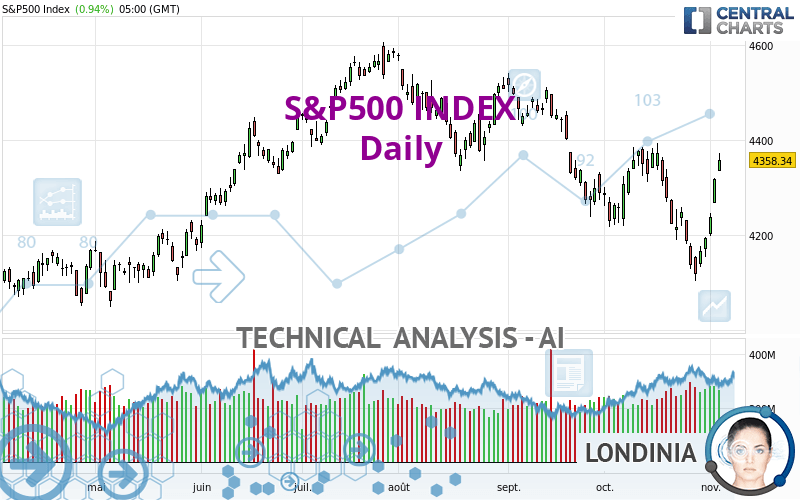

S&P500 INDEX - Daily - Technical analysis published on 11/05/2023 (GMT)

- 167

- 0

Click here for a new analysis!

- Timeframe : Daily

- - Analysis generated on

- Status : TARGET REACHED

Summary of the analysis

Additional analysis

Quotes

The S&P500 INDEX price is 4,358.34 USD. The price has increased by +0.94% since the last closing and was between 4,334.23 USD and 4,373.62 USD. This implies that the price is at +0.56% from its lowest and at -0.35% from its highest.The Central Gaps scanner detects the formation of a bullish gap marking the strong presence of buyers against sellers at the opening. This formed a quotation gap.

Opening Gap UP

Type : Bullish

Timeframe : Openning

So that you have an overall view of the price change, here is a table showing the variations over several periods:

Near a new LOW record (1 month)

Type : Bearish

Timeframe : Weekly

Technical

A technical analysis in Daily of this S&P500 INDEX chart shows a slightly bearish trend. 53.57% of the signals given by moving averages are bearish. Caution: the strong bullish signals currently being given by short-term moving averages indicate that this slightly bearish trend could quickly be reversed. The Central Indicators market scanner is currently detecting several bullish signals that could impact this trend:

Bullish price crossover with Moving Average 20

Type : Bullish

Timeframe : Daily

Bullish price crossover with adaptative moving average 20

Type : Bullish

Timeframe : Daily

In fact, Central Analyzer took into account 18 technical indicators and the result was as follows: 9 are bullish, 5 are neutral and 4 are bearish. Central Indicators, the detector scanner for these technical indicators has recently detected several signals:

Pivot points : price is over resistance 2

Type : Neutral

Timeframe : Weekly

Pivot points : price is over resistance 3

Type : Neutral

Timeframe : Daily

RSI indicator is back over 50

Type : Bullish

Timeframe : Daily

MACD crosses UP its Moving Average

Type : Bullish

Timeframe : Daily

Parabolic SAR indicator bullish reversal

Type : Bullish

Timeframe : Daily

SuperTrend indicator bullish reversal

Type : Bullish

Timeframe : Daily

Williams %R indicator is back over -50

Type : Bullish

Timeframe : Daily

The analysis of the price chart with Central Patterns scanners does not return any result.

Central Candlesticks, the scanner specialised in Japanese candlesticks, detects a bullish signal that could support the hypothesis of a small rebound in the very short term:

Upside gap

Type : Bullish

Timeframe : Daily

| S3 | S2 | S1 | Price | R1 | R2 | R3 | |

|---|---|---|---|---|---|---|---|

| ProTrendLines | 4,052.20 | 4,229.45 | 4,305.20 | 4,358.34 | 4,374.67 | 4,516.30 | 4,588.96 |

| Change (%) | -7.02% | -2.96% | -1.22% | - | +0.37% | +3.62% | +5.29% |

| Change | -306.14 | -128.89 | -53.14 | - | +16.33 | +157.96 | +230.62 |

| Level | Intermediate | Major | Intermediate | - | Major | Minor | Intermediate |

Attention could also be paid to pivot points to set price objectives:

