The Dow Theory trading method

- 2347

- 0

- 0

The classic Dow method requires opening a Long position (for purchase) at each break from the last highest, with a stop loss at the last lowest.

Conversely, the classic Dow method requires opening a Short position (for sale) at each break from the last lowest, with stop loss at the last highest.

When the trader is positioned (at the purchase for example), the Dow method continues to apply with the following highest/lowest. At each break from a last highest position, the trader will have to open a new Long position with a stop loss set below the last lowest. And the last open Long positions remain active and their stop losses are moved to the same level as the stop loss of the last open Long position.

The Dow method always makes it possible to enter in the direction of the ongoing movement.

On the other hand, the Dow method does not allow for opening Longs at the lowest, or Shorts at the highest. So the trader never gets an opening at the "best price". But isn't getting the best entry price on a trade just luck?

The Dow method (so well respected) makes it impossible to make the known, recognized and practised mistake (although traders forbid it) of lower averages. Indeed, the entry price and stop loss of each position is determined in advance; this also offers the trader the advantage of being able to calculate the amount of his positions based on his money management and his risk management.

Like most trading methods, the Dow method does not tolerate volatility well. Nothing is more annoying for a trader to open a Long on the last highest break, hoping to see his stop loss reached on a low wick, to see the price shoot up in the end. Not to mention that when the stop loss on the Long position is executed, the Short stop entry loss is activated. The trader thus suffers a losing double trade before seeing a Long disappear in latent capital gains at the end of the day.

It is only possible to apply the Dow method in one direction (buy or sell), but in theory the Dow method implies that the trader will always be positioned on income.

Technically, the trader must therefore use stop losses and stop entry orders to ensure that he is always in position.

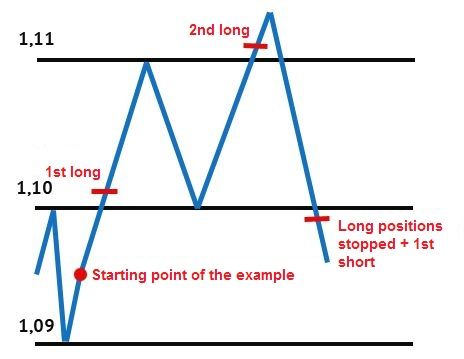

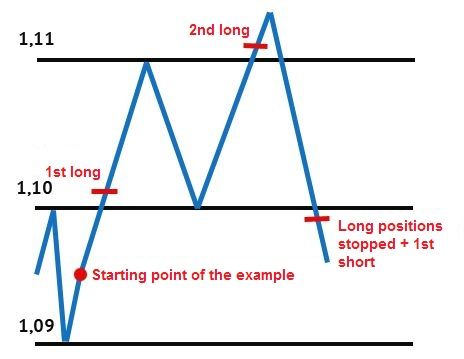

An example to better understand:

Starting from zero, the trader is flat (with no position). He will therefore start by determining which are the last highest/lowest.

The last lowest is 1.09. The last highest is 1.10.

The trader will therefore set two stop entry orders (with a stop loss attached):

One Long stop entry at 1.10XX with stop loss at 1.08XX

One Short stop entry at 1.08XX with stop loss at 1.10XX

NB : 1.10XX indicates a price just above 1.10 as you have to wait for a 1.10 bullish break to enter Long. 1.08XX indicates a price just below 1.09 because you have to wait for a bearish break of 1.09 to enter Short.

NB 2: for the rest of the example, set XX to 10 pips

The trader has his stop entry orders fixed and is waiting.

The Long stop entry is hit at 1.1010. The trader is therefore positioned to buy at 1.1010. The stop loss from this position is at 1.0890. As there have been no new highest or lowest prices formed, the other Short stop entry remains pending.

The price has now formed a last highest at 1.11 and a last lowest at 1.10.

The trader has 3 operations to perform:

- Position a new Long stop entry at 1.1110 (which will open a second Long), with a stop loss at 1.0990 (just below the last new lowest 1.10).

