Japanese candlesticks - Irikubi

- 2558

- 0

- 0

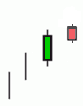

In neck pattern - bullish irikubi

Definition: A bullish irikubi (line in the neck) structure is comprised of two Japanese candlesticks. The first is a large bullish candlestick (green) followed by a small bearish candlestick (red) with a closing just below the closing level of the previous candlestick. The second candlestick must be significantly smaller than the first.

Illustration:

Characteristic: A bullish irikubi often forms after a significant increase characterized by several large green Japanese candlesticks.

Significance: The in neck pattern (bullish Irikubi) is a continuation pattern, it indicates a continuation of the bullish movement. The small red candlestick indicates a hedge on long positions.

Note: For the structure to be validated, the next candlestick must be bullish and close above the opening price of the small bearish candlestick (red).

Invalidation: If the lowest point of the small bearish candlestick surmounts the next candlestick, the structure can be considered invalidated.

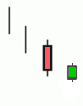

In neck pattern - bearish irikubi

Definition: A bearish irikubi (line in the neck) structure is comprised of two Japanese candlesticks. The first is a large bearish candlestick (red) followed by a small bullish candlestick (green) with a closing just above the closing level of the previous candlestick. The second candlestick must be significantly smaller than the first.

Illustration:

Characteristic: A bearish Irikubi often forms after a significant decline characterized by several large red Japanese candlesticks.

Significance: The in neck pattern (bearish Irikubi) is a continuation pattern, it indicates a continuation of the bearish movement. The small green candlestick indicates a hedge on short positions.

Note: For the structure to be validated, the next candlestick must be bearish and close below the opening price of the small bullish candlestick (green).

Invalidation: If the highest point on the small bullish candlestick surmounts the next candlestick, the structure can be considered invalidated.

About author

- 26

- 42

- 66

- 6