Cryptocurrency as a means of payment for central banks?

- 1107

- 0

- 0

The Federal Reserve Bank of St. Louis (one of the twelve regional reserve banks making up the U.S. central bank) has conducted a study that could answer major questions about cryptocurrencies. Researchers studied different currencies’ control structures and examined whether central banks would be willing to adopt cryptocurrencies as a means of payment.

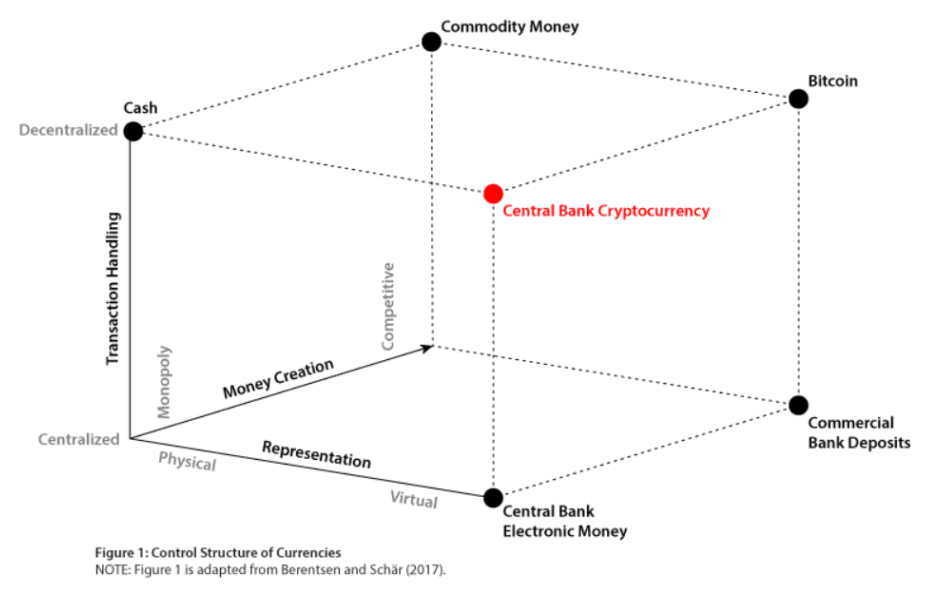

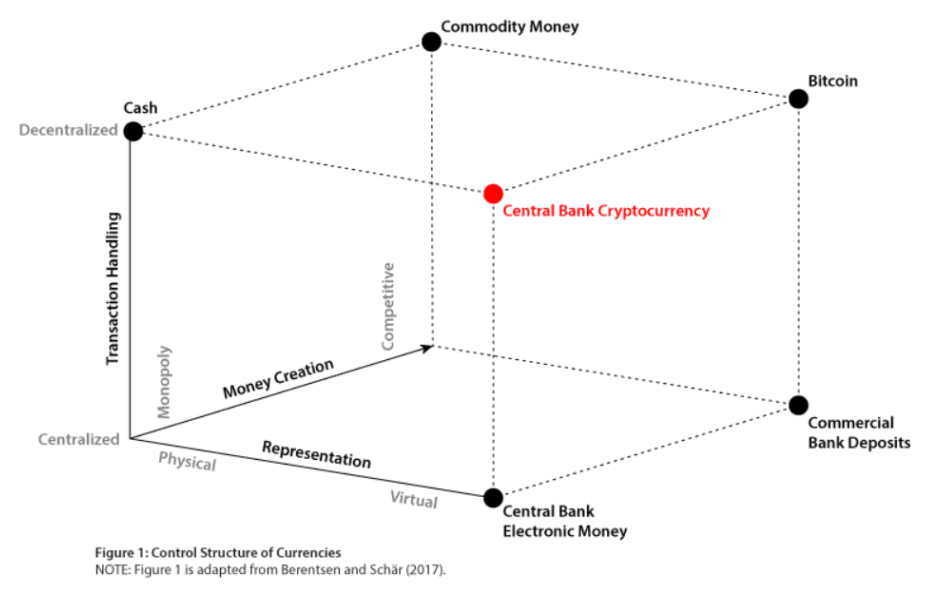

To assign cryptocurrencies to one of the monetary categories below , the researchers concluded that cryptocurrencies really defied the so-called "traditional" categorization.

Banks use a number of aspects to categorize money:

These aspects facilitate the distinction between raw materials (e.g. gold), physical currencies (e.g. the euro), etc. However, cryptocurrencies have proved to be difficult to analyse in a traditional way.

