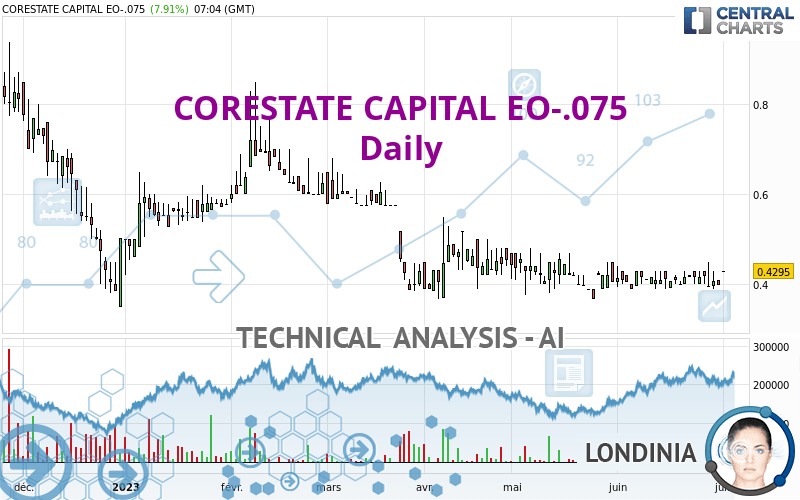

CORESTATE CAPITAL EO-.075 - Daily - Technical analysis published on 07/03/2023 (GMT)

- 93

- 0

- Timeframe : Daily

- - Analysis generated on

- Status : NEUTRAL

Summary of the analysis

Additional analysis

Quotes

CORESTATE CAPITAL EO-.075 rating 0.4295 EUR. The price has increased by +7.92% since the last closing and was traded between 0.4295 EUR and 0.4295 EUR over the period. The price is currently at 0% from its lowest and 0% from its highest.The Central Gaps scanner detects the formation of a bullish gap marking the strong presence of buyers against sellers at the opening. This formed a quotation gap.

Opening Gap UP

Type : Bullish

Timeframe : Openning

Here is a more detailed summary of the historical variations registered by CORESTATE CAPITAL EO-.075:

Near a new LOW record (1 month)

Type : Bearish

Timeframe : Weekly

Technical

Technical analysis of this Daily chart of CORESTATE CAPITAL EO-.075 indicates that the overall trend is slightly bearish. 57.14% of the signals given by moving averages are bearish. Caution: the slightly bullish signals currently being given by short-term moving averages indicate that this overall trend could be reversed. The Central Indicators market scanner is currently detecting several bullish signals that could impact this trend:

Bullish price crossover with Moving Average 20

Type : Bullish

Timeframe : Daily

Bullish price crossover with Moving Average 50

Type : Bullish

Timeframe : Daily

In fact, according to the parameters integrated into the Central Analyzer system, 11 technical indicators out of 18 analysed are currently bullish. Caution: the Central Indicators scanner currently detects an excess:

CCI indicator is overbought : over 100

Type : Neutral

Timeframe : Daily

MACD indicator: bullish divergence

Type : Bullish

Timeframe : Daily

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : Daily

Pivot points : price is under support 1

Type : Neutral

Timeframe : Weekly

RSI indicator is back over 50

Type : Bullish

Timeframe : Daily

Momentum indicator is back over 0

Type : Bullish

Timeframe : Daily

Williams %R indicator is back over -50

Type : Bullish

Timeframe : Daily

Central Patterns, the scanner specializing in chart patterns, did not identify any signals.

The Central Candlesticks scanner currently notes the presence of this pattern in Japanese candlesticks that could mark the end of the short-term trend currently underway:

