Chart pattern: Triple bottom

-

- 1

- Who voted?

- 5384

- 0

What is a triple bottom?

The triple trough or triple bottom is a bullish pattern in the shape of a WV. Three troughs follow one another, indicating strong support. This is a sign of a tendency towards a reversal.

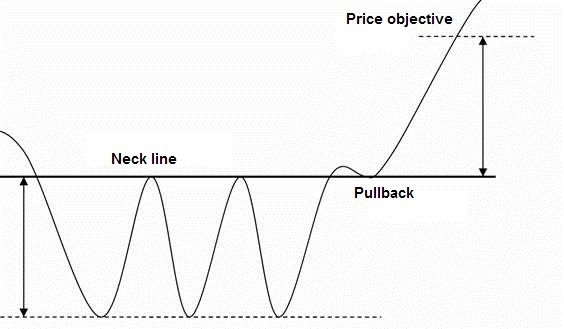

For the triple bottom below, the support zone allows the price to bounce back three times. The pattern’s neck line is formed by the higher of the two bullish peaks. A first rebound is therefore made and then the price comes back to hit the support line. The magnitude of the two troughs is normally the same (as in the case below), but it can happen that the first trough is lower than the next two. This configuration reinforces the validity of the pattern since it reflects a loss of momentum of the selling current

Be careful, if the second trough is lower than the other two, it may be an inverted head and shoulders pattern.

There is a second rebound, theoretically at the same level as the first rebound. If the neck line is broken at that moment, then it could be a double bottom. Therein lies the difficulty. In some cases, we only know afterwards what type of pattern we are faced with. There must be a return to the support. However, the 3rd trough may not be as low as the first two, which increases the chances of reversals (loss of momentum of the selling current). It is this 3rd rebound that causes the neck line to break and validates the bullish reversal.

Once the neck line is broken, the price can bounce back on that line (this line then becomes the support line, we call this a pullback), and then returns to bullish. The price objective is determined by the distance between the support line and the neck line.

Graphical representation of a triple bottom

Statistics on triple bottoms

Here are some statistics about triple bottoms:

- In 66% of cases, there is a bullish exit

- In 73% of cases, the pattern’s objective is reached once the neck line is broken

- In 96% of cases, there is a continuation of the bullish movement at the break of the neck line

- In 70% of cases, a pullback intervenes on the neck line

The different types of triple bottom

There are different types of triple bottom that can be differentiated according to 3 criteria:

- The shape of the trough: The trough can be V-shaped (called Adam troughs) or U-shaped (called Eve troughs).

- The level of the second trough: The second trough may be higher, at the same level or slightly lower than the first trough.

- The level of the third trough: The third trough may be higher, at the same level or lower than the second trough.

Notes on triple bottoms

- In case of a pullback, the bullish movement is weaker once the pattern’s objective is reached.

- If the support is tested at length before rebounding (base of the flat trough), then the increase following the break in the neck line will be greater

- The closer the three troughs are, the greater the pattern’s % success rate

- The more direct the movements between the neck line and the support, the better the pattern’s performance

- The greater the bearish movement preceding the triple bottom’s formation, the stronger the bullish movement at the break of the neck line will be.

- The pattern performs better if the third trough is shallower than the first two.

Trading strategies with triple bottoms

The traditional strategy:

Entry: Open a long position at the break of the neck line

Stop loss: The stop loss is placed below the neck line

Objective: Theoretical objective of the pattern

Advantage: the trade has a high percentage of success

Disadvantage: Pullbacks often overshoot the neck line. As a result, a stop loss placed too close can be blindly hit. To remedy this, it is possible to wait for the pullback on the neck line before opening a position. This allows you to place your stop loss better.

The aggressive strategy:

Entry: Open a long position after the formation of the second or third trough

Stop loss: The stop is placed under the lowest trough

Objective: Return to the neck line.

Advantage: The gain / risk ratio is high, the stop loss being placed close to the entry point

Disadvantage: The percentage loss of the trade is higher because the triple bottom is not yet confirmed.

For your information: The Triple Bottom is a reversal chart pattern. Its opposite is a Triple Top.

About author

- 22

- 42

- 61

- 6