Actual inflation and perceived inflation

-

- 0

- 3741

- 0

Definition of actual inflation and perceived inflation

Actual inflation is the rate of inflation measured by the consumer price index. Perceived inflation is the rate of inflation measured by a household opinion survey. The latter has no legitimacy from an economic point of view, it is a simple feeling. There is often a wide gap between actual and perceived inflation. Is the gap between the two real? How can this discrepancy be explained?

Calculation of actual inflation

To calculate the inflation rate, using the consumer price index, official statistical institute uses a basket of reference goods and services. It measures the price variation of more than 1,100 product families out of a total of 30,000 points of sale. The coverage rate for goods and services was 97% in 2016. Actual inflation therefore includes all consumer goods and services.

How can the difference between actual and perceived inflation be explained?

The low weighting of some expenditure items

Official statistical institute under-weight some expenditure items, such as housing and energy. For example, housing represents only 10% of the total basket of goods and services. However, for many households, housing represents a much larger share of their budget. Official statistical institute did not take into account the price surge between 2000 and 2008. In France, the average share of housing in the budget was 18% if we take the whole population (including those who had already repaid their mortgage) and 27% if we only take firsttime home buyers. Perceived inflation therefore seems much higher than actual inflation for a large part of the population. This gap is very real.

Consumption structure

Depending on your income and wealth, the structure of household’s consumption is very variable. With a modest income, consumption focuses on primary consumption goods and services (housing, food, health, transport, etc.). With higher incomes, consumption includes more diversified and secondary consumption items such as leisure, catering, clothing, etc.

Depending on the family of goods and services, inflation is highly variable. For example, it may increase significantly in housing and not in clothing and leisure. If actual inflation increases mainly in primary goods and services, the lowest incomes feel a higher perceived inflation than households with higher incomes. Conversely, if inflation is concentrated on secondary goods and services, the poorest households feel inflation’s effects very little.

The consumption structure, depending on your income and wealth, therefore has a major influence on perceived inflation.

Consumption frequency

If you regularly consume a good or service, which has risen sharply in price, you feel a significant gap between actual inflation and perceived inflation. Say, for example, you regularly use public transport, and suppose that 16% of this expenditure item is included in the official statistical institute basket. If train ticket prices increase by 5% but at the same time the price of other goods and services do not move in the basket, the inflation rate is 0.65% (5% * 13%). From your point of view, you perceive a higher rate of inflation than actual inflation, which is calculated on all the items of expenditure.

Households are more sensitive to price increases

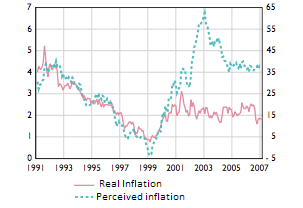

Here is a graph showing the changes in opinion polls between perceived and actual inflation in the euro zone:

It can be seen that if the inflation rate falls, perceived inflation is similar to actual inflation. On the other hand, after a period of sharply rising inflation, perceived inflation becomes much higher and increases over a longer period than actual inflation. Households feel that they are seeing their purchasing power melt away and they become very pessimistic.

About author

- 22

- 42

- 61

- 6