Doji

Type : Neutral

Timeframe : Daily

| S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|

| ProTrendLines | 0.3055 | 0.3929 | 0.4295 | 0.5940 | 0.7200 | 0.8988 |

| Change (%) | -28.87% | -8.52% | - | +38.30% | +67.64% | +109.27% |

| Change | -0.1240 | -0.0366 | - | +0.1645 | +0.2905 | +0.4693 |

| Level | Minor | Major | - | Minor | Intermediate | Minor |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.3820 | 0.3900 | 0.3940 | 0.4020 | 0.4060 | 0.4140 | 0.4180 |

| Camarilla | 0.3947 | 0.3958 | 0.3969 | 0.3980 | 0.3991 | 0.4002 | 0.4013 |

| Woodie | 0.3800 | 0.3890 | 0.3920 | 0.4010 | 0.4040 | 0.4130 | 0.4160 |

| Fibonacci | 0.3900 | 0.3946 | 0.3974 | 0.4020 | 0.4066 | 0.4094 | 0.4140 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.3153 | 0.3527 | 0.3753 | 0.4127 | 0.4353 | 0.4727 | 0.4953 |

| Camarilla | 0.3815 | 0.3870 | 0.3925 | 0.3980 | 0.4035 | 0.4090 | 0.4145 |

| Woodie | 0.3080 | 0.3490 | 0.3680 | 0.4090 | 0.4280 | 0.4690 | 0.4880 |

| Fibonacci | 0.3527 | 0.3756 | 0.3898 | 0.4127 | 0.4356 | 0.4498 | 0.4727 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 0.3153 | 0.3527 | 0.3753 | 0.4127 | 0.4353 | 0.4727 | 0.4953 |

| Camarilla | 0.3815 | 0.3870 | 0.3925 | 0.3980 | 0.4035 | 0.4090 | 0.4145 |

| Woodie | 0.3080 | 0.3490 | 0.3680 | 0.4090 | 0.4280 | 0.4690 | 0.4880 |

| Fibonacci | 0.3527 | 0.3756 | 0.3898 | 0.4127 | 0.4356 | 0.4498 | 0.4727 |

Numerical data

The following are the details of the technical indicators and moving averages that were collected to generate this technical analysis:

| RSI (14): | 55.21 | |

| MACD (12,26,9): | -0.0023 | |

| Directional Movement: | 10.9493 | |

| AROON (14): | 78.5714 | |

| DEMA (21): | 0.4078 | |

| Parabolic SAR (0,02-0,02-0,2): | 0.3772 | |

| Elder Ray (13): | 0.0180 | |

| Super Trend (3,10): | 0.4872 | |

| Zig ZAG (10): | 0.4295 | |

| VORTEX (21): | 0.9757 | |

| Stochastique (14,3,5): | 36.39 | |

| TEMA (21): | 0.4139 | |

| Williams %R (14): | -34.17 | |

| Chande Momentum Oscillator (20): | 0.0190 | |

| Repulse (5,40,3): | -4.4903 | |

| ROCnROLL: | -1 | |

| TRIX (15,9): | -0.1217 | |

| Courbe Coppock: | 0.24 |

| MA7: | 0.4116 | |

| MA20: | 0.4110 | |

| MA50: | 0.4201 | |

| MA100: | 0.4866 | |

| MAexp7: | 0.4123 | |

| MAexp20: | 0.4122 | |

| MAexp50: | 0.4295 | |

| MAexp100: | 0.4924 | |

| Price / MA7: | +4.35% | |

| Price / MA20: | +4.50% | |

| Price / MA50: | +2.24% | |

| Price / MA100: | -11.73% | |

| Price / MAexp7: | +4.17% | |

| Price / MAexp20: | +4.20% | |

| Price / MAexp50: | -0% | |

| Price / MAexp100: | -12.77% |

News

The latest news and videos published on CORESTATE CAPITAL EO-.075 at the time of the analysis were as follows:

- HANNOVER LEASING Group sets strategic course and strengthens core business with institutional clients

- EQS-News: Corestate Capital Holding S.A.: CONVENING NOTICE TO THE RECONVENED EXTRAORDINARY GENERAL MEETING OF THE SHAREHOLDERS

- EQS-News: Corestate Capital Holding S.A.: Noteholders' meetings approve bond restructuring with large majority – important milestone for debt reduction reached

- EQS-News: Corestate Capital Holding S.A.: Invitation to acquire New Super Senior Notes and New Shares by professional investors and qualified investors by submitting an offer until 30 June 2023

- EQS-News: Corestate Capital Holding S.A.: CONVENING NOTICE TO THE EXTRAORDINARY GENERAL MEETING OF THE SHAREHOLDERS

Add a comment

Comments

0 comments on the analysis CORESTATE CAPITAL EO-.075 - Daily