- Move the stop loss of the first Long to 1.0990.

- Move the short stop entry to 1.0990 (initially set to 1.0890), and change its stop loss to 1.1110 (so that it is above the new last higher in case of execution)

Long stop entry is hit at 1.1110. The trader now has 2 Longs at 1.1010 and 1.1110. The stop loss of these Long positions is identical and now stands at 1.0990. As there have been no new highest or lowest prices formed, the other Short stop entry remains pending at 1.0990.

The price drops sharply. Sob! It reaches 1.0990. Both Long positions are stopped, and the Short stop entry is executed.

The trader is now positioned Short (for sale) at 1.0990. The stop loss for this position is set at 1.1110.

The result of the two Long ones: 20 pips loss on the first Long; 120 pips loss on the second Long.

NB: this example is not biased towards the "seller" for the method. But it doesn't matter. Here's what it looked like:

Let's continue with this example, because it's often where Dow method traders stop.

When the trade is "returned", modifying the stop loss of the Short at the "true" last highest position (which, in the end, is located higher than 1.1110) should not be overlooked, nor should positioning a Long stop entry at this same level (having a stop loss below the last expected lowest).

And yes! Because if the price were to bounce back up to 1.1130 (for example) the Shorts would be cut and the trader would become flat again (with no position); and this is not in line with the method.

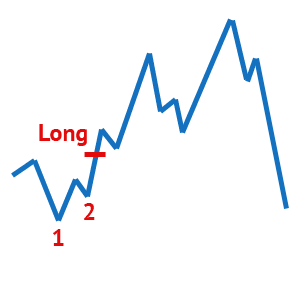

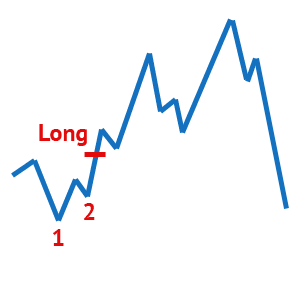

The main difficulty of the Dow method is to determine the last highest/lowest well. Based on this example, should point 1 or point 2 be taken into account?

Originally, all traders who use the Dow method will use point 1 as the main lowest.

But after opening the "Long", wouldn't the trader be tempted to use point 2 as the lowest? - so as to stick a little more to the price, and have a stop loss closer to his entry price?

In my opinion, strictly speakingthere is no "rule". That is to say, it is also quite possible to take into account only the last real highest/lowest, or to use the last intermediate highest/lowest. The key is not to change the "type" used as things progress.

A trader who only uses the "real" last highest/lowest (which are well marked) will finally apply a Dow method that can be described as quite "soft". On the other hand, a trader who uses all types of last highest/lowest uses an “aggressive” Dow method.

For the"soft" method, the trader lets the trade breathe, with well spread stop losses. In short: fewer trades, often showing higher profits, but also larger losses (when volatility or erratic movements appear).

For the so-called "aggressive" method, the trader sticks to the price, with stop losses very close to the entry price. In short: more trades, lower profits, and smaller losses.

In practice: it is (in my opinion) preferable to use the "real" last highest/lowest, and to let the trade breathe as much as possible

