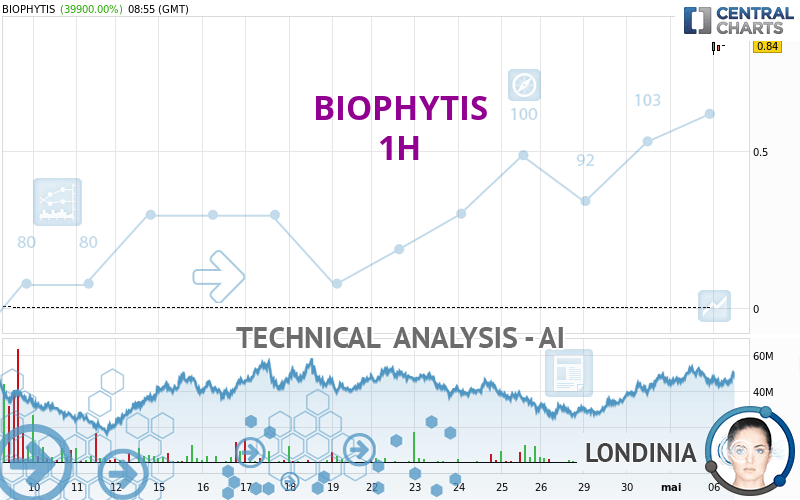

BIOPHYTIS - 1H - Technical analysis published on 05/06/2024 (GMT)

- 84

- 0

Click here for a new analysis!

- Timeframe : 1H

- - Analysis generated on

- Status : LEVEL MAINTAINED

Summary of the analysis

Additional analysis

Quotes

BIOPHYTIS rating 0.8200 EUR. The price has increased by +38,947.62% since the last closing and was traded between 0.8100 EUR and 0.8500 EUR over the period. The price is currently at +1.23% from its lowest and -3.53% from its highest.The Central Gaps scanner detects the formation of a bullish gap marking the strong presence of buyers against sellers at the opening. This formed a quotation gap.

Opening Gap UP

Type : Bullish

Timeframe : Openning

Here is a more detailed summary of the historical variations registered by BIOPHYTIS:

New HIGH record (1 year)

Type : Bullish

Timeframe : Weekly

New HIGH record (1st january)

Type : Bullish

Timeframe : Weekly

New HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

The Central Volumes scanner notes the presence of abnormal volumes:

Abnormal volumes

Timeframe : 20 days

Abnormal volumes

Timeframe : 50 days

Technical

Technical analysis of BIOPHYTIS in 1H shows a strongly overall bullish trend. 92.86% of the signals given by moving averages are bullish. This strongly bullish trend is supported by the strong bullish signals given by short-term moving averages. An assessment of moving averages reveals several bullish signals that could impact this trend:

Bullish trend reversal : Moving Average 20

Type : Bullish

Timeframe : 1 hour

Bullish trend reversal : Moving Average 50

Type : Bullish

Timeframe : 1 hour

Bullish trend reversal : Moving Average 100

Type : Bullish

Timeframe : 1 hour

Bullish trend reversal : adaptative moving average 20

Type : Bullish

Timeframe : 1 hour

Bullish trend reversal : adaptative moving average 50

Type : Bullish

Timeframe : 1 hour

Bullish trend reversal : adaptative moving average 100

Type : Bullish

Timeframe : 1 hour

In fact, according to the parameters integrated into the Central Analyzer system, 16 technical indicators out of 18 analysed are currently bullish. Caution: the Central Indicators scanner currently detects an excess:

RSI indicator is overbought : over 90

Type : Neutral

Timeframe : 1 hour

CCI indicator is overbought : over 100

Type : Neutral

Timeframe : 1 hour

Previous candle closed over Bollinger bands

Type : Neutral

Timeframe : 1 hour

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : 1 hour

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : 1 hour

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : Weekly

An analysis of the price chart with the Central Patterns scanner (detector of chart patterns and resistances and supports) shows a result that can have an impact on the price change:

Resistance of channel is broken

Type : Bullish

Timeframe : 1 hour

For a small setback in the very short term, the Central Candlesticks scanner currently notes the presence of this bearish pattern in Japanese candlesticks:

