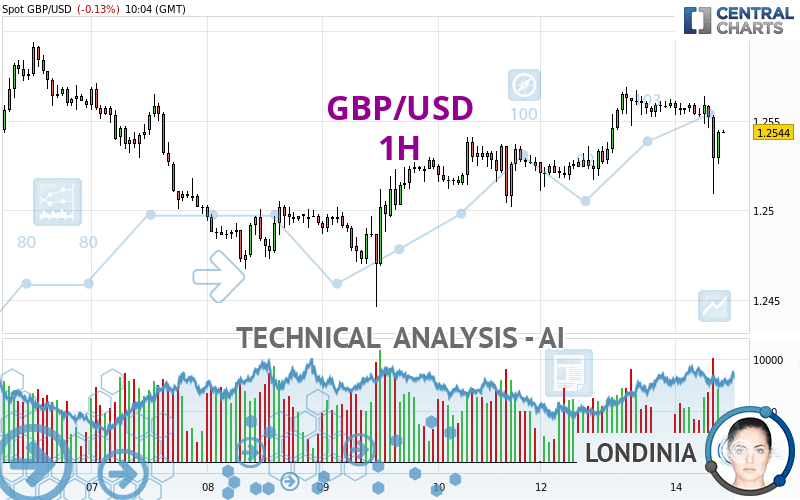

GBP/USD - 1H - Technical analysis published on 05/14/2024 (GMT)

- 75

- 0

Click here for a new analysis!

- Timeframe : 1H

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

The GBP/USD rating is 1.2544 USD. The price is lower by -0.13% since the last closing with the lowest point at 1.2509 USD and the highest point at 1.2564 USD. The deviation from the price is +0.28% for the low point and -0.16% for the high point.So that you have an overall view of the price change, here is a table showing the variations over several periods:

Near a new HIGH record (1 year)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1st january)

Type : Bullish

Timeframe : Weekly

Near a new LOW record (1 month)

Type : Bearish

Timeframe : Weekly

Technical

A technical analysis in 1H of this GBP/USD chart shows a bullish trend. 64.29% of the signals given by moving averages are bullish. Caution: the neutral signals currently given by short-term moving averages show us that the global trend is losing momentum. An assessment of moving averages reveals several bullish signals that could impact this trend:

Bullish price crossover with Moving Average 50

Type : Bullish

Timeframe : 1 hour

Bullish price crossover with adaptative moving average 50

Type : Bullish

Timeframe : 1 hour

Bullish price crossover with adaptative moving average 100

Type : Bullish

Timeframe : 1 hour

In fact, according to the parameters integrated into the Central Analyzer system, only 9 technical indicators out of 18 analysed are currently bearish. Caution: the Central Indicators scanner currently detects an excess:

CCI indicator is oversold : under -100

Type : Neutral

Timeframe : 1 hour

Previous candle closed under Bollinger bands

Type : Neutral

Timeframe : 1 hour

Williams %R indicator is back over -50

Type : Bullish

Timeframe : 1 hour

The Central Patterns scanner, which studies chart patterns, resistances and supports, has identified these signals:

Near support of triangle

Type : Bullish

Timeframe : 1 hour

Horizontal support is broken

Type : Bearish

Timeframe : 1 hour

Support of channel is broken

Type : Bearish

Timeframe : 1 hour

The Central Candlesticks scanner which studies Japanese candlesticks did not detect anything.

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 1.2490 | 1.2517 | 1.2540 | 1.2544 | 1.2556 | 1.2594 | 1.2633 |

| Change (%) | -0.43% | -0.22% | -0.03% | - | +0.10% | +0.40% | +0.71% |

| Change | -0.0054 | -0.0027 | -0.0004 | - | +0.0012 | +0.0050 | +0.0089 |

| Level | Minor | Intermediate | Intermediate | - | Major | Minor | Intermediate |