The researchers pointed out that gold has decentralized transaction processing, a competitive creation process which anyone can exploit, and it includes a finite supply; features shared with cryptocurrencies. However, gold also has an intrinsic value as a commodity, unlike currency, which represents the value of a commodity. Gold is not a form of currency with low liquidity, but it does not require significant accounting or proof of ownership.

Like currency, it is enough to be in possession of the gold at the time of the transaction to prove ownership. Cash is totally decentralized in this sense, without supervision or accounting, to be able to spend it in most cases. Creation, however, is centralized and monopolized. Electronic money is also monopolized with an infinite supply.

Commercial bank deposits and the central bank’s electronic money are considered virtual money because they have no physical representation - they exist only as documents. On the other hand, physical forms of money like gold and silver often do not even need a record to function in the market.

The answer is, no "known" or "traditional" categories. Cryptocurrencies have special features from all three categories, and even include new features which make them unique.

Bitcoin is the first virtual currency for which property rights on the different currency units are managed in a decentralized network. There is no central authority, no boss, and no management. And yet it still works.

The Bitcoin blockchain is the decentralized accounting system, and the so-called miners are the accountants. Decentralized digital asset ownership management is a fundamental innovation. It has the potential to disrupt the current payment infrastructure and the financial system. In general, this could affect all businesses and government agencies involved in record keeping.

The particularity of cryptocurrencies is that they combine the transactional advantages of virtual money with the systemic independence of decentralised transaction processing. In addition, as with gold, the creation of new cryptocurrency units is competitive. Anyone can engage in creating new cryptocurrency units by downloading mining software (if the cryptocurrency concerned can be "mined"), and can thus contribute to the system.

In practice, crypto mining has become more complex due to fierce competition and "mining professionals" with highly specialized equipment and access to cheap electricity.

The researchers gave great importance to a generally neglected point: "Every form of money has its advantages and disadvantages. That's why many forms of money coexist."

Money is without authorization and anonymous, without account and without registration. There is not a single attack point (such as a payment processing server) that can disrupt the cash payment system, making it a robust and decentralized payment system. There is also no credit or risk relationship with money. Transactions are final and conducted in person, allowing people to negotiate even if they do not trust each other. Of course, this is not viable for distance trading, such as online shopping, which is a disadvantage rectified by virtual money that allows new business opportunities in new distant markets.

The researchers pointed out that cash is the only liquid asset that can be used to save outside the private financial system, and they then put forward an interesting theory: “We believe there is a strong demand for a virtual asset, issued by a trusted party, which can be used to save outside the private financial system.”

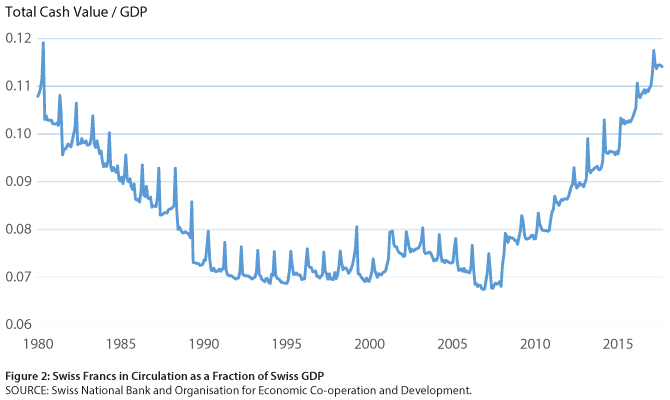

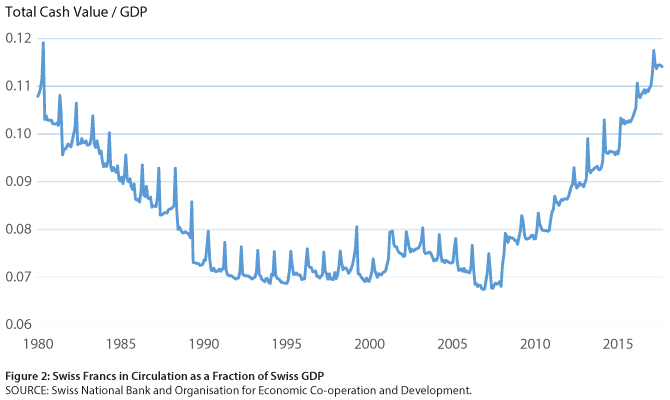

To demonstrate this, they followed the Swiss francs in circulation (in the form of cash) as a fraction of GDP from 1980 to 2017, and found three phases.

