The impact of high frequency trading

- 2751

- 0

- 0

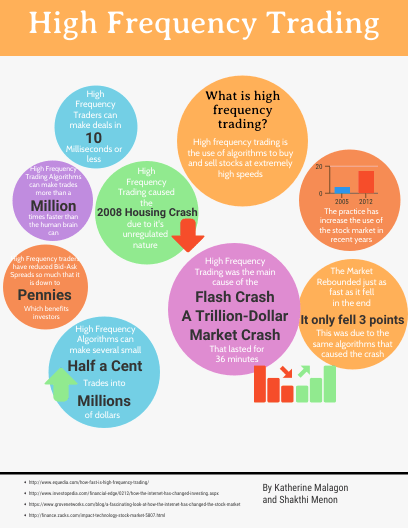

High frequency trading has been in fashion since the 2000s. With the development of computer technologies, this trading method has continued to attract more and more financial players. High frequency trading has a significant impact on all financial markets. The perverse effects are numerous and very often these effects are contra human traders, which we are.

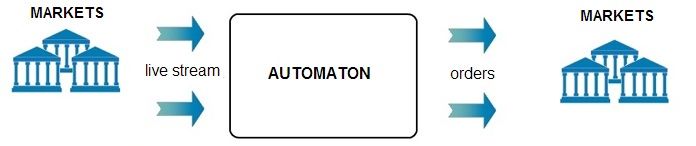

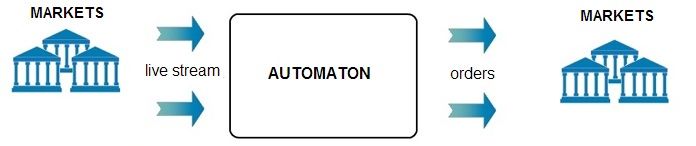

Highfrequency trading is a trading technique where computers and mathematics are king. The objective is to take advantage of minute market movements by placing a multitude of orders on a scale of ten milliseconds. To give you some idea, placing an order takes as long as the blink of an eye. High frequency trading is based on powerful trading algorithms and powerful servers. It is therefore a fully automated trading.

High frequency trading takes place in two steps:

-

-

-

These algorithms must be regularly modified to take account of changes in the market, technology and competition. An algorithm does not last more than 6 months. So the research and development costs are huge. A team of experts must be paid permanently to develop and update these algorithms.

All players know how to analyse flows, so the objective of a good trading algorithm is to make a decision as quickly as possible so as to send a signal to the market as quickly as possible.

-

For example, Spread Networks invested nearly $300 million to build a fibre optic cable to link the New York Stock Exchange to the Chicago Stock Exchange.

These powerful servers (which run the trading algorithms) must also be placed as close as possible to the world’s stock exchange servers (Euronext, London, etc.). The closer the server is to the exchange, the faster the information is transmitted. With high frequency trading, it's first come, first served.

There also needs to be a large number of servers available. The more servers you have, the faster you can analyse market flows and again there are a few precious milliseconds to gain that make all the difference in the end.

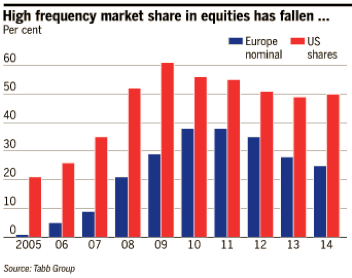

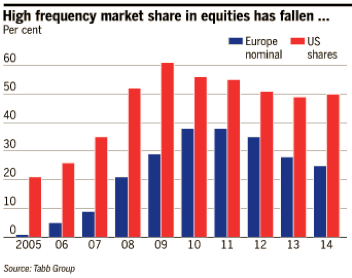

To show you the importance of high frequency trading on the stock markets, here is a chart showing its evolution over the last 10 years:

In Europe, high frequency trading accounts for around 25% of trading volumes. In terms of number of orders, high frequency trading represents more than 50% of orders transmitted to the market. In some cases, it even reaches 70%.

In the United States, high frequency trading is much more developed and accounts for 50% of the trading volume and could exceed 80% of the number of orders placed. That's the magnitude of high frequency trading!

You should know that of all orders placed by high frequency trading, more than half are cancelled and remain on the market for no longer than 0.2 milliseconds.