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 4,297.78 | 4,316.01 | 4,337.17 | 4,355.40 | 4,376.56 | 4,394.79 | 4,415.95 |

| Camarilla | 4,347.51 | 4,351.12 | 4,354.73 | 4,358.34 | 4,361.95 | 4,365.56 | 4,369.17 |

| Woodie | 4,299.26 | 4,316.74 | 4,338.65 | 4,356.13 | 4,378.04 | 4,395.52 | 4,417.43 |

| Fibonacci | 4,316.01 | 4,331.05 | 4,340.35 | 4,355.40 | 4,370.44 | 4,379.74 | 4,394.79 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 3,962.30 | 4,047.62 | 4,202.98 | 4,288.30 | 4,443.66 | 4,528.98 | 4,684.34 |

| Camarilla | 4,292.15 | 4,314.22 | 4,336.28 | 4,358.34 | 4,380.40 | 4,402.47 | 4,424.53 |

| Woodie | 3,997.32 | 4,065.13 | 4,238.00 | 4,305.81 | 4,478.68 | 4,546.49 | 4,719.36 |

| Fibonacci | 4,047.62 | 4,139.56 | 4,196.36 | 4,288.30 | 4,380.24 | 4,437.04 | 4,528.98 |

| Pivot points | S3 | S2 | S1 | PP | R1 | R2 | R3 |

|---|---|---|---|---|---|---|---|

| Standard | 3,777.41 | 3,940.59 | 4,067.20 | 4,230.38 | 4,356.99 | 4,520.17 | 4,646.78 |

| Camarilla | 4,114.11 | 4,140.67 | 4,167.24 | 4,193.80 | 4,220.36 | 4,246.93 | 4,273.49 |

| Woodie | 3,759.12 | 3,931.45 | 4,048.91 | 4,221.24 | 4,338.70 | 4,511.03 | 4,628.49 |

| Fibonacci | 3,940.59 | 4,051.29 | 4,119.68 | 4,230.38 | 4,341.08 | 4,409.47 | 4,520.17 |

Numerical data

The following is the status of the technical indicators and moving averages at the time of publication of this technical analysis:

| RSI (14): | 54.51 | |

| MACD (12,26,9): | -36.6000 | |

| Directional Movement: | -0.09 | |

| AROON (14): | -57.14 | |

| DEMA (21): | 4,205.53 | |

| Parabolic SAR (0,02-0,02-0,2): | 4,103.78 | |

| Elder Ray (13): | 55.87 | |

| Super Trend (3,10): | 4,119.43 | |

| Zig ZAG (10): | 4,317.78 | |

| VORTEX (21): | 0.9600 | |

| Stochastique (14,3,5): | 50.39 | |

| TEMA (21): | 4,201.62 | |

| Williams %R (14): | -26.15 | |

| Chande Momentum Oscillator (20): | -55.42 | |

| Repulse (5,40,3): | 2.3700 | |

| ROCnROLL: | -1 | |

| TRIX (15,9): | -0.1400 | |

| Courbe Coppock: | 5.85 |

| MA7: | 4,193.95 | |

| MA20: | 4,272.13 | |

| MA50: | 4,348.00 | |

| MA100: | 4,403.38 | |

| MAexp7: | 4,230.86 | |

| MAexp20: | 4,256.61 | |

| MAexp50: | 4,316.87 | |

| MAexp100: | 4,324.95 | |

| Price / MA7: | +3.92% | |

| Price / MA20: | +2.02% | |

| Price / MA50: | +0.24% | |

| Price / MA100: | -1.02% | |

| Price / MAexp7: | +3.01% | |

| Price / MAexp20: | +2.39% | |

| Price / MAexp50: | +0.96% | |

| Price / MAexp100: | +0.77% |

News

The last news published on S&P500 INDEX at the time of the generation of this analysis was as follows:

-

SP 500 Forecast August 7, 2023

SP 500 Forecast August 7, 2023

-

Weekly Technical Analysis: 12/06/2023 - US 500, EURUSD, USDJPY

Weekly Technical Analysis: 12/06/2023 - US 500, EURUSD, USDJPY

-

XTB Market update on US500 - 21/03/2023

XTB Market update on US500 - 21/03/2023

-

DXY, SP500 Slide as US Data Comes in Mixed | All Eyes on US Inflation Next Week

DXY, SP500 Slide as US Data Comes in Mixed | All Eyes on US Inflation Next Week

-

SP 500 and Risk Assets Consolidate as Technicals and Fundamentals Appear at Odds with Each Other

SP 500 and Risk Assets Consolidate as Technicals and Fundamentals Appear at Odds with Each Other

Add a comment

Comments

0 comments on the analysis S&P500 INDEX - Daily