Pivot points can also be used to set your price objectives. Here is the price situation in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.2466 | 1.2489 | 1.2524 | 1.2547 | 1.2582 | 1.2605 | 1.2640 |

| Camarilla | 1.2544 | 1.2549 | 1.2555 | 1.2560 | 1.2565 | 1.2571 | 1.2576 |

| Woodie | 1.2473 | 1.2492 | 1.2531 | 1.2550 | 1.2589 | 1.2608 | 1.2647 |

| Fibonacci | 1.2489 | 1.2511 | 1.2525 | 1.2547 | 1.2569 | 1.2583 | 1.2605 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.2301 | 1.2374 | 1.2449 | 1.2522 | 1.2597 | 1.2670 | 1.2745 |

| Camarilla | 1.2484 | 1.2498 | 1.2511 | 1.2525 | 1.2539 | 1.2552 | 1.2566 |

| Woodie | 1.2303 | 1.2375 | 1.2451 | 1.2523 | 1.2599 | 1.2671 | 1.2747 |

| Fibonacci | 1.2374 | 1.2430 | 1.2465 | 1.2522 | 1.2578 | 1.2613 | 1.2670 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.1879 | 1.2089 | 1.2289 | 1.2499 | 1.2699 | 1.2909 | 1.3109 |

| Camarilla | 1.2376 | 1.2414 | 1.2451 | 1.2489 | 1.2527 | 1.2564 | 1.2602 |

| Woodie | 1.1874 | 1.2087 | 1.2284 | 1.2497 | 1.2694 | 1.2907 | 1.3104 |

| Fibonacci | 1.2089 | 1.2246 | 1.2342 | 1.2499 | 1.2656 | 1.2752 | 1.2909 |

Numerical data

The following is the status of technical indicators and moving averages registered at the time this technical analysis was created:

| RSI (14): | 43.59 | |

| MACD (12,26,9): | 0.0001 | |

| Directional Movement: | -16.1634 | |

| AROON (14): | -14.2857 | |

| DEMA (21): | 1.2553 | |

| Parabolic SAR (0,02-0,02-0,2): | 1.2559 | |

| Elder Ray (13): | -0.0017 | |

| Super Trend (3,10): | 1.2568 | |

| Zig ZAG (10): | 1.2540 | |

| VORTEX (21): | 0.9140 | |

| Stochastique (14,3,5): | 42.63 | |

| TEMA (21): | 1.2549 | |

| Williams %R (14): | -41.82 | |

| Chande Momentum Oscillator (20): | -0.0018 | |

| Repulse (5,40,3): | 0.0353 | |

| ROCnROLL: | -1 | |

| TRIX (15,9): | 0.0061 | |

| Courbe Coppock: | 0.16 |

| MA7: | 1.2529 | |

| MA20: | 1.2495 | |

| MA50: | 1.2592 | |

| MA100: | 1.2633 | |

| MAexp7: | 1.2547 | |

| MAexp20: | 1.2550 | |

| MAexp50: | 1.2541 | |

| MAexp100: | 1.2533 | |

| Price / MA7: | +0.12% | |

| Price / MA20: | +0.39% | |

| Price / MA50: | -0.38% | |

| Price / MA100: | -0.70% | |

| Price / MAexp7: | -0.02% | |

| Price / MAexp20: | -0.05% | |

| Price / MAexp50: | +0.02% | |

| Price / MAexp100: | +0.09% |

News

The last news published on GBP/USD at the time of the generation of this analysis was as follows:

-

Weekly Technical Outlook: 08/05/2024 - USDJPY, GBPUSD, USDCAD

Weekly Technical Outlook: 08/05/2024 - USDJPY, GBPUSD, USDCAD

-

GBP/USD Forecast May 3, 2024

GBP/USD Forecast May 3, 2024

-

GBP/USD Forecast May 2, 2024

GBP/USD Forecast May 2, 2024

-

GBP/USD April 24 Forecast

GBP/USD April 24 Forecast

-

GBP/USD Forecast April 22, 2024

GBP/USD Forecast April 22, 2024

Add a comment

Comments

0 comments on the analysis GBP/USD - 1H