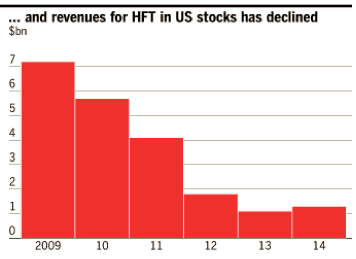

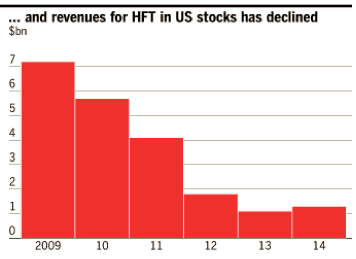

From 2009 (date of the subprime crisis), there has been a marked slowdown in high frequency trading on world markets. This is explained by a significant drop in revenues generated by this practice as shown in the following chart on U.S. equity revenues:

Competition in this environment has become fierce. Increases in the number of players has led to a real war and, as always, it is the strongest that have survived, the largest financial institutions (banks in particular) and trading companies. If we add to this the effects of the crisis which affected all financial players, this led to a decline in the number of high frequency trading players.

But the figure could quickly rise again with the drop in costs associated with operating a high frequency trading strategy. Since 2012, revenues from high frequency trading in US equities have stabilised.

For your information, the cost of a high frequency trading platform is estimated at about 3 million dollars, which is nothing compared to the potential gains. A good trading algorithm can yield tens of millions of dollars. There are some fixed costs to bear, but it's worth it!

-

-

-

-

Trading algorithms analyse information and, due to ultra-fast order placement (much quicker than all other traditional players), they can buy/sell to resell/redeem a few milliseconds later to the fund manager. In this way high frequency trading generates billions in profits through a technique that can be compared to insider trading.

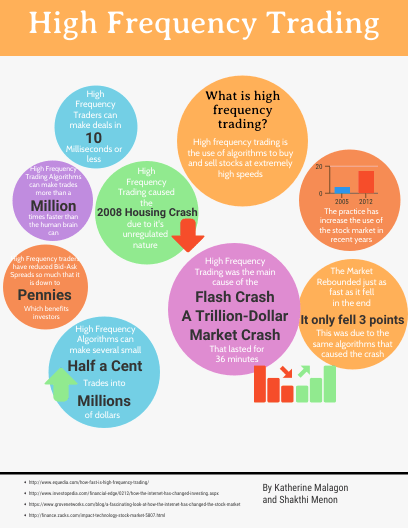

It has been produced a very nice computerised chart of high frequency trading:

-

These crashes show how high frequency trading can impact financial markets. With this type of crash, it is the different trading algorithms that feed the movement themselves, creating a movement disproportionate to an event.

-

In some cases, for example, the algorithm can send a much larger order than it should have. As a result, this can create large price differentials that cannot be avoided. Each year, several significant errors of this type are found. In other cases, the algorithm may place ludicrous orders (sometimes leading to the bankruptcy of the high frequency trading company). Knight Capital paid the price not long ago by updating its algorithm, which subsequently cost it $600 million in one hour!

If an algorithm shifts, it takes some time for the human to understand that there is a problem and in the meantime, the trading algorithm has had time to place a multitude of orders. When we see the way all algorithms are more or less linked, we can imagine catastrophic scenarios on the stock markets. During the 2010 crash, some shares that were worth several tens of dollars were quoted at 1 cent. Imagine the same thing happening on the global index. Scary!

-

-

-

-

-

One example perfectly sums up the omnipotence of the players in high frequency trading. As most of them are domiciled in London, a few years ago they put pressure on the Paris stock exchange to relocate its servers to London to gain a few milliseconds in their orders’ transmissions. The Paris stock exchange obviously accepted.

High frequency trading is king in the financial world and should have some good years ahead of it. In the long run, one may even wonder whether the machine will not definitively replace man on the financial markets.

Definition of high frequency trading

Highfrequency trading is a trading technique where computers and mathematics are king. The objective is to take advantage of minute market movements by placing a multitude of orders on a scale of ten milliseconds. To give you some idea, placing an order takes as long as the blink of an eye. High frequency trading is based on powerful trading algorithms and powerful servers. It is therefore a fully automated trading.

High frequency trading takes place in two steps:

-

Capturing market flows

: This is what allows trading algorithms to place their orders. The amount of information to study is enormous, hence the importance of having state-of-the-art computer equipment to analyse everything.-

Placing orders

: Once the market has been analysed, algorithms send orders to the market to take advantage of information obtained by capturing flows. To make the best use of this information, the transmission and execution time of orders must therefore be reduced to a minimum.

