Japanese candlesticks - Three methods

- 1728

- 0

- 0

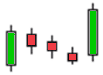

Bullish three methods

Definition: A bullish three methods structure is comprised up of five Japanese candlesticks.The first is a large bullish candlestick (green) followed by three small bearish candlesticks (red) which close in same range as the first candlestick.Each small candlestick must close lower than the previous one.Finally, the last candlestick must be a large bullish one and must close above the first candlestick’s highest point.

Illustration:

Characteristic: A bullish three methods structure often forms after a significant increase characterized by several large green Japanese candlesticks.

Significance: A bullish three methods structure is a continuation pattern, it indicates continuation of the bullish movement.This is a sign that buyers are maintaining the upper hand and simply gaining strength to continue the initial movement.

Note: The three small candlesticks can be of different colours.The important thing is that these three candlesticks remain in the initial range of the first one.

Invalidation: If one of the small candlesticks exceeds the upper boundary of the first candlestick’s range or if the last candlestick does not exceed this level, the bullish three methods pattern is invalidated.

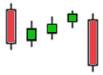

Bearish three methods

Definition: A bearish three methods structure is comprised up of five Japanese candlesticks.The first is a large bearish candlestick (red) followed by three small bullish candlesticks (green) which close in same range as the first candlestick.Each small candlestick must close higher than the previous one.Finally, the last candlestick must be a large bearish one and must close below the first candlestick’s lowest point.

Illustration:

Characteristic: A bearish three methods structure often forms after a significant drop characterized by several large red Japanese candlesticks.

Significance: A bearish three methods structure is a continuation pattern, it indicates continuation of the bearish movement.This is a sign that sellers are maintaining the upper hand and simply gaining strength to continue the initial movement.

Note: The three small candlesticks can be of different colours.The important thing is that these three candlesticks remain in the initial range of the first one.

Invalidation: If one of the small candlesticks exceeds the lower boundary of the first candlestick’s range or if the last candlestick does not exceed this level, the bearish three methods pattern is invalidated.

About author

- 26

- 42

- 66

- 6