The researchers added: "We believe that there are strong arguments in favour of electronic money in electronic form. The central bank’s electronic money meets the needs of the population for virtual currency without counterparty risk".

They do not talk about money so favourably, stating that money is inefficient, expensive, facilitates crime and limits the bank's ability to use negative nominal interest rates.

The bank believes that cryptocurrencies are a viable alternative to liquidity and could outperform liquidity when issues such as scalability, high costs and adoption are resolved, citing the "Lightning Network” as one potential solution to these problems.

The bank suggests issuing electronic money for everyone as an alternative, believing that this practice would help to discipline commercial banks and force them to encourage users to participate in higher interest rates to compensate for higher volatility. The St. Louis researchers believe that this would simplify monetary policy by promoting the widespread use of central bank accounts with interest rates as the main policy tool.

Because the market would be disaggregated, interest rates would be low, and because a central bank cannot become illiquid, there is no counterparty risk, unlike commercial banks. Because there is no credit available with the central bank’s electronic money, virtually no monitoring or maintenance is required.

In reality, the central bank would not even have to extend the infrastructure to provide all the central banks' electronic funds and accounts. Legislation could oblige commercial banks to integrate the central bank accounts and store customer funds externally with the central bank, thereby limiting risks for customers (in the event of commercial bank failure) and protecting funds better.

It makes little sense for central banks to issue cryptocurrencies even if it is technologically simple. The researchers claim that no reputable central bank is sufficiently motivated to issue a branded cryptocurrency in case the currency is linked to any crime, unfairly associating the bank with the crime and damaging the bank's activities.

"Once we remove the decentralized nature of a cryptocurrency, there's not much left. As Figure 1 shows, virtual money that is centralized and issued monopolistically by a central bank is the central bank’s electronic money."

The bank believes it is naive to expect a central bank to issue a cryptocurrency because of logistical problems and unnecessary risks. Because of the complete anonymity option, the bank would risk facilitating money laundering and other crimes, for which commercial banks have an obligation to take action. The researchers recognize the advantages of allowing anonymous transactions in situations where a government oppresses citizens, but feel that it is not appropriate for any government authority to actively facilitate anonymous transactions because of their obligation to collect taxes and prevent money laundering.

"On the one hand, governments can be bad actors and, on the other hand, some citizens can be bad actors. The former justifies an anonymous currency to protect citizens from bad governments, while the latter calls for transparency in all payments. The reality is in between."

Categorization of Money

To assign cryptocurrencies to one of the monetary categories below , the researchers concluded that cryptocurrencies really defied the so-called "traditional" categorization.

Banks use a number of aspects to categorize money:

- is the money represented physically or virtually?

- are transactions processed with centralized or decentralized payments?

- is the money’s production competitive or monopolized?

These aspects facilitate the distinction between raw materials (e.g. gold), physical currencies (e.g. the euro), etc. However, cryptocurrencies have proved to be difficult to analyse in a traditional way.

The researchers pointed out that gold has decentralized transaction processing, a competitive creation process which anyone can exploit, and it includes a finite supply; features shared with cryptocurrencies. However, gold also has an intrinsic value as a commodity, unlike currency, which represents the value of a commodity. Gold is not a form of currency with low liquidity, but it does not require significant accounting or proof of ownership.

Like currency, it is enough to be in possession of the gold at the time of the transaction to prove ownership. Cash is totally decentralized in this sense, without supervision or accounting, to be able to spend it in most cases. Creation, however, is centralized and monopolized. Electronic money is also monopolized with an infinite supply.

Commercial bank deposits and the central bank’s electronic money are considered virtual money because they have no physical representation - they exist only as documents. On the other hand, physical forms of money like gold and silver often do not even need a record to function in the market.

Which category for cryptocurrencies?

The answer is, no "known" or "traditional" categories. Cryptocurrencies have special features from all three categories, and even include new features which make them unique.

Bitcoin is the first virtual currency for which property rights on the different currency units are managed in a decentralized network. There is no central authority, no boss, and no management. And yet it still works.

The Bitcoin blockchain is the decentralized accounting system, and the so-called miners are the accountants. Decentralized digital asset ownership management is a fundamental innovation. It has the potential to disrupt the current payment infrastructure and the financial system. In general, this could affect all businesses and government agencies involved in record keeping.