The weapons of high frequency trading

-

The trading algorithm

: This is what detects buying or selling opportunities with flow analysis. It's the trading strategy. It is therefore a matter of developing an algorithm with the greatest expectation of gain while minimizing the risk (drawdown as low as possible). Financial institutions or trading companies which use high frequency trading pay very expensive mathematicians and computer scientists to develop the most efficient algorithm.These algorithms must be regularly modified to take account of changes in the market, technology and competition. An algorithm does not last more than 6 months. So the research and development costs are huge. A team of experts must be paid permanently to develop and update these algorithms.

All players know how to analyse flows, so the objective of a good trading algorithm is to make a decision as quickly as possible so as to send a signal to the market as quickly as possible.

-

Servers

: To take advantage of data flow analysis, it is necessary not only to have a good trading algorithm but above all to have the highest possible order and information transmission speed. For this, high frequency trading players invest millions of dollars to gain a few milliseconds.For example, Spread Networks invested nearly $300 million to build a fibre optic cable to link the New York Stock Exchange to the Chicago Stock Exchange.

These powerful servers (which run the trading algorithms) must also be placed as close as possible to the world’s stock exchange servers (Euronext, London, etc.). The closer the server is to the exchange, the faster the information is transmitted. With high frequency trading, it's first come, first served.

There also needs to be a large number of servers available. The more servers you have, the faster you can analyse market flows and again there are a few precious milliseconds to gain that make all the difference in the end.

High frequency trading in figures

To show you the importance of high frequency trading on the stock markets, here is a chart showing its evolution over the last 10 years:

In Europe, high frequency trading accounts for around 25% of trading volumes. In terms of number of orders, high frequency trading represents more than 50% of orders transmitted to the market. In some cases, it even reaches 70%.

In the United States, high frequency trading is much more developed and accounts for 50% of the trading volume and could exceed 80% of the number of orders placed. That's the magnitude of high frequency trading!

You should know that of all orders placed by high frequency trading, more than half are cancelled and remain on the market for no longer than 0.2 milliseconds.

From 2009 (date of the subprime crisis), there has been a marked slowdown in high frequency trading on world markets. This is explained by a significant drop in revenues generated by this practice as shown in the following chart on U.S. equity revenues:

Competition in this environment has become fierce. Increases in the number of players has led to a real war and, as always, it is the strongest that have survived, the largest financial institutions (banks in particular) and trading companies. If we add to this the effects of the crisis which affected all financial players, this led to a decline in the number of high frequency trading players.

But the figure could quickly rise again with the drop in costs associated with operating a high frequency trading strategy. Since 2012, revenues from high frequency trading in US equities have stabilised.

For your information, the cost of a high frequency trading platform is estimated at about 3 million dollars, which is nothing compared to the potential gains. A good trading algorithm can yield tens of millions of dollars. There are some fixed costs to bear, but it's worth it!

High frequency trading strategies

-

Volatility propulsion

: During an important economic announcement or if the market has just entered a bullish/bearish rally, trading algorithms fuel the movement with numerous orders to propel volatility. Before this type of manipulation, traders take options linked to volatility. If the volatility of the underlying asset increases, the price of the option rises and therefore creates large profits for the high frequency trading company.-

Detection of intentions

: High frequency trading algorithms place a multitude of orders at different prices to find buying and selling zones on the market. These orders are never executed, they are all cancelled. The objective is simply for other actors to reveal their strategies and intentions. Effectively, these orders (subsequently cancelled) will push market participants to place their orders. Once the intentions are known, the algorithm can use this information to buy/sell with a small profit. This technique allows you to create your own order book, to know it even before it appears. With these conditions, it is easy to win.-

Detect an order’s origin

: Some algorithms can detect an order’s origin by calculating the transmission speed of the order between market participants' servers and marketplaces. Thus, the algorithm can decrypt the operation method for placing orders by large market players. Knowing this information, the algorithm can take advantage of it.-

Flash orders

: This is one of the elements that creates a scandal with high frequency trading. Fund managers operate through trading systems that guarantee anonymity to avoid their intentions being predicted in the market. The problem is that large institutional high frequency traders can view these orders for a fraction of a second before they enter the market. To obtain information on orders before they are transmitted, high frequency trading companies pay a subscription to the order placing platforms.Trading algorithms analyse information and, due to ultra-fast order placement (much quicker than all other traditional players), they can buy/sell to resell/redeem a few milliseconds later to the fund manager. In this way high frequency trading generates billions in profits through a technique that can be compared to insider trading.

