Chart pattern: Bullish channel

- 15151

- 0

- 0

What is a bullish channel?

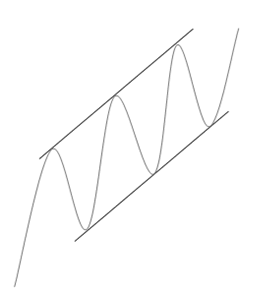

A bullish channel is a continuation chart pattern (of a trend). A bullish channel is made up of two parallel bullish lines. The price progresses between these two parallel lines; the upper line is called the "resistance line"; the lower line is called the "support line".

Each of these lines must have been touched at least twice to validate the pattern.

NB: a line is said to be "valid" if the price line touches the support or resistance at least 3 times.

This implies that the bullish channel pattern is considered valid if the price touches the support line at least 3 times and the resistance line twice (or the support line at least twice and the resistance line 3 times).

The bullish channel (with its inverse: the bearish channel) is the most frequent chart pattern and the one most used in technical analysis. It is found on all time units.

There is no theoretical price objective on this chart pattern. The movement is bullish and can continue as long as the bullish channel support line is not broken (channel exit).

Graphical representation of a bullish channel

Notes on bullish channels

- In a bullish channel, it is not advisable to open a short position (for sale) in contact with the upper boundary (the channel’s resistance line). As the current trend is bullish, the only objective would be to aim for a return to the lower boundary (the channel’s support line), but generally with little prospect of performance. Choose long positions (at the time of purchase) after rebounding of the bullish channel’s support line.

- If you want to avoid false breaks as much as possible (false channel exits), it is advisable to draw the trend lines (resistance and support lines) based on the candlesticks’ low and high points (wicks) and not the candlestick bodies.

- Statistics show us that bullish channel exits mostly occur on the fourth contact with the support line. However, the statistical output percentage on the fourth contact is low. It is therefore not advisable to aim for a bullish channel exit when the price is about to test the support line for the fourth time.

- It can be seen that the more often the support line has been tested and has held during the rebound, the more severe the break out of the support line / bullish channel exit is.

- When the price has validated an exit from a bullish channel, it is very common for the price to make a pullback in resistance on the bullish channel’s support line; even the price continues its progress below the channel’s support line (generally forming in the end a wider bullish channel; creation of a new support line).

For your information: A bullish channel is a continuation chart pattern. Its opposite is a bearish channel.

About author

- 5

- 1

- 0

- 4