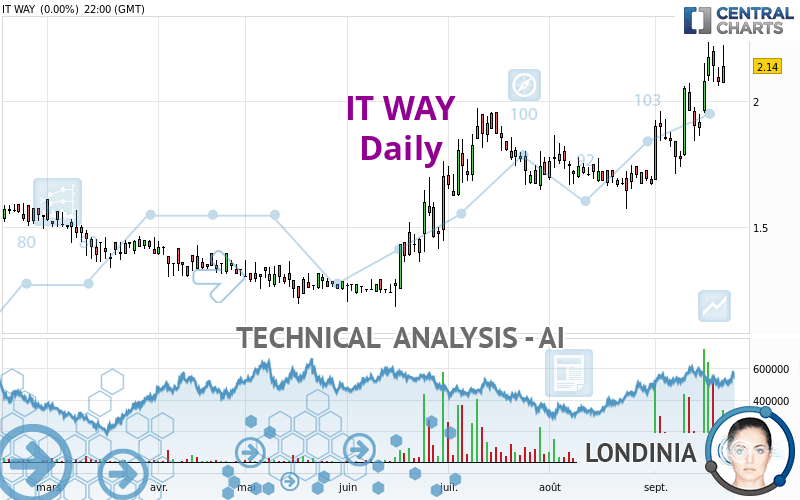

IT WAY - Daily - Technical analysis published on 09/22/2023 (GMT)

- 111

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : INVALID

Summary of the analysis

Additional analysis

Quotes

The IT WAY rating is 2.280 EUR. The price has increased by +6.54% since the last closing with the lowest point at 2.145 EUR and the highest point at 2.300 EUR. The deviation from the price is +6.29% for the low point and -0.87% for the high point.The Central Gaps scanner detects a bullish opening marking the presence of buyers ahead of sellers at the opening but not sufficiently marked to allow the price to register a quotation gap.

Bullish opening

Type : Bullish

Timeframe : Openning

Here is a more detailed summary of the historical variations registered by IT WAY:

Near a new HIGH record (1 year)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1st january)

Type : Bullish

Timeframe : Weekly

Near a new HIGH record (1 month)

Type : Bullish

Timeframe : Weekly

The Central Volumes scanner detects abnormal volumes on the asset:

Abnormal volumes

Timeframe : 5 days

Abnormal volumes

Timeframe : 20 days

Abnormal volumes

Timeframe : 50 days

Technical

Technical analysis of this Daily chart of IT WAY indicates that the overall trend is strongly bullish. 92.86% of the signals given by moving averages are bullish. This strongly bullish trend is supported by the strong bullish signals given by short-term moving averages. There is no crossing of moving average by the price or crossing of moving averages between themselves.

An assessment of technical indicators shows a strong bullish signal.

Caution: the Central Indicators scanner currently detects an excess:

CCI indicator is overbought : over 100

Type : Neutral

Timeframe : Daily

Williams %R indicator is overbought : over -20

Type : Neutral

Timeframe : Daily

Pivot points : price is over resistance 1

Type : Neutral

Timeframe : Daily

The Central Patterns scanner, which studies chart patterns, resistances and supports, has identified these signals:

Near resistance of channel

Type : Bearish

Timeframe : Daily

Near horizontal support

Type : Bullish

Timeframe : Daily

Central Candlesticks, the scanner specialised in Japanese candlesticks, detects this inversion signal that could impact the current short-term trend:

Doji

Type : Neutral

Timeframe : Daily

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 1.718 | 1.912 | 2.150 | 2.280 | 2.500 | 2.840 | 3.190 |

| Change (%) | -24.65% | -16.14% | -5.70% | - | +9.65% | +24.56% | +39.91% |

| Change | -0.562 | -0.368 | -0.130 | - | +0.220 | +0.560 | +0.910 |

| Level | Minor | Major | Intermediate | - | Minor | Minor | Major |

To determine price objectives, it is also possible to use the pivot points. Here is the price position in relation to pivot points:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.910 | 1.990 | 2.065 | 2.145 | 2.220 | 2.300 | 2.375 |

| Camarilla | 2.097 | 2.112 | 2.126 | 2.140 | 2.154 | 2.168 | 2.183 |

| Woodie | 1.908 | 1.989 | 2.063 | 2.144 | 2.218 | 2.299 | 2.373 |

| Fibonacci | 1.990 | 2.049 | 2.086 | 2.145 | 2.204 | 2.241 | 2.300 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.487 | 1.633 | 1.857 | 2.003 | 2.227 | 2.373 | 2.597 |

| Camarilla | 1.978 | 2.012 | 2.046 | 2.080 | 2.114 | 2.148 | 2.182 |

| Woodie | 1.525 | 1.653 | 1.895 | 2.023 | 2.265 | 2.393 | 2.635 |

| Fibonacci | 1.633 | 1.775 | 1.862 | 2.003 | 2.145 | 2.232 | 2.373 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 1.241 | 1.405 | 1.537 | 1.701 | 1.833 | 1.997 | 2.129 |

| Camarilla | 1.587 | 1.614 | 1.641 | 1.668 | 1.695 | 1.722 | 1.749 |

| Woodie | 1.224 | 1.397 | 1.520 | 1.693 | 1.816 | 1.989 | 2.112 |

| Fibonacci | 1.405 | 1.518 | 1.588 | 1.701 | 1.814 | 1.884 | 1.997 |

Numerical data

The following are the details of the technical indicators and moving averages that were collected to generate this technical analysis:

| RSI (14): | 69.93 | |

| MACD (12,26,9): | 0.1170 | |

| Directional Movement: | 24.980 | |

| AROON (14): | 78.571 | |

| DEMA (21): | 2.112 | |

| Parabolic SAR (0,02-0,02-0,2): | 1.974 | |

| Elder Ray (13): | 0.184 | |

| Super Trend (3,10): | 1.837 | |

| Zig ZAG (10): | 2.280 | |

| VORTEX (21): | 1.1940 | |

| Stochastique (14,3,5): | 83.16 | |

| TEMA (21): | 2.182 | |

| Williams %R (14): | -3.39 | |

| Chande Momentum Oscillator (20): | 0.440 | |

| Repulse (5,40,3): | 7.1070 | |

| ROCnROLL: | 1 | |

| TRIX (15,9): | 0.6590 | |

| Courbe Coppock: | 37.83 |

| MA7: | 2.115 | |

| MA20: | 1.927 | |

| MA50: | 1.816 | |

| MA100: | 1.613 | |

| MAexp7: | 2.122 | |

| MAexp20: | 1.973 | |

| MAexp50: | 1.826 | |

| MAexp100: | 1.704 | |

| Price / MA7: | +7.80% | |

| Price / MA20: | +18.32% | |

| Price / MA50: | +25.55% | |

| Price / MA100: | +41.35% | |

| Price / MAexp7: | +7.45% | |

| Price / MAexp20: | +15.56% | |

| Price / MAexp50: | +24.86% | |

| Price / MAexp100: | +33.80% |

News

The last news published on IT WAY at the time of the generation of this analysis was as follows:

- Cognosec AB (Publ): Cognosec completes acquisition of ITWAY's Cyber Security Value Added Distributor interests in Turkey and Greece

- Cognosec AB (Publ): Cognosec enters into an exclusive agreement to acquire ITWAY's Cyber Security Value Added Distributor interests in Turkey and Greece for €10 million

-

Fake News Finds It Way In A Story About Lebron James

Fake News Finds It Way In A Story About Lebron James

-

IT Way

IT Way

-

IT Way

IT Way

Add a comment

Comments

0 comments on the analysis IT WAY - Daily