AUD/USD - AUD/USD Tested the 0.7500 Key Level - 12/06/2016 (GMT)

- Who voted?

- 421

- 0

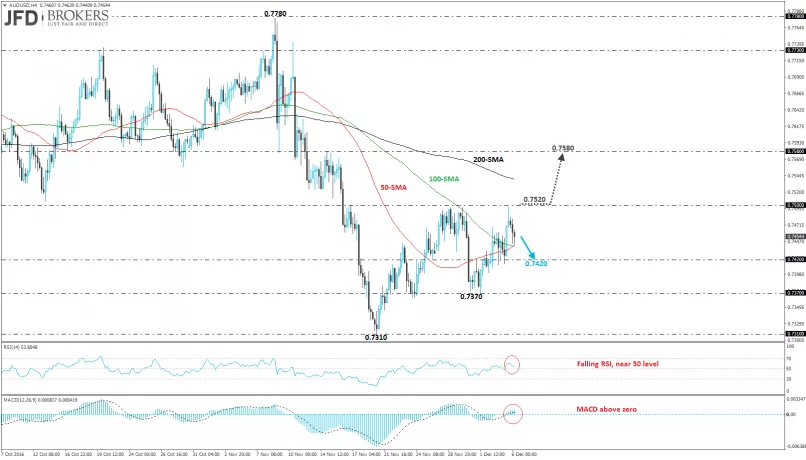

- Timeframe : 4H

AUD/USD Chart

RBA Left Rates Unchanged; AUD/USD falls

Reserve Bank of Australia left its key interest rate unchanged at the record low of 1.50% today, as policymakers expect higher commodity prices to stimulate the national income. However, this dropped slightly the domestic currency versus the U.S. dollar, almost 0.40%. The central bank had reduced the cash rate by 25bp each time in August and May. Australia’s central bank expects a slowing growth due to the end of this year before it picks up again in the second half of the next year. The Australian Bureau of Statistics will release Australia’s third quarter GDP tomorrow and is forecasted to slow down to 0.2% from 0.5%.

AUD/USD - Technical Outlook

The AUD/USD pair rose 0.4% over yesterday’s session and the Reserve Bank of Australia’s monetary policy meeting did not push the market for further gains. The pair challenged the 0.7500 key level and edged lower after the rebound on the latter level. Further down, the price met the bullish crossover of the 50-SMA to 100-SMA on the 4-hour chart and it was an obstacle for the price to slip below it. Currently, the commodity currency is developing near the 0.7460 level and the next initial target is the 0.7420 support level to the downside. If there is a penetration of the 0.7500 psychological barrier to the upside, then the price will expose to 0.7580. The RSI indicator is approaching the 50 level whilst the MACD oscillator lies above its mid-level.

Reserve Bank of Australia left its key interest rate unchanged at the record low of 1.50% today, as policymakers expect higher commodity prices to stimulate the national income. However, this dropped slightly the domestic currency versus the U.S. dollar, almost 0.40%. The central bank had reduced the cash rate by 25bp each time in August and May. Australia’s central bank expects a slowing growth due to the end of this year before it picks up again in the second half of the next year. The Australian Bureau of Statistics will release Australia’s third quarter GDP tomorrow and is forecasted to slow down to 0.2% from 0.5%.

AUD/USD - Technical Outlook

The AUD/USD pair rose 0.4% over yesterday’s session and the Reserve Bank of Australia’s monetary policy meeting did not push the market for further gains. The pair challenged the 0.7500 key level and edged lower after the rebound on the latter level. Further down, the price met the bullish crossover of the 50-SMA to 100-SMA on the 4-hour chart and it was an obstacle for the price to slip below it. Currently, the commodity currency is developing near the 0.7460 level and the next initial target is the 0.7420 support level to the downside. If there is a penetration of the 0.7500 psychological barrier to the upside, then the price will expose to 0.7580. The RSI indicator is approaching the 50 level whilst the MACD oscillator lies above its mid-level.

This member did not declare if he had a position on this financial instrument or a related financial instrument.

Add a comment

Comments

0 comments on the analysis AUD/USD - 4H