How to trade gap?

- 2348

- 0

- 0

Definition of a gap

A gap is a bullish or bearish spread between the closing price of one candlestick and the opening price of the next candlestick. A gap is due to a large number of orders going in the same direction between the two candlesticks. There are two types of gap:

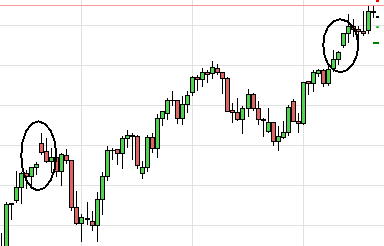

- An upward gap (bullish gap) occurs when the opening price of a candlestick is higher than the closing price of the previous candlestick. For example, there are two bullish gaps on the chart below:

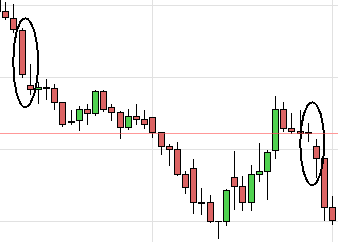

- A downward gap (bearish gap) occurs when the opening price of a candlestick is lower than the closing price of the previous candlestick. For example, there are two bearish gaps on the chart below:

Most gaps are related to market closures.

On Forex, these gaps mostly occur only on Sunday evenings when the market opens. In fact, on the other days of the week, Forex is open continuously. In reality, Forex remains open 7 days a week but it is the brokers who block access to this market to individuals over the weekend. Gaps are thus visible only by individuals, institutional investors see continuous quotations.

On the stock exchange, the gaps are more regular since the European, American or Asian stock exchanges have fixed opening hours. Gaps therefore often appear at the opening of the next day. These gaps are caused by orders accumulated when openings and closings are fixed.

We can therefore say that the majority of gaps are opening gaps, although it is possible to see them during the day, most of the time when important economic news is published. Indeed, only economic news can cause such price differences over a short period of time.

The rest of the time, the opening price of the candlestick will be the same as the closing price of the previous candlestick.

Strategies for gap trading

There are several strategies:

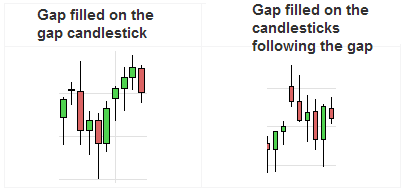

- Trade on the correction: Most of the time, the gaps are filled, that is to say that after the gap, the price returns towards the closing price of the candlestick which preceded the gap. The gap can be filled on the candlestick on which the gap acts, but also on the following candlesticks. It should be noted that the majority of the gaps are filled. The difficulty lies in placing the protective stops. Two scenarios can occur if the gap is filled:

Although the gaps are mostly filled, it is difficult to gap trade. Effectively, the gap could be filled after one or several candlesticks or quite simply never be filled. I therefore would not advise entering in the opposite direction to the gap or in the very short term.

- Wait for the gap to be filled: Another technique consists in waiting for the correction to be made (gap filled), then to enter in the gap’s direction when the last highest (inversely, lowest) of the gap’s opening candlestick has been passed, depending on the time unit used. The most aggressive can open a position at the beginning of a rebound/correction, once the gap is filled. The larger the gap, the greater the probability that the movement will continue in the direction of the gap after the gap is filled. The problem still being placing the protective stops, which can prove delicate. We are then often forced to put stops somewhat far apart. However, the closing price of the candlestick preceding the gap candlestick is often a good support when there is a relapse, and conversely, it is a big resistance when there is a price rebound.

Study of gaps

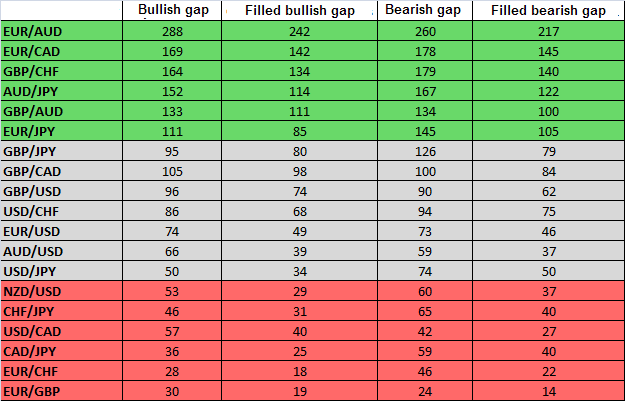

Here is a study carried out on the gaps between 2000 and 2010 in daily Forex. It shows the number of bullish and bearish gaps that were filled over the period. The study was conducted on gaps greater than 20 pips for more relevance. The results are as follows:

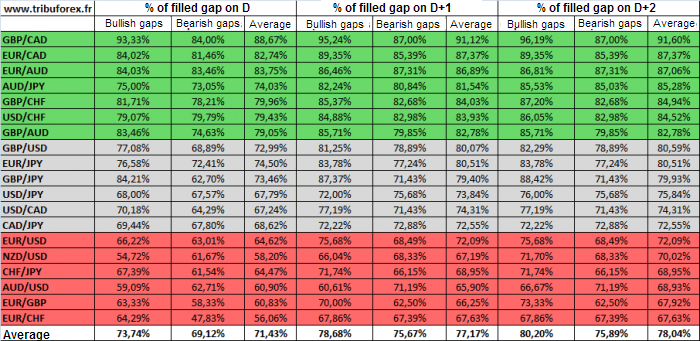

Next, here is the percentage of gaps filled on D (i.e. the day the gap occurred), on D+1 and D+2 on each forex pair:

The results are impressive. Around 80% of the gaps are filled on Forex on D+2. It is obviously the most volatile pairs that have the highest percentage. This statistic reflects the importance of closing the gap before the movement continues. The moment when the gap is filled is also a good opportunity to go in the direction of the gap (for those who would like to gap trade). Note that the percentage difference between D+1 and D+2 is minimal.

Also note that bullish gaps are filled more often than bearish gaps. It's probably psychology that comes into play. On the stock market, investors often believe that downward movements are more powerful than upward movements (which is not the case). When a bearish gap occurs, investors believe more in the continuation of the movement than in the immediate filling of the gap.

About author

- 5

- 1

- 0

- 4