The particularity of cryptocurrencies is that they combine the transactional advantages of virtual money with the systemic independence of decentralised transaction processing. In addition, as with gold, the creation of new cryptocurrency units is competitive. Anyone can engage in creating new cryptocurrency units by downloading mining software (if the cryptocurrency concerned can be "mined"), and can thus contribute to the system.

In practice, crypto mining has become more complex due to fierce competition and "mining professionals" with highly specialized equipment and access to cheap electricity.

Example of the central bank’s electronic money

The researchers gave great importance to a generally neglected point: "Every form of money has its advantages and disadvantages. That's why many forms of money coexist."

Money is without authorization and anonymous, without account and without registration. There is not a single attack point (such as a payment processing server) that can disrupt the cash payment system, making it a robust and decentralized payment system. There is also no credit or risk relationship with money. Transactions are final and conducted in person, allowing people to negotiate even if they do not trust each other. Of course, this is not viable for distance trading, such as online shopping, which is a disadvantage rectified by virtual money that allows new business opportunities in new distant markets.

The researchers pointed out that cash is the only liquid asset that can be used to save outside the private financial system, and they then put forward an interesting theory: “We believe there is a strong demand for a virtual asset, issued by a trusted party, which can be used to save outside the private financial system.”

To demonstrate this, they followed the Swiss francs in circulation (in the form of cash) as a fraction of GDP from 1980 to 2017, and found three phases.

- Phase 1: from 1980 to 1995, when financial innovations replaced the use of money as a means of exchange or store of value. The Swiss population increasingly used debit and credit cards for payments.

- Phase 2: which ran from 1995 to 2008, when card payments and online banking expanded, but, as the chart shows, cash usage did not decline further.

- Phase 3: lasted from 2008 to 2017, at a time when the flow of liquidity was increasing, which, according to the researchers, is due to the global financial crisis from 2007.

The researchers added: "We believe that there are strong arguments in favour of electronic money in electronic form. The central bank’s electronic money meets the needs of the population for virtual currency without counterparty risk".

They do not talk about money so favourably, stating that money is inefficient, expensive, facilitates crime and limits the bank's ability to use negative nominal interest rates.

The bank believes that cryptocurrencies are a viable alternative to liquidity and could outperform liquidity when issues such as scalability, high costs and adoption are resolved, citing the "Lightning Network” as one potential solution to these problems.

The bank suggests issuing electronic money for everyone as an alternative, believing that this practice would help to discipline commercial banks and force them to encourage users to participate in higher interest rates to compensate for higher volatility. The St. Louis researchers believe that this would simplify monetary policy by promoting the widespread use of central bank accounts with interest rates as the main policy tool.

Because the market would be disaggregated, interest rates would be low, and because a central bank cannot become illiquid, there is no counterparty risk, unlike commercial banks. Because there is no credit available with the central bank’s electronic money, virtually no monitoring or maintenance is required.

In reality, the central bank would not even have to extend the infrastructure to provide all the central banks' electronic funds and accounts. Legislation could oblige commercial banks to integrate the central bank accounts and store customer funds externally with the central bank, thereby limiting risks for customers (in the event of commercial bank failure) and protecting funds better.

When will the central banks' cryptocurrencies be available?

It makes little sense for central banks to issue cryptocurrencies even if it is technologically simple. The researchers claim that no reputable central bank is sufficiently motivated to issue a branded cryptocurrency in case the currency is linked to any crime, unfairly associating the bank with the crime and damaging the bank's activities.

"Once we remove the decentralized nature of a cryptocurrency, there's not much left. As Figure 1 shows, virtual money that is centralized and issued monopolistically by a central bank is the central bank’s electronic money."

The bank believes it is naive to expect a central bank to issue a cryptocurrency because of logistical problems and unnecessary risks. Because of the complete anonymity option, the bank would risk facilitating money laundering and other crimes, for which commercial banks have an obligation to take action. The researchers recognize the advantages of allowing anonymous transactions in situations where a government oppresses citizens, but feel that it is not appropriate for any government authority to actively facilitate anonymous transactions because of their obligation to collect taxes and prevent money laundering.

"On the one hand, governments can be bad actors and, on the other hand, some citizens can be bad actors. The former justifies an anonymous currency to protect citizens from bad governments, while the latter calls for transparency in all payments. The reality is in between."

About author

- 5

- 1

- 0

- 4