Black marubozu

Type : Bearish

Timeframe : 1 hour

Long black line

Type : Bearish

Timeframe : 1 hour

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 0.0144 | 0.1360 | 0.7047 | 0.8200 | 1.1700 | 1.6880 | 2.6100 |

| Change (%) | -98.24% | -83.41% | -14.06% | - | +42.68% | +105.85% | +218.29% |

| Change | -0.8056 | -0.6840 | -0.1153 | - | +0.3500 | +0.8680 | +1.7900 |

| Level | Major | Intermediate | Minor | - | Minor | Major | Intermediate |

To determine price objectives, it is also possible to use the pivot points. Here is the price position in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.0017 | 0.0019 | 0.0020 | 0.0022 | 0.0023 | 0.0025 | 0.0026 |

| Camarilla | 0.0020 | 0.0021 | 0.0021 | 0.0021 | 0.0021 | 0.0022 | 0.0022 |

| Woodie | 0.0017 | 0.0019 | 0.0020 | 0.0022 | 0.0023 | 0.0025 | 0.0026 |

| Fibonacci | 0.0019 | 0.0020 | 0.0021 | 0.0022 | 0.0023 | 0.0024 | 0.0025 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.0017 | 0.0019 | 0.0020 | 0.0022 | 0.0023 | 0.0025 | 0.0026 |

| Camarilla | 0.0020 | 0.0021 | 0.0021 | 0.0021 | 0.0021 | 0.0022 | 0.0022 |

| Woodie | 0.0017 | 0.0019 | 0.0020 | 0.0022 | 0.0023 | 0.0025 | 0.0026 |

| Fibonacci | 0.0019 | 0.0020 | 0.0021 | 0.0022 | 0.0023 | 0.0024 | 0.0025 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | -0.0008 | 0.0006 | 0.0014 | 0.0028 | 0.0036 | 0.0050 | 0.0058 |

| Camarilla | 0.0015 | 0.0017 | 0.0019 | 0.0021 | 0.0023 | 0.0025 | 0.0027 |

| Woodie | -0.0012 | 0.0005 | 0.0010 | 0.0027 | 0.0032 | 0.0049 | 0.0054 |

| Fibonacci | 0.0006 | 0.0015 | 0.0020 | 0.0028 | 0.0037 | 0.0042 | 0.0050 |

Numerical data

The following are the details of the technical indicators and moving averages that were collected to generate this technical analysis:

| RSI (14): | 99.93 | |

| MACD (12,26,9): | 0.1156 | |

| Directional Movement: | 97.3372 | |

| AROON (14): | 71.4285 | |

| DEMA (21): | 0.2670 | |

| Parabolic SAR (0,02-0,02-0,2): | 0.0021 | |

| Elder Ray (13): | 0.6108 | |

| Super Trend (3,10): | 0.5948 | |

| Zig ZAG (10): | 0.8200 | |

| VORTEX (21): | 1.0111 | |

| Stochastique (14,3,5): | 64.31 | |

| TEMA (21): | 0.3731 | |

| Williams %R (14): | -3.54 | |

| Chande Momentum Oscillator (20): | 0.8178 | |

| Repulse (5,40,3): | -8.7300 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | 107.8384 | |

| Courbe Coppock: | 25,998.85 |

| MA7: | 0.1191 | |

| MA20: | 0.0433 | |

| MA50: | 0.0196 | |

| MA100: | 0.0124 | |

| MAexp7: | 0.3600 | |

| MAexp20: | 0.1506 | |

| MAexp50: | 0.0652 | |

| MAexp100: | 0.0345 | |

| Price / MA7: | +588.50% | |

| Price / MA20: | +1,793.76% | |

| Price / MA50: | +4,083.67% | |

| Price / MA100: | +6,512.90% | |

| Price / MAexp7: | +127.78% | |

| Price / MAexp20: | +444.49% | |

| Price / MAexp50: | +1,157.67% | |

| Price / MAexp100: | +2,276.81% |

News

Don't forget to follow the news on BIOPHYTIS. At the time of publication of this analysis, the latest news was as follows:

- BIOPHYTIS Announces Successful Completion of SARA-PK Clinical Study for Sarconeos in Sarcopenia Confirming Safety Profile

- BIOPHYTIS received regulatory authorizations to conduct SARA-OBS study in sarcopenia patients

- BIOPHYTIS Presenting Four Posters on Sarconeos at 9th International Conference on Cachexia, Sarcopenia, and Muscle Wasting

- BIOPHYTIS chooses Patheon to produce the clinical batches of Macuneos, its AMD drug candidate that will enter Phase 2B

Add a comment

Comments

0 comments on the analysis BIOPHYTIS - 1H