It has been produced a very nice computerised chart of high frequency trading:

High frequency trading risks

-

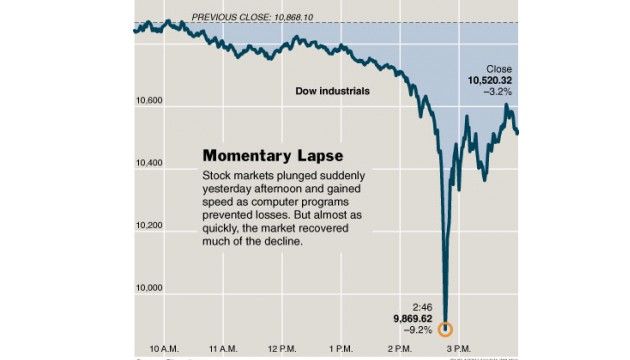

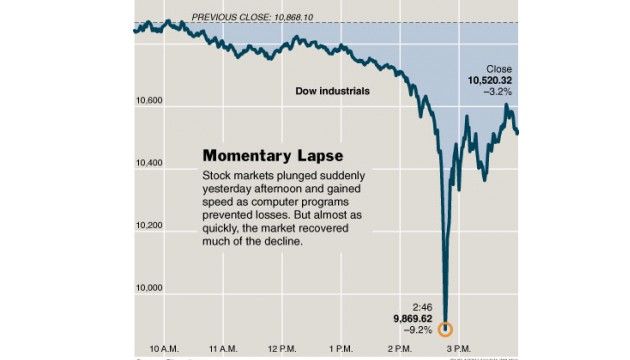

Flash crash

: Flash crashes occur continuously in all financial markets, but some are larger than others. One of the best known is that of the 6th May 2010 which saw the Dow Jones lose more than 9% in a few minutes to finally return to its initial point as shown in the chart below:

These crashes show how high frequency trading can impact financial markets. With this type of crash, it is the different trading algorithms that feed the movement themselves, creating a movement disproportionate to an event.

-

No control

: Orders are so fast that it's impossible to control them. So if the algorithm makes an error in placing orders, no one has time to react.In some cases, for example, the algorithm can send a much larger order than it should have. As a result, this can create large price differentials that cannot be avoided. Each year, several significant errors of this type are found. In other cases, the algorithm may place ludicrous orders (sometimes leading to the bankruptcy of the high frequency trading company). Knight Capital paid the price not long ago by updating its algorithm, which subsequently cost it $600 million in one hour!

If an algorithm shifts, it takes some time for the human to understand that there is a problem and in the meantime, the trading algorithm has had time to place a multitude of orders. When we see the way all algorithms are more or less linked, we can imagine catastrophic scenarios on the stock markets. During the 2010 crash, some shares that were worth several tens of dollars were quoted at 1 cent. Imagine the same thing happening on the global index. Scary!

-

Increased volatility

: High frequency trading considerably increases volatility in all financial markets which makes it much harder for us (humans) to decipher market movements. With volatility, all excess movements are accentuated, which carries many risks.The impact of high frequency trading in the world of finance

-

Higher transaction costs for humans

: With the numerous trading strategies used by high frequency trading algorithms, the cost of transactions is higher for humans (fund managers, individuals, etc.). Algorithms make you pay a higher price at the time of purchase or gain a lower price at the time of sale. If we paid the right price, the players in high frequency trading would not make a profit.-

Trend creation

: High frequency trading creates both short-term and long-term trends in the financial markets. During an economic announcement, it is mainly the algorithms that create the movements. In the longer term, algorithms create demand for certain securities and push us to sell other securities. Effectively, by optimizing the price a fund manager is willing to pay for a security each time, high frequency trading fuels the movement even more. Instead of a single purchase order from a fund manager, 3 or 4 purchase orders will be placed on the market, creating a snowball effect.-

Changes in trading conditions

: High frequency trading has led to significant changes in humans’ trading methods. There are more and more excesses on the financial markets today, they create more and more speculative bubbles and at a higher rate than before. Humans must therefore take this into account in their long-term trading. In the short term, increased volatility has forced humans to adapt to these new trading conditions. This can be seen on the Forex market which was once a trend market and has now become a much shorter term market.-

Eviction of man

: The players in high frequency trading are trading platforms’ best clients, they earn commissions on every order placed. Given the quantity of orders they transmit, it is a real gold mine for these platforms. As a result, they give in to all their whims and often make decisions that go against the individual client (and are favourable to trading algorithms).One example perfectly sums up the omnipotence of the players in high frequency trading. As most of them are domiciled in London, a few years ago they put pressure on the Paris stock exchange to relocate its servers to London to gain a few milliseconds in their orders’ transmissions. The Paris stock exchange obviously accepted.

High frequency trading is king in the financial world and should have some good years ahead of it. In the long run, one may even wonder whether the machine will not definitively replace man on the financial markets.

About author

- 5

- 1

- 0

- 4