Japanese candlesticks - Harami

- 2126

- 0

- 0

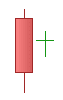

Bullish Harami

Definition: A bullish Harami structure is comprised of two Japanese candlesticks. There is a long bearish candlestick (red) followed by a small bullish candlestick (green) with a range contained within the first candlestick. This is a kind of reverse bearish engulfing.

Illustration:

Characteristic: A bullish Harami structure often forms after a significant drop characterized by several large red Japanese candlesticks.

Significance: A bullish Harami is a reversal pattern, it indicates a bullish trend reversal. This reflects a loss in the momentum and strength of movement.

Note: The larger the body of the second candlestick, the more likely there is to be a lateralisation phase in the price. This may be the case in a resistance zone. On the other hand, the smaller the body of the second candlestick, the stronger the reversal structure is. The ideal trend reversal structure is a

bullish Harami cross:

Invalidation: If the wicks of the second candlestick exceed the range of the first candlestick, the bullish Harami structure is invalidated.

Variant of the bullish Harami: If the second candlestick is also bearish, we call this structure a homing pigeon:

Bearish Harami

Definition: A bearish Harami structure is comprised of two Japanese candlesticks. There is a long bullish candlestick (green) followed by a small bearish candlestick (red) with a range contained within the first candlestick. This is a kind of inversed bullish engulfing.

Illustration:

Characteristic: A bearish Harami structure often forms after a significant increase characterized by several large green Japanese candlesticks.

Significance: A bearish Harami is a reversal pattern, it indicates a reversal of the bearish trend. This reflects a loss in the momentum and strength of movement.

Note: The larger the body of the second candlestick, the more likely there is to be a lateralisation phase in the price. This may be the case in a support zone. On the other hand, the smaller the body of the second candlestick, the stronger the reversal structure is. The ideal trend reversal structure is a bearish Harami cross:

Invalidation: If the wick on the second candlestick exceeds the range of the first candlestick, the bearish Harami structure is invalidated.

About author

- 25

- 42

- 66

- 6