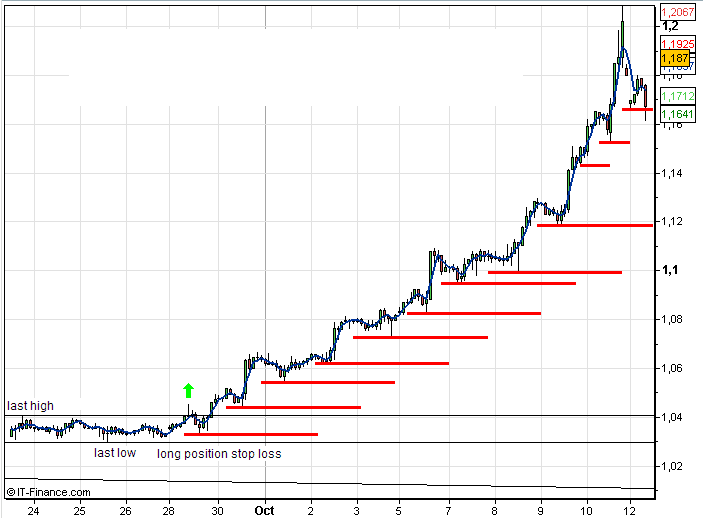

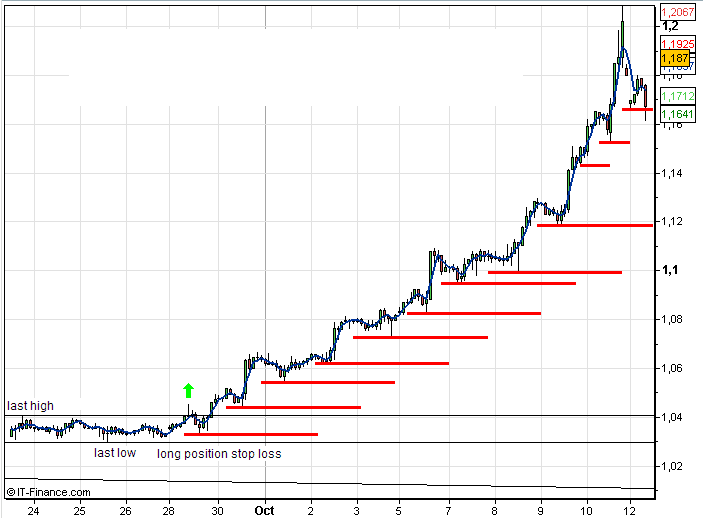

Here is a typical example of movement sought when applying the Dow method; A trend movement, without too marked a correction.

This example only serves to illustrate the type of movement sought; it does not take into account the Long’s accumulation which would have been triggered with each break of the last highest. I will let you imagine the total added value.

If you have understood everything about the Dow method, then you understand that there is an ERROR in this example.

An index: with the Dow method, the movement indicated for the last stop loss should not normally have been done. The Long’s stop loss should have been left at the previous lowest. The question is why?

And this error is the result of other errors.

Awaiting your answers.

Conversely, the classic Dow method requires opening a Short position (for sale) at each break from the last lowest, with stop loss at the last highest.

When the trader is positioned (at the purchase for example), the Dow method continues to apply with the following highest/lowest. At each break from a last highest position, the trader will have to open a new Long position with a stop loss set below the last lowest. And the last open Long positions remain active and their stop losses are moved to the same level as the stop loss of the last open Long position.

Advantages and disadvantages of the Dow method

The Dow method always makes it possible to enter in the direction of the ongoing movement.

On the other hand, the Dow method does not allow for opening Longs at the lowest, or Shorts at the highest. So the trader never gets an opening at the "best price". But isn't getting the best entry price on a trade just luck?

The Dow method (so well respected) makes it impossible to make the known, recognized and practised mistake (although traders forbid it) of lower averages. Indeed, the entry price and stop loss of each position is determined in advance; this also offers the trader the advantage of being able to calculate the amount of his positions based on his money management and his risk management.

Like most trading methods, the Dow method does not tolerate volatility well. Nothing is more annoying for a trader to open a Long on the last highest break, hoping to see his stop loss reached on a low wick, to see the price shoot up in the end. Not to mention that when the stop loss on the Long position is executed, the Short stop entry loss is activated. The trader thus suffers a losing double trade before seeing a Long disappear in latent capital gains at the end of the day.

From a Long trade to a Short trade with the Dow method

It is only possible to apply the Dow method in one direction (buy or sell), but in theory the Dow method implies that the trader will always be positioned on income.

Technically, the trader must therefore use stop losses and stop entry orders to ensure that he is always in position.

An example to better understand:

Starting from zero, the trader is flat (with no position). He will therefore start by determining which are the last highest/lowest.

The last lowest is 1.09. The last highest is 1.10.

