Chart pattern: Ascending broadening wedge

- 56018

- 0

- 0

What is an ascending broadening wedge?

An ascending broadening wedge is a bearish chart pattern (said to be a reversal pattern). It is formed by two diverging bullish lines.

An ascending broadening wedge is confirmed/valid if it has good oscillation between the two upward lines. The upper line is the resistance line; the lower line is the support line.

Each of these lines must have been touched at least twice to validate the pattern.

NB: a line is said to be "valid" if the price line touches the support or resistance at least 3 times.

This implies that the ascending broadening wedge pattern is considered valid if the price touches the support line at least 3 times and the resistance line twice (or the support line at least twice and the resistance line 3 times).

An ascending broadening wedge does not mark the exhaustion of the buying current, but the sellers’ ambition to take control. The divergence of the two lines in the same direction (increase in price magnitude) informs us that the price continues to increase with movements that are increasingly high in magnitude. The buyers manage to make the price rebound on the support line but lose control after the formation of a new highest point. The lowest point reached during the first correction on the ascending broadening wedge’s support line forms the support. A second wave of increase then occurs with more magnitude, signalling the loss of buyers' control after a new highest point. A third wave is formed afterwards but buyers lose control again after the formation of new highest points.

During the formation of an ascending broadening wedge, volumes do not behave in any particular way but they increase strongly when the support line breaks.

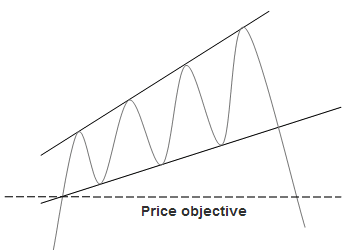

CASE 1: formation of an ascending broadening wedge after a bullish movement

This type of pattern appears on the peaks, it is a bearish reversal pattern.

The break in the support line definitively validates the pattern.

The price objective is determined by the lowest point at which the ascending broadening wedge was formed.

NB: often, the steeper the ascending broadening wedge’s trend lines, the faster the price objective is reached.

Statistics of the ascending broadening wedge after a peak

In 80% of cases, the exit is bearish.

In 75% of cases, an ascending broadening wedge is a reversal pattern.

In 60% of cases, an ascending broadening wedge’s price objective is achieved when the support line is broken.

In 21% of cases, the price makes a pullback in resistance on the ascending broadening wedge’s support line.

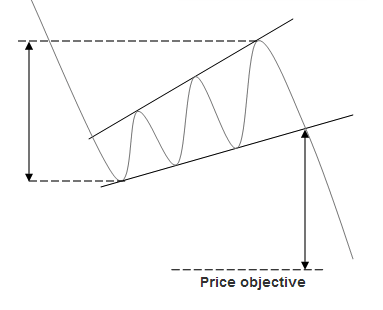

CASE 2: formation of an ascending broadening wedge after a trough

This type of pattern appears during the correction in a bearish movement, it is a bearish continuation pattern. Resumption of the bearish movement after correction.

The break in the support line definitively validates the pattern.

The price objective is given by plotting the wedge’s maximum height onto the breaking point

NB: pullbacks are harmful to the pattern’s performance.

Statistics of the ascending broadening wedge after a trough

- In 79% of cases, the exit is bearish.

- In 23% of cases, an ascending broadening wedge occurs in a consolidation movement.

- In 81% of cases, the pattern's price objective is achieved when the support line is broken.

- In 40% of cases, the price makes a pullback in resistance on the ascending broadening wedge’s support line.

For your information: An ascending broadening wedge is a reversal chart pattern. Its opposite is a descending broadening wedge.

About author

- 5

- 1

- 0

- 4