Trading strategy: PYRAMID TRADING

- 4329

- 0

- 0

What is Pyramid trading?

Pyramid trading is a trading strategy linking trades which exit at the end of a movement. It's a technique of maximizing your gains by strengthening your position as long as the market gives you cause to do so. Winnings are protected by moving the stop loss, incrementally, as the movement progresses. The Dow method, for example, is one of the pyramid trading techniques. The trader opens an additional position at each break of the last highest/lowest. The protection stop for all the open positions is moved to below the last lowest in a bullish trend and above the last highest in a bearish trend.

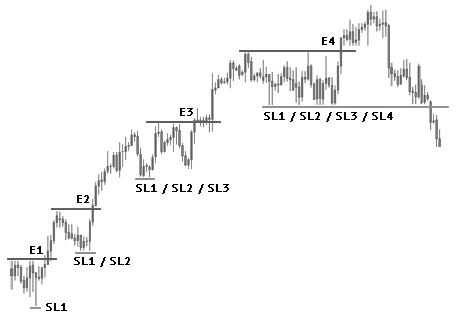

Here is an example of the use of a pyramid trading technique using the Dow method:

This chart shows that a total of 4 long positions are taken (E1 to E4). A new position is opened at each break from the highest and the stop loss for all the positions is moved to below the last lowest (SL1 to SL4). After purchasing E4, the stop losses for the 4 positions are executed at the same price. The last position loses but the 3 others win, each with different winnings.

Pyramid trading can be based on several methods. For example, a new position can be opened each time the prices touches a bullish or bearish slant. There are no rules. It is up to you to determine your bullish or bearish signals.

Using this technique, the benefits are exponentially amplified.

Disadvantages of pyramid trading

- Psychological management: traders do not like to lose and mostly seek to protect their gains. With pyramid trading, however, the opposite happens. The trader takes the risk of seeing his gains disappear more quickly if the market turns around. Fear of losing is one of the emotions most traders have.

- Reading performance: You must be able to differentiate the performance achieved with your usual trading strategy from that due to a pyramid trading technique, on your trading account. The positions taken with pyramid trading must therefore be different in size (in trade volume).

- Risk Management: Pyramid trading is based on an accumulation of positions. The size of your positions should not be too large. Risk has to be measured and controlled for all positions. It is therefore advisable to have smaller position sizes for each reinforcement.

- Risk/return ratio: For pyramid technique to be profitable, each new position must at least maintain the risk/return ratio offered by the position taken at the outset. Effectively, additional positions will often be based on bullish or bearish signals different from your basic strategy. If the risk/return ratio is lower, from a mathematical point of view, there is no point in practising pyramid trading. It becomes more beneficial to double the size of the position from the start.

Pyramid trading on losing trades

This consists in averaging down to lower the cost price. This type of strategy is to be avoided in trading without strict rules. On the one hand, this certainly means that you do not put a protective stop on your trades. Emotions will then come into play, you will not accept a loss and you will lose your objectivity. Your positions will be based on your starting (losing) position, not current market conditions. You will cling to the hope of seeing your cost price again, as quickly as possible. To increase your chances, you will make lower averages.

Downward pyramid trading can only be considered if you anticipate that you will be able to cover them before your first trade. In the size of your positions and the management of your risk, you will then take this element into account. As a result, your overall risk will not exceed a traditional trade without pyramid trading.

The two charts that follow summarize the steps taken by a trader who did not anticipate pyramid trading on a losing trade.

The closing of the trade(s) is done manually or automatically.

About author

- 25

- 42

- 66

- 6