The trader will therefore set two stop entry orders (with a stop loss attached):

One Long stop entry at 1.10XX with stop loss at 1.08XX

One Short stop entry at 1.08XX with stop loss at 1.10XX

NB : 1.10XX indicates a price just above 1.10 as you have to wait for a 1.10 bullish break to enter Long. 1.08XX indicates a price just below 1.09 because you have to wait for a bearish break of 1.09 to enter Short.

NB 2: for the rest of the example, set XX to 10 pips

The trader has his stop entry orders fixed and is waiting.

The Long stop entry is hit at 1.1010. The trader is therefore positioned to buy at 1.1010. The stop loss from this position is at 1.0890. As there have been no new highest or lowest prices formed, the other Short stop entry remains pending.

The price has now formed a last highest at 1.11 and a last lowest at 1.10.

The trader has 3 operations to perform:

- Position a new Long stop entry at 1.1110 (which will open a second Long), with a stop loss at 1.0990 (just below the last new lowest 1.10).

- Move the stop loss of the first Long to 1.0990.

- Move the short stop entry to 1.0990 (initially set to 1.0890), and change its stop loss to 1.1110 (so that it is above the new last higher in case of execution)

Long stop entry is hit at 1.1110. The trader now has 2 Longs at 1.1010 and 1.1110. The stop loss of these Long positions is identical and now stands at 1.0990. As there have been no new highest or lowest prices formed, the other Short stop entry remains pending at 1.0990.

The price drops sharply. Sob! It reaches 1.0990. Both Long positions are stopped, and the Short stop entry is executed.

The trader is now positioned Short (for sale) at 1.0990. The stop loss for this position is set at 1.1110.

The result of the two Long ones: 20 pips loss on the first Long; 120 pips loss on the second Long.

NB: this example is not biased towards the "seller" for the method. But it doesn't matter. Here's what it looked like:

Let's continue with this example, because it's often where Dow method traders stop.

When the trade is "returned", modifying the stop loss of the Short at the "true" last highest position (which, in the end, is located higher than 1.1110) should not be overlooked, nor should positioning a Long stop entry at this same level (having a stop loss below the last expected lowest).

And yes! Because if the price were to bounce back up to 1.1130 (for example) the Shorts would be cut and the trader would become flat again (with no position); and this is not in line with the method.

Determining a last highest / lowest

The main difficulty of the Dow method is to determine the last highest/lowest well. Based on this example, should point 1 or point 2 be taken into account?

Originally, all traders who use the Dow method will use point 1 as the main lowest.

But after opening the "Long", wouldn't the trader be tempted to use point 2 as the lowest? - so as to stick a little more to the price, and have a stop loss closer to his entry price?

In my opinion, strictly speakingthere is no "rule". That is to say, it is also quite possible to take into account only the last real highest/lowest, or to use the last intermediate highest/lowest. The key is not to change the "type" used as things progress.

A trader who only uses the "real" last highest/lowest (which are well marked) will finally apply a Dow method that can be described as quite "soft". On the other hand, a trader who uses all types of last highest/lowest uses an “aggressive” Dow method.

For the"soft" method, the trader lets the trade breathe, with well spread stop losses. In short: fewer trades, often showing higher profits, but also larger losses (when volatility or erratic movements appear).

For the so-called "aggressive" method, the trader sticks to the price, with stop losses very close to the entry price. In short: more trades, lower profits, and smaller losses.

In practice: it is (in my opinion) preferable to use the "real" last highest/lowest, and to let the trade breathe as much as possible

What are users of the Dow method looking for?

Here is a typical example of movement sought when applying the Dow method; A trend movement, without too marked a correction.

This example only serves to illustrate the type of movement sought; it does not take into account the Long’s accumulation which would have been triggered with each break of the last highest. I will let you imagine the total added value.

If you have understood everything about the Dow method, then you understand that there is an ERROR in this example.

An index: with the Dow method, the movement indicated for the last stop loss should not normally have been done. The Long’s stop loss should have been left at the previous lowest. The question is why?

And this error is the result of other errors.

Awaiting your answers.

About author

- 28

- 42

- 45

- 6